A commentor had asked what business school I am attending and it is Rutgers University. A few weeks ago I tweeted about the school not accepting Visa. With the school not accepting Visa has made me put on my thinking cap.

I’m leaning towards American Express gift cards to pay my tuition. If I can pick up Mastercard gift cards at 5x at the supermarket, I will certainly use that to pay my tuition.

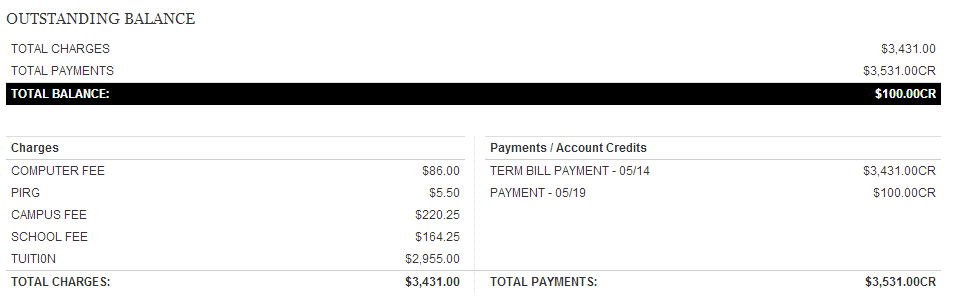

Anyway, Rutgers has contracted a third party payments company to handle the electronic payments and causes a delay of a few days before Rutgers sees the payment. Tuition was due on May 14, and I paid in full. As a test, I paid an extra $100 on May 15, the due date.

I now have a credit of $100:

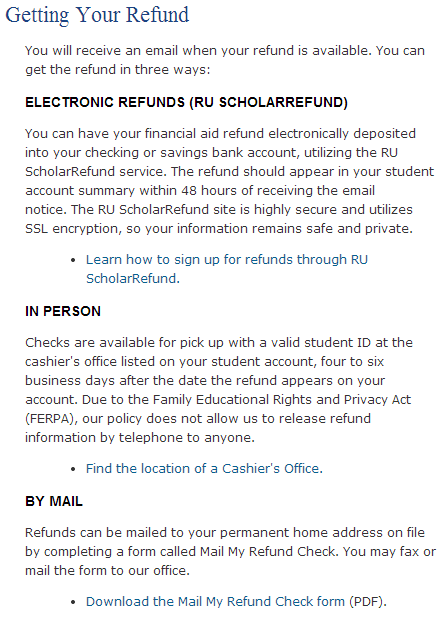

To credit me, I have a range of options, none of which would go back to the funding source:

At 2.5% fee, you may be turned off, but it’s low enough where you can easily profit from a 5% card. I say this is a limited opportunity because you need to be a student, and if you or your eligible dependent attends a university in a state that can not charge a convenience fee, this could be one great way to manufacture spend through over paying the tuition for a refund.

Side Note: Found from Central Connecticut State University and explains why Visa is not accepted.

Why is VISA no longer accepted?

Visa regulations do not allow a convenience fee charge unless the fee is also charged for every payment method (check, cash). Due to these restrictions CCSU will not be able to accept Visa credit card as a method of payment.

Don’t shit where you eat.

What are they going to do? Not let you pay tuition anymore?

Some places don’t let you graduate with library fines.

If you’re going to do it, find a campus that lets you unenroll with a full refund within a set period of time with less fees instead.

Agreed with William, in less poignant words. There are schools that will hold your graduation until all dues are paid.

CTP welcome back! This is very timely as UCLA charges a 2.75% uplift on credit card payments. My son’s tuition for the fall is due starting in July so I will be testing the waters as well. Worst case an AGC at 3% cashback through a portal and I break even. Is Evolve Money dead for 529 contributions?

You could take out a student loan, and use Evolve to repay the loan for about 1% (cost of Visa GC). If you pay right away the interest will be negligible if any.

The university my fiancée is doing her MBA at allows online payments as well with no fee for credit cards, however, it only says credit card or checking/savings accounts for payment. If I choose credit card it asks for the billing address associated with the card. It allows Visa, Amex, and Mastercard. Ideally I would like to use cards I purchase with one of my 5% cash back cards at pharmacies or grocery stores. Does the fact that don’t allow “debit” cards matter? Do I need to associate a billing address with these cards and if so what cards can purchase that would allow me to do so?

I honestly couldn’t tell you as each school would likely use different services. At this time, I cannot confirm the payment services Rutgers uses.

In addition, you maybe able to try to go to the BURSAR/payment office and try and pay there. Had I known manufactured spending while earning my undergraduate degree, I would have taken this route and paid on campus at the BURSAR office with a bunch of $500 cards.

Thanks! We will give it a shot. And yes, I really wish I had known about MS back when I was doing my undergrad degree as well.

Ethical qualms about pushing money through such a pipe? Or does the onerous convenience fee absolve you of that worry? If I could reliably push $100,000/month through for such a shoddy return (5% purchase, less card fee, less 2.75% user fee) I might consider it. But can you really move enough GC’s this way, on an ongoing basis, to make it worth your time and trouble? As a college student, I’m pretty sure you could find a better use of your time, no?

The ethics to this did cross my mind – but because of the 2.5% fee credit card processing fee they are charging, I feel that they are compensated for the credit card swipe so it becomes a wash. In my eyes, I view this as if I were going to Walmart and buying a money order. In this scenario, it would be Rutgers paying me back for over payments in the form of a check.

I was catching up to my reading list and Tahsir and Amol from Hack My Trip mentioned this at the CLT DO, which I really wish I had the chance to attend: “this “hobby” is literally worth what you put into it” http://hackmytrip.com/2014/05/charlotte-milemadness-thoughts-review/

I do find this to be worth my time as I will be able to leverage all the current offers and hit every spend goal that I have projected that I otherwise would not be able to hit.

Hi Matt, it isn’t clear in your post but I assume your reference to the 2.5% is a fee your school is charging you to pay by Amex? Am I reading that correctly?

If so, just an aside because I find the MC/Visa/Amex business fascinating – I’m not sure if the CCSU page you linked to is outdated reasoning. Their policy change is from mid-2011 and I think the big Visa/MC litigation which resulted in a bit more freedom for merchants to charge convenience fees settled in summer 2012.

Of course, even then, the reasoning doesn’t fully make sense to me.

Here is how the NYT explained it in August 2012:

“Under the agreement, a merchant that added a surcharge to Visa or MasterCard transactions would also be required to add the surcharge to American Express transactions, if the merchant took American Express.

But American Express has its own rule that says merchants must treat every form of electronic payment equally — and that means that to add the surcharge to American Express transactions, the merchant would have to add it to every other card it accepted, including debit cards. But both Visa and MasterCard prohibit surcharges on debit cards — Catch-22! — which effectively means merchants cannot add a surcharge to any transaction.”

So if I’m reading this correctly, if your institution surcharges Amex cards, they also have to surcharge debit cards (I don’t think anyone has to surcharge cash, despite the CCSU explanation) – that doesn’t sound correct to me and it is hard to believe they don’t accept debit cards, but maybe that is the case. But there seems to be an irony here if the outcome of the litigation combined with the private contracts is that your school can’t accept visa, which has a lower fee than Amex.

Seems they would have been better off barring Amex … oh well, just trying to figure this all out.

The 2.5% surcharge is across all cards used. I used my Fidelity Amex for the entire bill, then the Barclay’s Lufthansa Miles and More card for the extra $100 payment

oh sorry, not Matt’s post … this kind of musing is more his thing I think ….

Great info Matt, just found your blog and plan to become an avid reader. The cash back route seems like too much work for me and with few cards, and meeting spend thresholds isn’t the problem. Sorry in advance for what may be an excessively nubie question but Is there a reasonable route to pay college tuition (my daughter’s) where a 2.5% card fee is charged with a miles-earning card?