Options trading is an easy way to gamble on the market. Read that line again before moving on. This post will explore one of the most basic of Options Trades, and look at the ways to maximize profit by tax avoidance, cost reduction and consider the risks of the game. The gamble that occurs is that the buyer of the option hopes it will appreciate before it expires, and the seller of the option hopes it will not appreciate before it expires.

The reason this works is that an option is priced in two components:

- Time Value – the more time you have on the contract the more chances of the price appreciating due to a market movement, therefore an option with a longer time will cost more to purchase, and the price will decay on a daily basis until the Time Value vanishes altogether on the last day of its life.

- Intrinsic Value – this is the amount between the purchase price and the market price. For example if you have an option to buy Ford Motor company at $16 when it currently trades at $16.70 there will be 70 cents of intrinsic value built into the price of the purchase.

A brief introduction to the concept of an Option

- An Option is a derivative. Which means that it is linked in price and performance to another equity.

- An Option allows you to purchase stock at an agreed price at any point up until an agreed time in the future.

- An Option is time limited, when the time expires the Option ends, and it will be either a profit or loss event on that day.

How people lose money with Options Trades

People who Buy options are able to lose money in the transaction, people who Sell options are able to lose potential upside in the transaction. There will always be one winner and one loser in the transaction, and the broker who facilitates the deal will get paid by both parties. Uncle Sam plays a role too, and in the realization event that occurs to conclude an options trade one person will claim a loss and one a gain.

What defines a buyer and a seller of options, and how can we leverage this?

Anyone can buy or sell Options, however there are certain characteristics and traits of buyers and sellers that are important to note. People who typically buy Options are speculators.

Speculation within a portfolio is an acceptable habit, providing it is not something that consumes the entire strategy of your savings and investment plan. What I have found from my experience is that people who are speculating with a large portion, or even all of their investments are doing so in the pursuit of Wealth Accumulation this strategy is pursued by people who do not have a depth of wealth already and are willing to take risks to achieve gain.

People who have sufficient savings and a properly structured financial plan focus instead on Wealth Preservation they are wealthy already, and their goal is to maintain their lifestyle with as little risk as necessary.

I would posit that a buyer of Options is a person pursuing Wealth Accumulation, whilst there are some strategies where Options purchases are hedges and some might say is a Preservation tactic I would counter that with the notion that their underlying stock play is in itself too risky a strategy in solitude that it requires the Option to offset the risk, therefore the trade when considered holistically is a Wealth Accumulation Strategy.

By the same token, the seller of Options is also pursuing Wealth Accumulation, though it might well be in a very different place within the risk matrix, playing with a small amount of risk on a larger base of assets in order to provide some income from wealth.

People who sell options on the other hand, typically have sufficient wealth accumulated in order to ‘float’ the transaction. There are two ways to sell options, selling Covered or selling Naked. Naked means you don’t own the underlying stock and therefore require cash or margin to cover the purchase – this is high risk, and I discuss it further in subsequent posts for the sake of brevity.

Selling Covered Calls – this is the simple strategy of selling the ‘Option’ to buy your stock from you at a predetermined price. Options typically operate in blocks of 100 shares, so by selling 5 options to buy your stock from you it is necessary to own 500 shares of the underlying stock, let’s look at an example of this in action:

You own 500 shares of Ford Motor Company (F) with a current market value of $16.70 the value of this asset is 500x$16.70 for $8,350. Since you own the shares, you can actually sell up to 5 Options to buy this from you in the future.

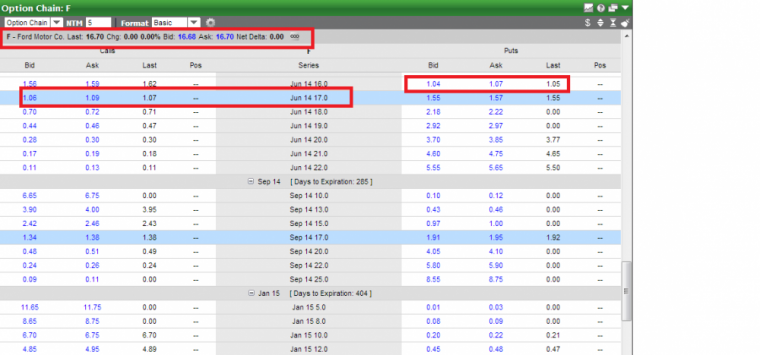

If you were to consider selling 5 Call Options with the expiry of Jun 14 you can see that they are currently trading within a bid/ask spread of $1.06 – $1.09 which is a good market. What this means is that people are willing to buy (Bid) 1 Options Contract for $1.06 and people want to sell them for $1.09. When the bid meets the ask a trade happens, so you can see a trade occurring somewhere soon within these ranges. A wider spread means there is less excitement in the trade and it will be harder to trigger.

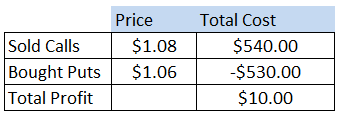

Let’s assume that the sale price is $1.08 5 options at this price would be valued as follows: Number of Contracts x Contract Size x Sale Price therefore: 5x 100x $1.08 for a total cost of $540.

Wealth Characteristics that we just witnessed

- The buyer of the contracts would require wealth of $540 (plus trading fees) to Buy the options.

- The seller of the contracts would require wealth of $8,350 (trading fees would be paid from the $540 income) to Sell the options.

Tax Consequences of the trade

- The buyer of the contracts spent money and this is reflected by creating a Basis in his Options Position of $540. If the options expire worthless he will claim a loss of $540, if the trade is profitable the basis will be deducted from the sale price to create the gain.

- The seller of the contracts received money, and this is considered investment income of $540. The income will be recognized for Tax Purposes when there is no longer a debt attached to the trade, when the options position is closed by execution or expiration. Due to the nature of options it is likely that this will be a short term capital gain.

How can we use this information to profit?

By considering options trading and characteristics it is possible to create the most advantageous positions for us, let’s look at how.

How to maximize profit as a Seller of Options

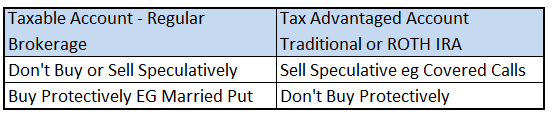

If you are selling options it is your hope that they will expire worthless, it is likely that the trade will occur in less than 365 days as most options are short term (there are long term options too, these are called LEAPs) therefore by engaging in a Sale of Options trade you are asking to be part of a Short Term Capital Gain event. Short term capital gains are taxed at your regular income rate, which destroys value in the trade. This tax can be avoided if you sell the option within an tax advantaged account – such as an IRA (either a Traditional, where it will be deferred or a ROTH, where it will be free of tax).

Selling options within a regular brokerage account means you are ready to accept Short Term Capital Gains which makes it pointless to trade, since you will be giving up between 30-40% of your profit as tax.

Another reason to consider selling options only from within a Retirement account as per the above is that you must consider your basis in the underlying stock. For example, if you bought Ford Motor Company at say in August 2013 at $14 and it is now trading at $16.70 and you go onto sell the Options at $17 the following happens if you bet badly:

- Jun 14 contracts $17

- June 2014 Ford stock price $17.60

- Options Execute at expiration, requiring you to sell you stock and realize a short term capital gain twice:

- 500x $3 (sale price minus purchase price, it sells at $17 despite the market being $17.60) for $1500

- Options Contract Income of $540

- Total short term capital gains of $2,040

Of course, if you have the cash available there is a way that you could avoid selling the Ford stock, if you take action and buy back the options contracts on the final day for the price of 60 cents per contract plus a penny or two for a total cost of $300 (5x100x$0.60) you wouldn’t have to sell the stock to the holder of the contract because you bought out of it. This is a good strategy, but requires you watching your investments on expiration week.

If you take no such action, then the automatic transaction will occur and you will sell your stocks to the holder of the options contract with no regard for capital gains on the underlying stock.

How to maximize profit as a buyer of Options

Theoretically, if we decide it is more likely that you will lose money than gain money in an options purchase the easiest way to maximize profit is to not buy options! However, depending on the type of purchase there could be some good ways to leverage tax avoidance on the transaction:

Pure Speculative Buy

This is when you buy naked, just in the hope that a stock will pop on earnings and you can make a nice profit. Typically you will lose more bets than win on this one, so the decision going into it could be to trade within a taxable account, because each failed transaction creates a Capital Loss that you can collect, which will offset the costs of the trade. However, that’s somewhat counter intuitive since you are buying in the hope of a gain, so you really want that gain to be tax sheltered. My advice – don’t do it. If you want the stock buy the stock, don’t buy the option.

Protective Purchase

There are options strategies that can be deployed to provide downside protection, I mentioned this earlier as a trait of wealth accumulation strategies, and it is the case. However, protective purchases should be considered within any sale of options, which I will explain shortly. The protective purchase involves buying an option that you hope will expire worthless. The intention of this transaction is focused on insurance for your underlying stock.

Since your goal when embarking in protective purchases is to see the purchase become worthless within a short period of time you are saying that you wish to create a short term capital loss. If you do this inside a retirement account it counts as nothing, but if you do this inside a regular brokerage account you can capture the loss and therefore offset the cost of the strategy.

Understanding the Risk of a Covered Call sale within a Retirement Account

There is a risk when selling a call that the price of your stock drops dramatically, but you cannot sell it. If you are the type of investor that has stop/loss orders on their transactions these orders must be canceled in order to place a trade inside a retirement account. This is an unintended consequence of regulation that bans naked call writing within a retirement account.

Here’s an example of what can go wrong, using the Ford Stock Example.

You bought the stock at $14, it is currently trading at $16.70 and you sell Jun 14 $17 calls for $1.08

On January 2nd some calamitous news occurs to Ford, and the price of the stock plummets to $13, the price of the option would drop to something like 0.05 cents as it would be very unlikely to be profitable again by June. If you had a stop loss order in place at say $16 to protect against this it would trigger, and you would be left holding a naked call position, which is illegal within a Retirement Account. Despite the fact that you have enough money from the sale of the stock to cover the position (now only valued at 5 cents) they wouldn’t allow you to create this situation just in case it flipped back up.

For example, if the crash in price was some sort of stock market blip/error and the price returned to $16.70 immediately you would suddenly be in danger zone territory, since you have enough money right now to deliver the stocks, and each penny it went up from here would start destroying your savings. We discussed earlier that it would require $8,350 to own the stock (500 shares) at $16.70 well, if your stop loss kicked in at $16 then you only have $8,000 from which to meet the obligation, so you would be in trouble.

So due to the scenario above the system will not allow you to set up a stop/loss on a stock that is linked to a covered call. This means you need to ride the market out and be prepared to follow the price up and down.

Introducing the Married Put

This is the protective buy I discussed earlier, and it’s purpose is to protect your wealth when you cannot set up stop loss orders. A put is the opposite of a call option and is described as follows:

A Put option allows you to force someone to buy the stock from you at a price you set. For example – if I buy a Put option for Ford at $16 it means that I can always find a buyer for my stock at $16 even if the price of it drops down to $13 a share as highlighted above. This provides me with the insurance I am looking for to protect my play.

However, I don’t really want to have to use the put, because I don’t want to sell for $16, ideally the price will hover around $16.70 (or just under the $17 Call I sold) meaning my underlying stock holds its value and I make a profit from the 5 calls I sold earlier when they expire worthless. Of course, the problem with buying a Put is that it costs money, and this money eats into my profit. However, when structured properly you create a perfect options strategy, that cannot lose money, which is pretty neat. The catch is – pricing is pretty tight to make this work.

Looking again at June 14, which is the duration of our risk obligation for this transaction. If I was to acquire Jun 14 $16 puts the spread is $1.04-$1.07. I would take the money that I made from selling the calls, and spend them on the Put. Lets assume the put sold for $1.06.

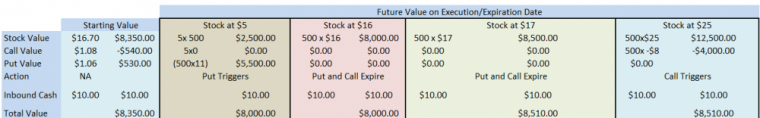

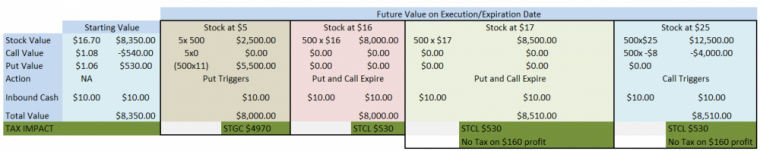

So at this stage in the game we are $10 better off from an income perspective as we netted $540 from the sale of our Covered Calls, and we spent $530 of that on purchasing our Protective Puts. Here’s how the profit looks on expiration day, note I am using an assumed basis of $16.70 here rather than $14 paid for diagrammatic purposes.

By building the Married Put you have created an upper and a lower boundary on your investment. It can never be worth less than $8,000 even if they stock went to zero, and it can never gain more than $510 as anything above a stock price of $17 will trigger the sale. Anything within the price range of $16-$17 is where your profit or loss can happen.

It might seem from this example that there is little value to be had from this, and in truth the cost of the insurance by building in the Married Put does obviously detract from profit, but it also builds in that downside protection. However, this is where we again turn to using tax avoidance to increase profit.

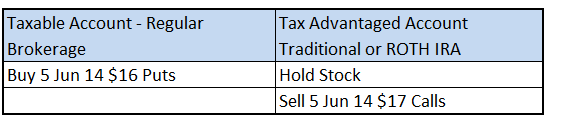

We buy the Married Put with the idea that it will never be needed, and we are crafting a short term capital loss. So if we structure the investment as something that is interlinked but allocated strategically we can create the following (note the No tax on the profit assumes trade within a ROTH IRA, if it was a Traditional IRA then the tax would be deferred :

If you assume a tax rate of say 28% the value of the short term capital loss harvested ($530) by buying the Married Put in a Taxable account is worth an additional $148.30 to the transaction. Furthermore, as you can see in the example the only time you are impacted by a Capital Gain is when the Put kicks in to protect your investment, and you don’t need to wait until it drops down to $5 to trigger it, you can activate your Married Put insurance at any point, so doing so around $12 would provide the same investment return of $8,000 with a smaller capital gain on the Put of only $1,470.

Keep Fees Low

The final consideration that you should think of when maximizing profit through Options Trading is transactional fees from your broker. If you use an broker that specializes in Options such as OptionsHouse you can keep costs to a minimum in order to maximize your profit. You can have both Taxable Trading accounts and a Roth or Traditional IRA set up with this company and create that tax sheltered Married Put that I described in this article.

I personally use OptionsHouse for my trades, since they have lower fees than any other broker that I could find, and are always running cool promotions to get new customers, these are the current offerings, they all pay me a commission if you signup with them, I think all require a $10,000 investment and a certain number of trades for things like the Xbox and Tablets, I thought to include a bunch of these right at the bottom so that there is something for everyone:

Get 100 Commission-Free Trades at OptionsHouse.com!

Get a Free Dell Monitor When You Open and Fund an Account at OptionsHouse.

Get a FREE Google Nexus Tablet when you open and fund a new OptionsHouse account.

Get a FREE Kindle Fire HD when you open and fund an OptionsHouse account.

Get a FREE subscription to eIBD when you open and fund a new OptionsHouse account

Get a FREE Xbox 360 when you open and fund a new OptionsHouse account

Get Free Morningstar Investing Newsletters When You Open and Fund a New Account at OptionsHouse

Open an Account at OptionsHouse and Get a Free Subscription to Financial Times.

Refer-A-Friend to Trade at OptionsHouse.com and get $150 or 30 Free Trades! Learn More

Trade FREE for 60 days when you open and fund a new OptionsHouse account

If I’m following you correctly, you’re describing a collar (or, if you prefer, risk reversal) where you buy the puts in your taxable account and you hold the underlying and sell the calls in a tax advantaged account… which makes sense, because if your IRA allows options trading it will certainly allow call-writing. However, the advantage will net out if F falls below $16 before June 2014, since you’ll be paying for those gains in the taxable account. Of course, if you are of the belief that the put won’t finish in the money (and stock markets do generally increase!) I’d be with you on keeping it in the taxable.

I don’t know I’d employ it though – with the benefit of knowing the maximum profit and loss comes the downside of being limited in further appreciation on the underlying. Of course, that’s a limit on call writing itself, not the strategy, haha. For someone writing covered calls this is something to keep in the back pocket when you’re worried about downside risk.