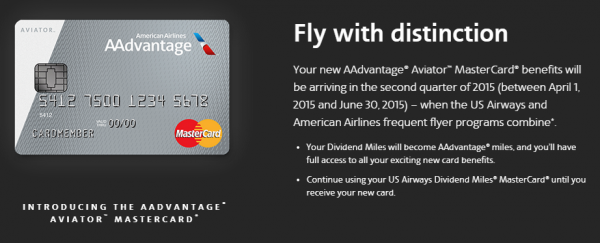

Hat tip to jolesch on Travel Codex for asking Barclay about the Aviator Cards and discovering there’s actually two more. I called Barclay’s and the agent told me there’s actually a link that Barclay’s has that describes the four versions instead of the previously covered two with The Points Guys being the first(?) to write about it. In addition, which stinks because of the poor call quality, there were spending bonuses leading up to the product switch. I didn’t catch all of it, but did hear the first one will be a 50% bonus, not including the one that Kenny @ Miles4More posted.

The common theme among the four versions are:

- Earn American Airline AAdvantage miles, this rate will depend on the card version

- Chip + PIN capabilities

Until user jolesch posted it on Travel Codex forum, I had not heard of the “Blue” and “Aviator” version.

Blue AAdvantage card:

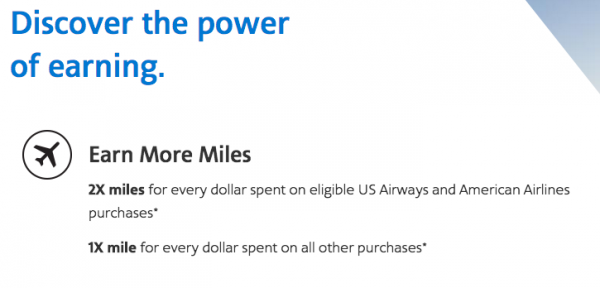

The Aviator Blue card would earn 1 mile for every $1 spent, everywhere and 2 miles for every dollar on US Airways or American Airlines

Aviator AAdvantage Card:

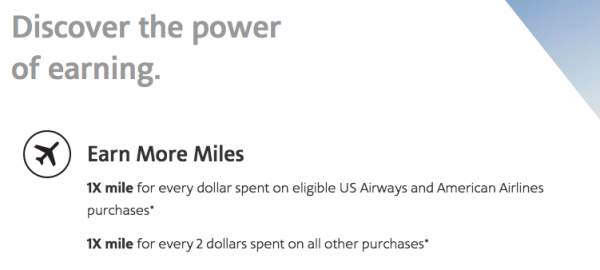

The AAdvantage Aviator card without any nouns following aviator, is the weakest card in terms of earning and benefits. It will earn 1 AAdvantage mile for every $2 spent and you must pay a foreign transaction fee when using abroad.

The Differences:

The bottom line among the four offerings are:

- Benefits

- Earn Rate

Some of the differences on the Silver version, the highest version, will allow you to earn Elite Qualifying Miles if you reach certain spend thresholds, bonus spend for hotels and car rentals, companion certificate, and 10% of your miles back when you redeem award miles.

The Red version, the second highest, only have the following overlaps with the Silver card: the 10% back when redeeming miles as well as priority boarding, no foreign transaction fee, and 25% off inflight purchases. The only notable difference I can find are: $100 flight discount for spending $30,000 on the card and smaller bonus for spending on US Airways or American Airlines and lack of hotel and car rentals.

The Blue version only has no foreign transaction, a 2x for US Airways or American Airlines earn rate, and a 25% inflight discount.

The Aviator version doesn’t have any of the aforementioned benefits. Its only benefit is earning AAdvantage miles, at a hobbled rate.

To get to the link to see all of the details, go to www.aviatormastercard.com/[product_name]

Replace [product_name] with:

- aviator

- silver

- blue

- red

So how will we know which card Barclay will give us when they transition over? Do we have to request one?

My guess would be a combination if you have the Premier World edition w/ or w/o Mastercard World Elite and if you pay the Annual Fee card or not. In the past, there were details of a lesser US Airways card if you were not approved for the Premier version and that is where I think the Blue and Aviator versions would link to.

For those that pay the $89 annual fee, my guess on how they would break down the users to Silver and Red would be which Mastercard version and from the customer input if they want a higher annual fee version

Funny, but minutes ago I just received an email from Barclays informing me that I would be receiving the Aviator Red between April 1-July 15, so I would guess others will be receiving their emails very soon. As a data point, my card is about 4 months old, but I also have the Citibank equivalent.

Me too, saying that I’ll be receiving the Red as well

I’d want the Silver if only for the companion ticket and EQM but according to my statement the benefits look like I’m getting the Red card. I wonder if I can ask them to upgrade me to the Silver card?