I wrote about the Upromise bonus being increased temporarily in early May. The good Doctor of Credit noticed something I didn’t realize when we went to press:

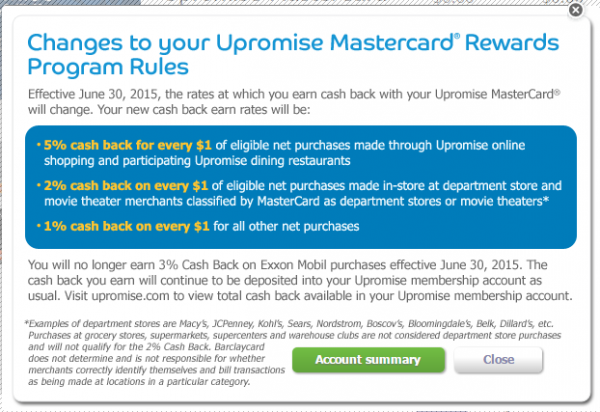

- participating Upromise Dining Restaurants (previously 4%)

- eligible purchases from participating travel partners through Upromise.com (previously only 1%)

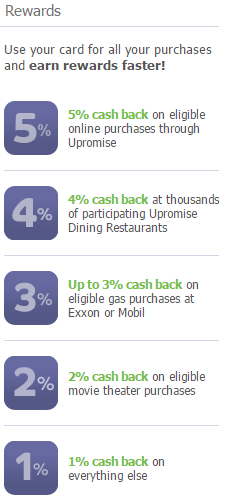

Here is the current bonus structure when you use your Barclay Upromise credit card:

- 5% cash back when you click through the Upromise mall

- 4% cash back at the participating Upromise restaurants

- 3% on purchases at Exxon or Mobil

- 2% cash back from movie theaters

- 1% everything else

Here’s the new bonus structure after June 30, 2015:

- 5% at participating Upromise restaurants instead of 4%

- 2% cash back with purchases made in store at department store and movie theaters

- Loss of 3% of at Exxon or Mobil purchases

My Opinion:

With the category changes, it doesn’t make an impact to me, but I’m sure it will affect others.

I felt like the Exxon or Mobil purchases trapped you with that brand of gas versus a more generic 2x Chase Ultimate Rewards using an Ink card or 5% cash back from American Express Old Blue Cash. The in store department store purchase I am not a fan of since you must go into the store to earn 2% cash back, but with Discover, Chase Freedom, or Citi Dividend Platinum card having the rotating category of Department Store, I would use those cards instead of the Upromise. For the movie theaters, the Freedom card has it beat again on the quarterly and the Citi Thank You Premier has 2x on entertainment which will beat the Upromise.

Has your sign up bonus $100 cleared yet? Do you think people saying it takes long time to clear are isolated incidents now?

It did! about 10 days ago, in total we’re looking at nearly 2 months for it to post into the Upromise account.

They’re definitely slow to pay out. Now I’m waiting for them to do the automatic sweep into the Sallie Mae savings account I set up for an extra 10%.