I’m currently build model portfolios for my new firm. When looking at US Equities as part of a portfolio the question is how far to stratify them in an attempt to create management opportunities, it is my belief that the more we can granularize a product, the more opportunities will emerge, however this comes with complexity and has an impact on overall efficiency.

If we look at the US equity market as represented by an ETF the tickers VTI and SCHB are quite good ones to consider. They are broad market index investments that cover most equity options in the US. My first consideration was to chop this via market cap. Doing so allows us to find tilt opportunities, or weighting more on certain types of firms or funds.. One long held belief has been that Small Caps offer a value premium, such segmentation would allow an investor to explore this concept further.

Segmenting by Market Cap

Market Capitalization is the total dollar amount of outstanding shares. It is calculated by multiplying the number of shares by the current share price. Firms are segmented into Small, Mid, and Large cap based on the final value:

Growth vs Value Investing

Value investing looks at present day fundamentals of a company to see if the price of the company, as reflected by its market cap offers a discount on its value. In other words, is it ‘cheap’. An investor considering Apple AAPL using this approach may look at the amount of cash reserves it holds, and the current price to earning (P/E) ratio. Growth investing contrasts with this in that investors may be willing to pay a premium on the current intrinsic value of a company if it might grow rapidly in the future. We see this approach most commonly with speculative purchases in the technology industry. An investment in Twitter (TWTR) would be ‘growth’ driven as its current fundamentals are very poor, but if they could figure out monetization properly the value of the company could skyrocket.

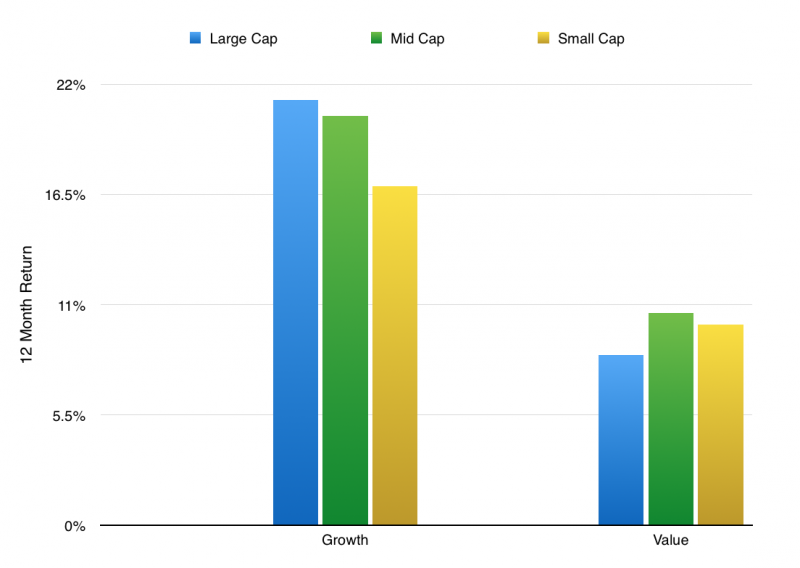

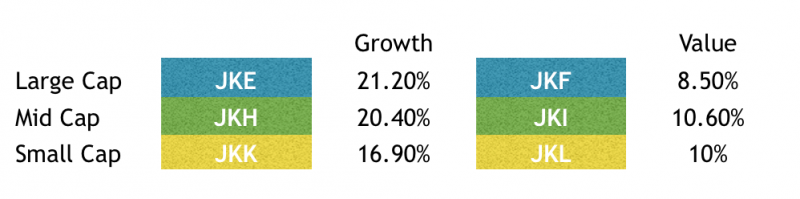

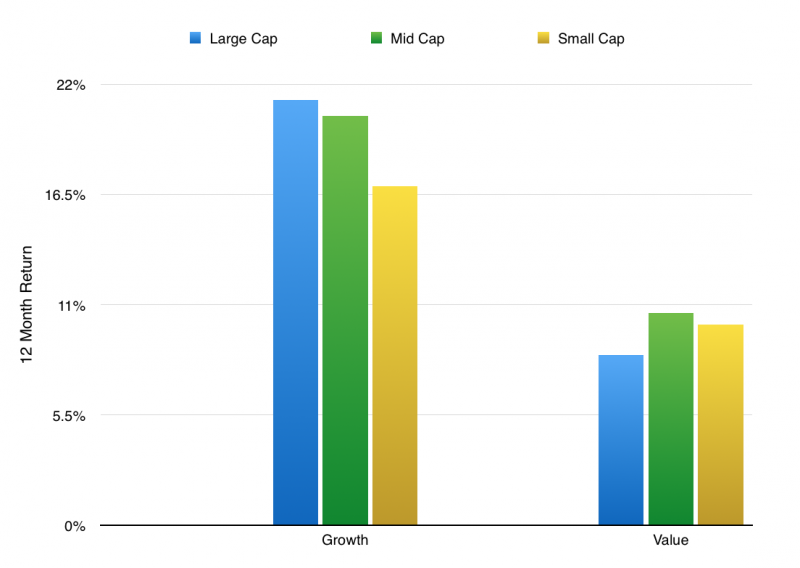

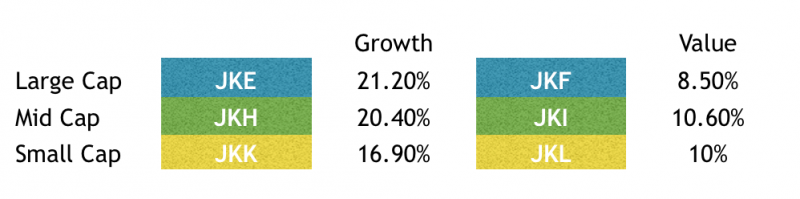

Interestingly though, this premium is not evident over the past 12 months. As you can see, the best returns have been seen by Growth rather than Value stocks, and ironically, Large Growth are really leading the pack. It seems that current valuations of small caps are high.

Growth vs Value 12 month performance

Growth vs Value 12 month performance

Comparing performance to the average

The above segmentation of fund shows how each strata has performed individually, which means that the broader index we discussed at the start (VTI and SCHB) will be averages of the above, returning 15.75% and 15.53% respectively. Herein lies the tilt discussion.

Do you accept the average, and be happy with your 15.x return, or do you elect to take the 6 ETFs outlined above and use them to create a strategic or ’tilted’ asset allocation?

The post Building Model Portfolios -US Equities appeared first on Saverocity Finance.

Continue reading...

If we look at the US equity market as represented by an ETF the tickers VTI and SCHB are quite good ones to consider. They are broad market index investments that cover most equity options in the US. My first consideration was to chop this via market cap. Doing so allows us to find tilt opportunities, or weighting more on certain types of firms or funds.. One long held belief has been that Small Caps offer a value premium, such segmentation would allow an investor to explore this concept further.

Segmenting by Market Cap

Market Capitalization is the total dollar amount of outstanding shares. It is calculated by multiplying the number of shares by the current share price. Firms are segmented into Small, Mid, and Large cap based on the final value:

- Small Cap $300M-$2B

- Mid Cap $2B-$10B

- Large Cap >$10B

Growth vs Value Investing

Value investing looks at present day fundamentals of a company to see if the price of the company, as reflected by its market cap offers a discount on its value. In other words, is it ‘cheap’. An investor considering Apple AAPL using this approach may look at the amount of cash reserves it holds, and the current price to earning (P/E) ratio. Growth investing contrasts with this in that investors may be willing to pay a premium on the current intrinsic value of a company if it might grow rapidly in the future. We see this approach most commonly with speculative purchases in the technology industry. An investment in Twitter (TWTR) would be ‘growth’ driven as its current fundamentals are very poor, but if they could figure out monetization properly the value of the company could skyrocket.

Interestingly though, this premium is not evident over the past 12 months. As you can see, the best returns have been seen by Growth rather than Value stocks, and ironically, Large Growth are really leading the pack. It seems that current valuations of small caps are high.

Growth vs Value 12 month performance

Growth vs Value 12 month performance

Comparing performance to the average

The above segmentation of fund shows how each strata has performed individually, which means that the broader index we discussed at the start (VTI and SCHB) will be averages of the above, returning 15.75% and 15.53% respectively. Herein lies the tilt discussion.

Do you accept the average, and be happy with your 15.x return, or do you elect to take the 6 ETFs outlined above and use them to create a strategic or ’tilted’ asset allocation?

The post Building Model Portfolios -US Equities appeared first on Saverocity Finance.

Continue reading...

Last edited: