Let me start off by saying the credit cards that I have are heavily weighed into the Star Alliance. I have several Chase cards earning Ultimate Rewards, one Citi card earning Thank You points, and one American Express Blue for Business earning Membership Rewards. Both the Thank You points and Membership Rewards don’t do much for me because I don’t have any premium cards that would allow me to transfer to any useful partner. I still use them to build up my cache of points until I am ready. That being said, at this current stage I am heavy on the Star Alliance for redemptions. I wouldn’t transfer my Ultimate Rewards into British Airways for long haul premium awards. I haven’t put much thought into redeeming with Korean Air, given all the steps and work required to redeem. That leaves me with Singapore Krisflyer and United Airlines MileagePlus, both Star Alliance members. As much as I want to diversify further for better options of flights, I have been thinking jumping into Aeroplan, the loyalty program for Air Canada, another Star Alliance member.

In the last few months, I have been researching heavily into signing up for the TD Bank Aeroplan credit card for US residents. This card is not good for pure spend.

- Earn 2X Aeroplan Miles per $1 spent on Air Canada net purchases1

- Earn 1 Aeroplan Mile per $1 spent on all other net purchases1

It’s not a deal breaker that Evolve is now garbage. The real winning piece with the TD Bank Aeroplan card is the Aeroplan Distinction with the emphasis mine.

DISTINCTION ELIGIBLE MILES

Eligible miles are miles earned in the Aeroplan Program directly at participating partners and include base and certain bonus mile offers. Unless otherwise indicated at the time of offer, the following miles are not eligible for Distinction status: financial card sign-up; bonus miles received as a benefit of the Air Canada Altitude program or Aeroplan Distinction status; miles accumulated through conversion from other programs or transfers between member accounts, top-up miles, contest prizes, and reinstated miles. Aeroplan reserves the right, at their sole discretion, to change the miles eligible for Distinction status from time to time by either adding to or deleting from this list. Eligible miles are considered to be earned on the activity date, meaning the date upon which the member performed the qualifying activity. In the case of financial card partners, the activity date is the statement date.

Eligible miles are miles earned in the Aeroplan Program directly at participating partners and include base and certain bonus mile offers. Unless otherwise indicated at the time of offer, the following miles are not eligible for Distinction status: financial card sign-up; bonus miles received as a benefit of the Air Canada Altitude program or Aeroplan Distinction status; miles accumulated through conversion from other programs or transfers between member accounts, top-up miles, contest prizes, and reinstated miles. Aeroplan reserves the right, at their sole discretion, to change the miles eligible for Distinction status from time to time by either adding to or deleting from this list. Eligible miles are considered to be earned on the activity date, meaning the date upon which the member performed the qualifying activity. In the case of financial card partners, the activity date is the statement date.

Basically, it says, no transferred miles of any kind, no sign up bonus, contests, reinstatement of expired miles, or top-up miles count towards the distinction. Any miles that are earned straight into the Aeroplan program count towards the distinction status.

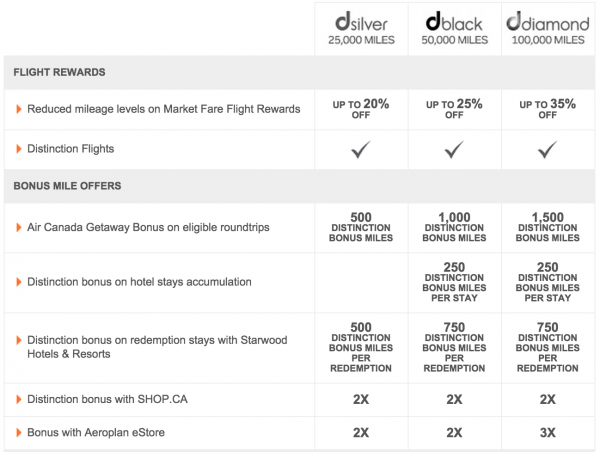

What Is Distinction?

If you have distinction status, either silver, black, or diamond, you could start with a 20% off mileage reduction or up to 35% off on Market Fare Flight rewards (only applicable on Air Canada operated flights). Extra bonus miles and a few other benefits like special treatment at Fairmont. You’d also have the ability to earn twice as many points on their online portal as well. Here’s a great post describing the Market Fare Flight rewards and other benefits on Distinction.

I apologize, I can’t find any details in regards to the Distinction program + Starwood. From the chart, it reads like redeeming Aeroplan miles for a night on a Starwood property you would earn back a few miles.

Why Even Choose Aeroplan?

As I mentioned at the top, my choices for my Ultimate Rewards for airlines would be United or Singapore, and going into the Aeroplan would further entrench me into Star Alliance. On the earning side of things with the credit card, it’s not good. However, once you cross the 25,000 mile threshold, you now earn an automatic 2x extra miles from the Aeroplan Estore.

That would be awesome! Think about it, if there’s a vendor giving you 5x, and you get 2x, that’s a quick 10x. Double dip? Sure, that’s a 20x haul. At least I hope that is my interpretation and not a 5x + 2x. In which case, it’s still not terrible, but 10x is a whole lot nicer.

Yes, in 2014, Aeroplan devalued, but if you are getting the extra miles earned from the portal, the devaluation won’t hurt as badly. Not only that, once you hit the dsilver status, and you continually use the portal, you could hit ddiamond real fast and earn at the 3x rate.

When you look at basic division, the larger the denominator, the cheaper the miles become in gift card churning (fees/miles or points earned). There have been many times where I am trying to get the denominator as large as possible from the portals and credit card spend, but the math just doesn’t work out sometimes. If the eStore bonus pans out as I interpret, earning miles through gift card churning would be ridiculously easy.

Continue reading...