A couple weeks ago, I tweeted that I joined Raise’s bulk selling program.

Guess who’s a bulk seller @RaiseMarket? This guy!! Super excited

— Chasing The Points (@ChasingThePts) March 2, 2015

I am here to write my thoughts about Raise.

Scratching The Surface Thoughts:

Raise is an interesting business model, it’s like an eBay marketplace, but exclusively for gift cards. The following several statements are based off of my experience from selling electronic gift certificates. My bulk sales manager/partner advised me the physical gift cards are the same way, except Raise will cover the postage and you will mail it out to the customer.

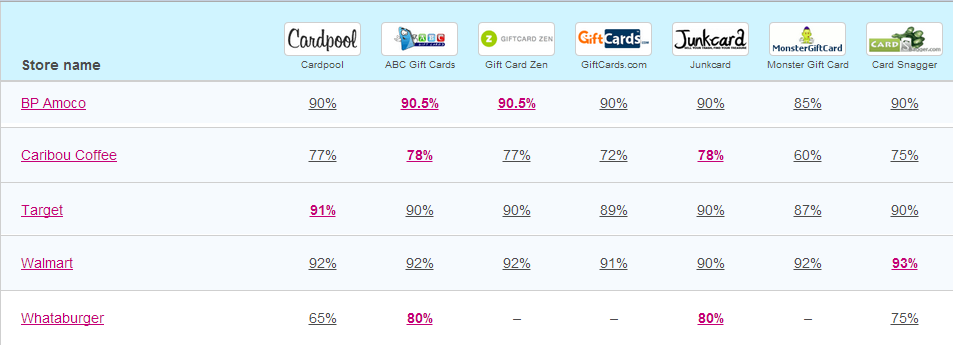

Like all of the exchanges, Raise has a variable commission for all of the brands gift cards.

My initial misconception about Raise was the 15% commission sale of every gift card, so I want to take that back. I got it wrong. The 15% commission is if you’re selling onesie twosie gift cards, for the non bulk seller. The bulk rates varying with the A list brands of gift cards, brands that have residual values of 88%+ are the A list brands are anywhere from 6 to 8% commission on the sale price. You, the seller, determines the sale price. Here’s an example of Kroger

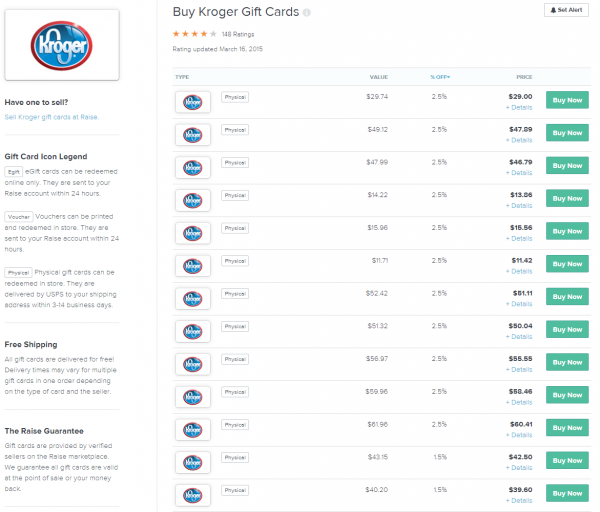

Someone is pricing a bunch of Kroger gift cards at 2.5% off and likely someone else is pricing at 1.5% off. Besides setting your prices, the biggest difference that I’ve noticed with Raise is how advanced they are compared to the other gift card exchanges. I was reading this article on Inc about Andrew Mason, former CEO of Groupon (emphasis mine):

Mason now also has a considerable disdain for that oft-heard Silicon Valley idea that startups should be driven by data.

And Raise falls squarely within the Silicon Valley idea of startups about data. With Cardpool and GiftCard Zen, I’ve had to ask for reports on my sales numbers and do some number crunching.

In a matter of about three weeks, I’ve sold over $3,500 on Raise and a couple thousand more that’s still listed, pending a sale. It took me months with the other exchanges because at the time I was still “growing” and figuring things out.

Where Raise Excels:

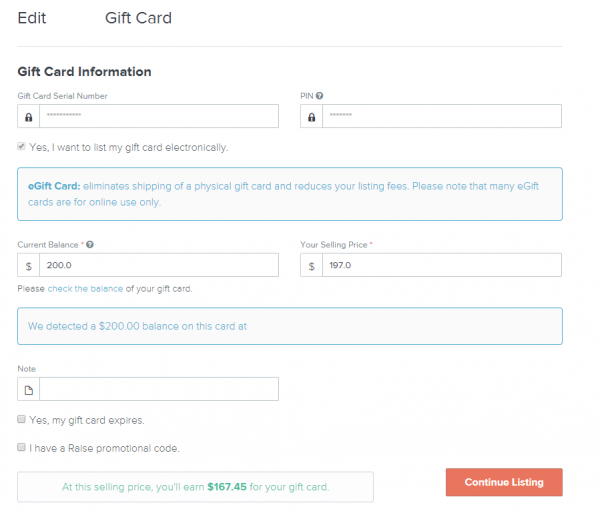

Raise is great if all you do is sell A list branded gift cards because then you control the sale price and people are snapping up gift cards as low as 1% off and offers competitive rates similar to GiftCard Zen and Cardpool. Remember how I mentioned Raise is advanced? In the next screenshot below you will see that they have scripts in the background that automatically check the gift card balance for verification. I like that! You don’t need to hire an intern doing menial work to check a gift card balance. This will lower the SG&A expenses.

Where Raise Doesn’t Shine:

I had a little back and forth with my sales partner on the Raise commission. It confused the heck out of me. It kept displaying the non bulk price, but if you’re locked in as a bulk seller then you’ll receive the bulk commissions.

Notice in the screenshot above, it has 167.45 that I would receive, it’s after the 15% from $197. I don’t like how opaque the system is and I have made a couple of requests for a chart of commissions so I can do my homework and see what gift cards are good for churning, but rates are with their Analytics team. This is where Cardpool and Giftcard Zen really shine are with the more transparent rates. You have to have faith in the system that it will work correctly like Delta and their award chart.

What Makes Raise Unique:

This part caught me by surprise when I first started with Raise. Raise never puts out any of their money for the gift cards that are listed on the website. Both Cardpool and GiftCard Zen accepts all liability with the cards in that they will pay you for the gift cards and accept it as inventory. Raise does not do that. Because of this feature, I find myself obsessively checking Raise to see if someone bought my gift card or not. With Cardpool and GiftCard Zen, it’s almost like a set it and forget it. That being said, if you can’t float your money, you should not sell on Raise. The velocity in which you are able to sell your gift cards on Cardpool and GiftCard Zen is amazing, as soon as you submit the cards, payments are near next day and you can continue the cycle.

Final Thoughts:

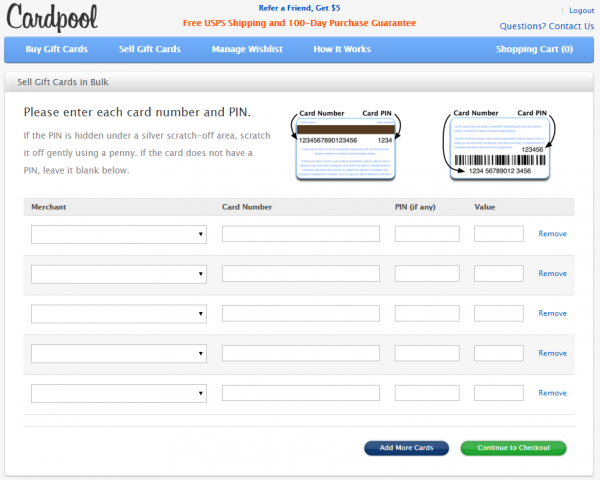

There are no clear winners for the three exchanges that I have sold on. All three have their quirks and nuances that make them who they are. If I were to touch upon the qualitative aspects, I think Raise and Giftcard Zen are the winners, it’s easy to reach a single point of contact and have a decent email exchange. Cardpool is getting better, but not quite there. Quantitative aspects, all three are similar with Cardpool being at the bottom only because that’s the only place I can put Cardpool. The bulk sales system Cardpool has, you’d need an intern because they don’t have any upload feature.

But that’s fine with me, because I actually do not use Cardpool’s bulk sales order form because I’m trying to create as many orders as possible to create the free expedited postage.

So happy with your volume buddy.

Although, You are going to need a lot of accounting with tax form they will send at the end of year. I am sure you are keeping buy receipts of your giftcards to match the books and show loss while filing taxes.

Thanks KP! Yep, got a stack of receipts, but I need to talk to my accountant about the portal bonuses and how they’ll factor in.

If in accounting portal bonuses are also factored then you may end up paying tax on credit card rewards you will be earning, which will decrease value. If no portal factor counted, your sell is a loss, and may actually help in overall taxes.. 😉

Yea, many cards were sold for a “loss,” with the points still not redeemed yet so it’s still a paper loss, for now