In the last year and a half I have been manufacture spending a healthy amount of miles mostly through gift card churning. I was telling my friend that I now have too many airline miles than I know what to do with it.

Unfortunately, I don’t have an unlimited amount of vacation time to use up all the miles so they will sit for a while. Saving them isn’t the best option with various program devaluations like United’s devaluation where partner airline redemptions are quite expensive.

While reviewing my portfolio of points, I realized the programs that I am in all of my flexible points are not good to redeem as cash to use directly as hotel redemptions.

Here is my portfolio of flexible rewards:

- US Bank Flexperks

- Citi Thank You

- Chase Ultimate Rewards

- American Express Starwood Preferred

Only the first three have an online travel agency that allows hotels to be booked with points. Only Chase’s program allows the points to be redeemed at $.012/point and I don’t I would ever redeem the points as cash for a room. Citi’s program allows you to spend the Thank You Points at $.0125 or $.0133/point depending on the card for airfare, and $.01/pt for hotel rooms. US Bank’s Flexperks only allows the points to be redeemed at $.01 as well, but it would behoove you to redeem it for flights as each point could be worth up to $.02/point.

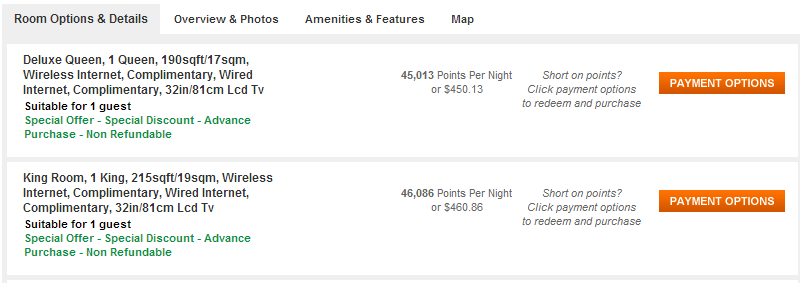

If you don’t have a particular hotel brand, the Thank You program does offer a discount for hotel stays:

Discounted rooms:

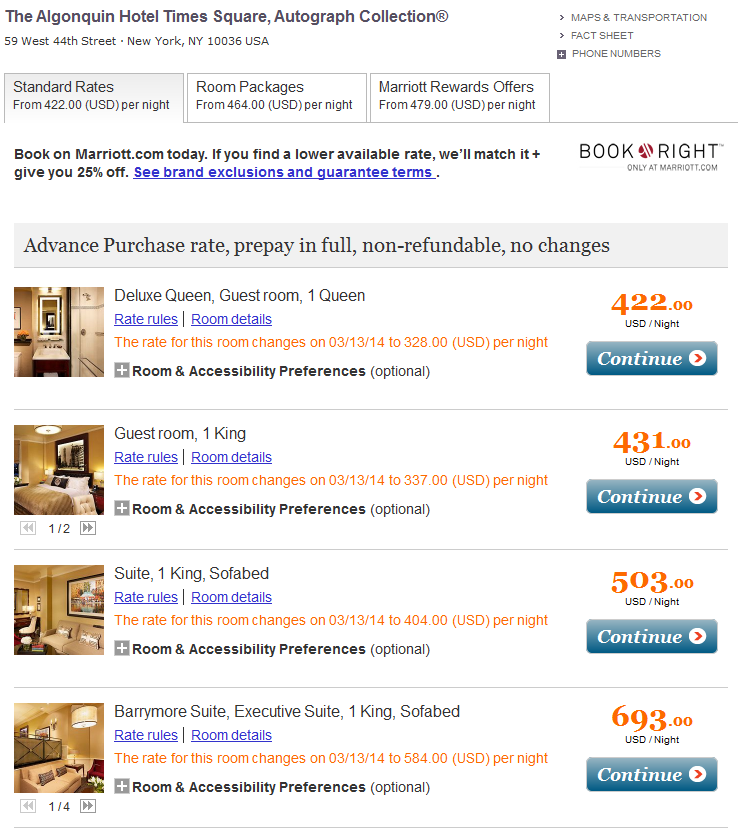

From Marriott:

If you research the hotel itself, the Citi discount is not a deal. The Marriott site has every room cheaper than Citi’s travel agency portal.

What I have done in the past with Citi was MS the Thank You points for Hyatt gift checks where the points are still worth $.01 and with checks I could do a points and cash stay. While I like 5% back, I could earn it from other avenues like cash back or Ultimate Rewards instead of locking it up in Citi’s Thank You program. If I am generating 5% cash and will still use it at Hyatt, it wouldn’t make any sense to MS into Thank You points until there are better redemption options.

Until I use up all the miles I will focus on purely cash back taking home at least a thousand dollars this year. Once I’m low on miles, I will MS back into it.

You can always get creative and figure out how to sell the points for cash. I prefer certain airlines over others I. Order to reduce tax/fuel charge costs, so I will sell off points that would otherwise be too costly to use. I just sold a glutton of points for over $2k and prior to that even for points for over $1,500. No point in losing points due to work conflicts are redeeming them for less via the CC company. Not saying I would always recommend this, as cash is usually the lowest pay out, but it is also the most flexible and easiest to spend.

Thanks for the idea! I am not sure if I would want to do that, I fear a program ban