The Citi ThankYou Points program has long been a lagging competitor to Chase and AMEX transferrable points programs. However, Citi has added transfer partners and enough benefits to make ThankYou cards worth looking at, especially if you’ve already maxed out the number of cards you’re comfortable applying for with other issuers. Let’s take a look at the accounts that do earn ‘full’ points, the ones you can transfer. For an in-depth look at transfer possibilities to see if ThankYou points will work for you or your family, check out this post by Travelisfree.

Citi ThankYou® Premier Card

has a $125 annual fee which is waived the first year and an innovative (in the fact that many applicants won’t ever get the full bonus) signup bonus: 20,000 points after $2,000 in purchases within the first 3 months of account opening, then 30,000 points after another $3,000 in purchases within the first 3 months of your second year of being a cardmember. It does earn 3X points on dining and entertainment and 2X on most travel. This offer stinks, check out why!

There is a much better offer for this card available to Citigold clients as long as you don’t mind doing some manufactured spending on this card: earn up to 50,000 bonus ThankYou Points — 30,000 points after $3,000 in purchases within the first 3 months of becoming a cardmember and 20,000 points after a total of $15,000 in purchases within the first 12 months. So to take advantage of that offer you do have to spend an additional $10,000 but you have a year to do so, you earn points on those purchases, and you don’t have to pay the $125 annual fee.

Citi Prestige® Card

The public offer for this card is 30,000 points after spending $2000 within 3 months. Compared to the Premier Card, the bonus categories are reversed at 2X points on dining and entertainment and 3X on most travel. Also, points on a Premier card account can be used at 1.6 cents per point for AA and US Airways tickets. The annual fee is $450, easily offset with airline credits during the first year. Again, the in-branch offer is better if you can get it.

The in-branch offer for Citigold clients: earn up to 60,000 bonus ThankYou Points — 30,000 points after $3,000 in purchases within the first 3 months of becoming a cardmember and 30,000 points after a total of $15,000 in purchases within the first 12 months. The annual fee for Citi Gold clients is reduced to $350, and the rest of the benefits are the same. For an account of applying with the public offer and requesting a match to 60K, check out this post by The Frequent Miler. You may also be able to get this offer without any CitiGold account as Rapid Travel Chai did in this post. Also, you get a 15% bonus on points (not counting bonus points) earned annually if you’re a Citigold client.

Prestige® Card lounge access and airline credits.

Citi Prestige account holders get unlimited access to AA, US Airways and Priority Pass Select airport lounges along with 2 guests or his/her immediate family. This is easily the most generous lounge benefit out there, unless your travels regularly take you to airports with AMEX Centurion lounges. While the annual fee is not waived, the Citi Prestige card hass a $250 annual air travel credit, so as long as you spend $250 each year with any airline for any reason, you can get $500 in credits within the first year of holding the card. Unlike other cards that require you to select an airline or have restrictions on what qualifies for a credit, this one is simple. You get a credit for your first $250 spent directly with an airline. For us, that was $50 in US Airways checked bag fees we couldn’t avoid, and the first $200 of the taxes and fees on our Australia/New Zealand trip. There is one wrinkle with the credits:

This statement credit is an annual benefit available for purchases appearing on your billing statements from December through the following December. Pending transactions that do not post in your December billing cycle will count towards the next year’s Air Travel Credit.

So you can actually spend in late December after your December statement posts for 2016 credit, but you must spend $250 with airline(s) before your December statement to get the full 2015 credit.

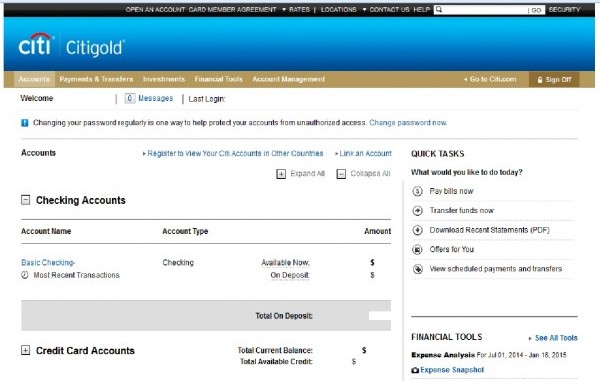

Becoming and remaining a Citigold client

- You can open a Citigold checking account, and pay the $30 monthly fee if your combined average balance falls below $50,000 in a month. From Citi’s website:

Your combined average balance range during this period will be used to determine whether or not you will be charged a monthly service fee for the statement period. Fees waived for $50,000 or more in linked deposit (includes checking, savings, money market accounts and CDs) and retirement accounts.

- Or you can do what we did: open a Citigold account (fees are waived for the first 2+ months) with an AA miles or ThankYou Points bonus, wait until the bonus posts, and downgrade to Basic checking which only requires one monthly direct deposit and billpay to avoid monthly fees. We use Bluebird, Serve, Redcard, and/or Paypal for the direct deposit, and any payment initiated on the Citi checking site to a non-Citi credit card counts as a bill payment. Staying Citigold? Read on…

In 2013 I opened a Citigold checking account for 30K AA miles. I downgraded to Basic checking after the miles posted 3-4 months later and never paid any fees. The balance was never over $2000. Since then my Citi login has always said Citigold at the top, and all phone reps for Citi checking and credit cards begin conversations by thanking me for being a Citigold customer. I expect I would lose Citigold if I closed that account, but otherwise I get Citigold treatment without the requirements and fees. Bonnie did exactly the same except with a 40K ThankYou point bonus for opening the Citigold account.

Basic checking is golden!

Last year Bonnie got the public ThankYou Premier offer with the split 50K bonus. It wasn’t the best decision, but I think we’ll go ahead and pay the $125 for the 30,000 points and then decide if we want to use them for a $300 mortgage payment.

I have churned various AA cards since Jan 2013, 12 cards total across various products, personal and business. Far short of what might have been possible, but a nice haul nonetheless. Ever since Citi added transfer partners and increased the credit to $250, I wanted to open a Citi Prestige card with the offer in-branch Citigold offer. But Citi closed or sold all of their branches within a 3 hour drive of San Antonio. So I googled the nearest branch and called them directly:

‘Yes, I’d like to talk to a banker.’

‘Ok, what for?’

‘Because I want to open a credit card with an offer that I think is only available in the branch, and y’all closed all of your San Antonio branches. I’d like to apply over the phone or via mail or email with the offer you have in the branch.’

The banker came on and said, ‘sure if you’re a Citigold client you can apply under this offer. Let me email you the application, scan and send it back, and I’ll process it.’

I filled it out, complete with my Citigold (basic) checking account number, and emailed it. Also on the paperwork he sent me were 60K AA Executive and 50K AA Platinum offers with none of the new language on some Citi offers that no longer allow churning. Minimum spending requirements on all of those offers are high, but the Executive card offer might be worthwhile for someone who wants to keep it long-term as the annual fee on it is also reduced to $350.

I called Citi a couple days later to check app status and they said there was no application in the system yet. Three days after emailing the application, the banker called me back and said he needed me to talk to someone to process my application. Someone verified I was me and then transferred me to one of my favorite South Dakotans who approved it after the usual 2 minute hold, and transferred some credit from my one remaining AA Platinum card. Success!

Is it worth it?

So far, it definitely is with just one little hangup. Adding the ThankYou points my checking account had earned was no problem, and they instantly became more valuable. 3X points are nice when we eat out or pick up lunch, and the first statement closed leaving me with the 40K points I needed to transfer to Air France for a flight within South Asia at 10K miles per person. If I hadn’t opened this card, we’d have needed to transfer AMEX points to Air France instead. With the current British Airways 40% bonus, having those 40K ThankYou points ‘earned’ us 56,000 British Airways Avios.

The hangup? Everything about the card is backwards, and cashiers can’t figure it out! The magnetic strip is on the front but with very little color contrast, and everything else is on the back of the card. With the 15K spend I’ve been using it for nearly everything, and it seems every time I use the Prestige card I have to explain the silly thing to the cashier.

The magnetic strip is where?

The $250 credit posted along with the $350 annual fee. Again, no tricks or registration needed, you just have to use the Prestige card for any purchase from an airline.

A few fun questions remain: Could the Prestige card be churned? Would it work to open a Prestige midyear, open a Premier 5 or 6 months later to keep the points active, close the Prestige shortly after maxing out the second $250 and then open another Prestige card? How many Premier or Prestige cards can you have at once? I just might have to do some testing…

– Kenny

Continue reading...

Last edited: