I saw this topic today over at Nerdwallet, and wanted to share some insight on the matter. Note the standard disclaimer that everyone is unique, and to pay a professional if you want to do anything involving your money.In order to understand this decision, you need to first understand the basic difference between a Roth and […]

Guiding your way through Long Term Care

Long Term Care refers to the period of time in which loved ones will require additional assistance to complete the routines of daily living. Importantly, it isn’t just about money, or finding a facility that will be able to accommodate them in their retirement, but that is a part of it. This post will explore […]

Payroll in Xero with a Solo 401(k)

From a tax perspective, a Solo 401(k) AKA Individual 401(k) is one of the most attractive retirement solutions for solopreneurs. The Solo 401(k) also allows you to cover your spouse, if you have other employees though, you have to consider other options, such as a more traditional 401(k) program, or something like a SEP-IRA or […]

Social Security Restricted Application really exists

I’ve spoken about the changes to Social Security in the past, here’s a post on them. I’ve just spent the past hour on the phone with the Social Security Administration and out of frustration want to issue this PSA.Social Security Restricted Application STILL EXISTS for those born before 1954. The restricted application strategy is as […]

Private Pensions – know your options

Private Pensions offer the holder a multitude of options, in extreme cases I have reviewed plans with over a dozen different choices for the account holder. Here’s some key criteria that you should consider when reviewing your options: Make sure you are vestedBefore we look at the options, it is important to ensure you are […]

Making sense of changes to Social Security

The recent Bipartisan Budget act included provisions to close what were deemed ‘loopholes’ within Social Security strategies. Here’s a quick breakdown of what changed: Section 831 (a) – anyone who files for any benefit is deemed to have filed for all benefits. Section 831 (b) any benefits for an auxiliary (spousal payments) must be stopped when […]

Can you afford a Financial Advisor?

There is a real battle on right now for new clients for financial advisors – the battleground is at the Generation XY level. Let’s bust through some of the bullshit, and discover who actually needs an advisor, and what fees are really worth.Firstly, we need to acknowledge that everyone is playing around with the benchmark […]

The Great Robo-Advisor Bubble

I talk about Robo Advisor firms a fair bit on here, I had planned on moving on so you guys don’t think I’m a one trick pony. I was doing a good job of that until one of the ‘Growth’ team over at WealthFront decided to jump into my conversation on Twitter with a Fee […]

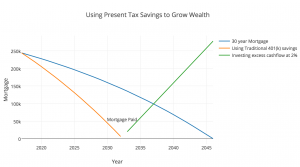

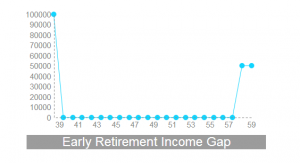

The dichotomy of early retirement and tax advantaged savings

I am a proponent of the FIRE concept, Financial Independence, Retire Early. Though the first part of the statement is the key, and once you have achieved financial independence you don’t have to start knitting, it just means that you have options. Options that can include taking a year (or a lifetime) off to sail […]

Backdoor Roth IRA – building a Roth IRA when income limits exclude you

One of the biggest frustrations to high earning people is how to build retirement assets when their income precludes them. Due to salary phases outs many tax incentives do not qualify for such earners, including the Traditional and the Roth IRAs. However, there is a way to create Roth IRA accounts using the Backdoor Roth […]