I know the site is a little Manufactured Spending heavy right now. I am sorry if that is a turn off for other of my readers, but I found it interesting to run the tournament, and what’s more, when I get user interaction from something like this, I get the opportunity to spot areas to delve into for educational purposes, which is something that I love to do, even more than pimp my credit card selection (please feel free to sign up for a few, by which I mean anything between 5-7 cards ideally, if this post is not applicable to you). Not for you? OK lets look at one of the biggest mistakes people make when thinking about manufactured spending.

Manufactured Spending is an alternative way to earn points and miles when you have a loan pending

Two people asked me why I wasn’t playing in the Tournament. The same reason for both answers is because I am selling my apartment in Brooklyn right now, and that has two consequences, one is that I simply don’t have the time, the other is that manufactured spending hurts your credit score when done in volume, and this is a volume tournament.

Everybody seems to know that applying for Credit Cards prior to getting a mortgage is a bad idea (or if you don’t you do now, it is a bad idea) the reason for this is that new credit applications act as hard credit inquiries which will temporarily ding your credit score, potentially making you appear more of a credit risk, and adding some percentage points to your loan, which over 30 years can make a massive difference to the amount of interest you pay.

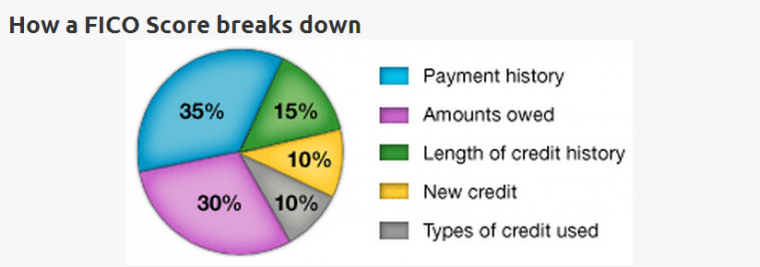

If you think like this, congratulations, you are on the way to financial mastery. However, what people often gloss over is that according to FICO, the company behind a key score, new credit applications (IE applying for a new card prior to a mortgage) make up 10% of your score, whereas credit utilization actually makes up 30%. When it comes to FICO and debt, the actual equations are a little obfuscated, but at the most highest theoretical level you can see that applying for new cards is a 10% weight, whereas utilization is a 30% weight, which means it is at least as bad to carry debt, if not up to 3x as bad, as to apply for new cards.

In examples I read about, not all credit utilization is bad. For example if you have a loan that you have paid from 100% down to 75% that is a good thing for your score, since it shows history of payments, but if you have a credit card that leaped up from Zero utilization to 50%, that is really bad. Read more here.

Key Mistake #1 People think if you pay off your bill in full each month you have no problems with Credit Utilization

This is huge. Every day during the month your utilization can be pulled from the Credit Card and used to explore your Credit Use FICO score. If you Manufacture Spend that impacts your credit utilization, you can do more harm to your score than applying for a new card. This pull happens when any hard pull happens, but also, it just gets sent over for monthly reporting purposes.

Credit Utilization has two key elements:

- Debt to Card Credit Line, EG a $5,000 Barclay Arrival Card, you put $2,000 on it via Bluebird. That day you have a 40% utilization level, if they pull that number your score will be affected. Even carrying that balance for 1 day can harm your credit score. Try to keep your utilization to around 15% of the card limit, and pay off mid month with an extra online payment whenever it starts creeping up.

- Debt to Income ratio, EG if you have 5 x $5,000 limit cards and put $800 on each of them, you are now carrying 16% per card, but also carrying $4,000 of debt which can tie into your income and adversely affect your score.

Watch the 36% Backend Rate for Mortgages

Mortgages have a 36% PITI+Debt ratio guideline. That means Payments+Interest+Taxes+Insurance+Debt repayments should not exceed 36% of your monthly income. So if you suddenly throw several thousand extra debt dollars in through manufactured spend you can skew these numbers, which will either prevent you from getting the loan you want, or increase your risk profile with the lender and make you pay more interest. Incidentally, the 36% is just a guideline, you can actually get loans around 43% (lowered from mid 50’s since Dodd-Frank Pt 2 ) on the backend with bank approval, many borrowers will pay a subprime rate as they start heading above 36% Backend Ratios.

Conclusion

It is possible to fly under the radar, but you have to be so very careful when doing so. That one opportunity to buy up $5,000 in Vanilla that might take 3-5 days to load to the Bluebird can hit your credit score harder than applying for a new card, that period of time, however short, and however well intentioned can be pulled by the credit reporting agencies and it can appear as a flag that you are in financial difficulty and a higher risk borrower.

READ MY FOLLOW UP POST HERE – I drill down on the facts after being challenged on how these firms report

Very interesting. Let’s suppose that you run the utilization up to 50% one month, but are then back down to 10-15% in subsequent months. Does the one time period of 50% negatively impact future scores pulled? In other words, does temporary high utilization have any lasting impact, and if so, for how long? Thanks.

I would imagine that it stays on the report, just like your hard pulls do in which guide the spacing of ‘app-o-ramas’ however, I tried to confirm this by pulling my credit report and for some reason I couldn’t gain online access to it and need to manually pull, so I can’t confirm how it looks.

You might want to try, this site allows you a free copy from the big 3, you can apply for one or more at a time, but only once per year (per type) for free – beware of imposter sites, this one is legit: https://www.annualcreditreport.com

Thank you for this post I thought it was wonderful. Since I started to get more credit cards I haven’t been as diligent with mid-cycle payoffs. However pointing out the importance of keeping utilization down was an eye opener. Even though I can’t control which date during the month this number will be pulled it is something I need to make sure I check regularly. I have a new goal after reading this to stay below 15%. I will also have to check my PITI to see what overall spend level would put me above the 36% as a personal FYI to avoid.

I’ve wanted to do this but I’ve also heard reports (mostly on FT, for what it’s worth) that regularly paying down your balance mid-cycle will trigger some increased scrutiny and possibly bad effects (e.g. amex financial review, chase shutdown). Any truth to these rumors?

Maybe. Maybe not. I’ve never been shut down or subject to financial review. But if I have had credit utilization penalties. If you are worried about those negatives (or rumors thereof) then don’t play, just wait a bit until your loan is sorted and then get back on the horse.

Or do play, and accept that such things may happen.

It’s everyone for themselves to decide how to navigate this, the point of this post is for people applying for credit, if you are not applying for credit then who cares about utilization?

If you are applying for credit, what means more- a rumor of a review, or the fact that your utilization if not paid down will impact your score? For me fact>rumor and even if rumor is true it’s doesn’t mean a negative impact vs credit score hits are real. A bird in the hand is worth two in the bush.

Everybody will answer differently based on circumstance and risk tolerance. Personally, I don’t care if I get reviewed and won’t care (too much) if I get a shut down, there is always something else, but I will care if my score pushes points onto my mortgage for manufactured spending for a couple of months when I could have just flown under the radar.

Good luck with your decision, and thanks for raising a very relevant concern.

Nice post Matt. You went over a lot of good details to be aware of, but why not also point out some ways to stay under FICO’s radar? I’ve transitioned to using my ink and simply cash cards while applying for my refinance which allowed me to zero out my credit score utilization during this process.

Interesting, frankly I didn’t think it would. Most people with inks in this game haven’t got a legit TIN and are acting as ‘sole props’ with their SSN which I thought would count. Are you sure it doesn’t when the only thing connected is your SSN?

I am a sole proprietor and have the full credit report when it was pulled a couple weeks ago. Only the inquiry would show up on your credit report. The utilization, and amount of credit line do not show up. I believe the only reason it would show up is if you have delinquencies with the account.

“This pull happens when any hard pull happens”

I don’t think you know what you’re taking about.

The credit companies report your balance to the credit bureaus once every 30 days.

Some do it when the statement closes, and other do it on a random day of the month.

+1

If you pay off the bill before it posts it won’t affect your utilization. And even once it posts, it only send your balance once a month.

@yuneeq Sorry guys, this just is not my experience with it. If yours is different great, but when I go big it hits my utilization, and before the bill is due. I do respect your experience in this, but I think we have seen different things.

– Edit-

Just re-read your comment Yuneeq – that if you pay it off before it posts is fine, agree 100%, what I am addressing here is: pay off in full at end of statement per autopay/pay in full will get you in trouble, and that as soon as you go high in utilization you are risking that report being pulled on whatever day it may be and if you are holding the balance, you get dinged.

This is aimed at people that think if they don’t apply for new cards, and pay off in full each month they can MS or just spend on big ticket items with no risk, which is not the case.

Additionally, I am seeing if there may be a report sent (more of a push than a pull) on certain utilization, I may have got that wrong, and am currently cross checking statements, credit reports and FAKO to see what that is all about.

@Mark I think I may have worded that poorly with the word “pull” here from what I understand what you say here is correct, but additionally, I was getting alerts that were too connected to the transaction to be random days. I am trying to track it down now and find out what is correct, though at the very least we are in agreement in essence that you must pay down before you bill comes, and not just auto-pay full balance, and that if you carry a high utilization and it does report on that random day you will have it recorded.

I said:

“Debt to Card Credit Line, EG a $5,000 Barclay Arrival Card, you put $2,000 on it via Bluebird. That day you have a 40% utilization level, if they pull that number your score will be affected”

Which I think you agree with, and regardless of you paying off in full or not if the above happens, it looks bad on your report.

I’m trying to see if it goes one further, and if making a large enough purchase triggers alerts, I somewhat think it does, but will confirm, I may have been thrown a curve ball by a third party tracking that helps that.

Matt, I am almost sure that if you pay off your spending before your statement date, it would not affect your credit score since the reported amount to the credit agencies is the amount your statement close with.

The below is a very simple MS paying your own credit card directly from Bluebird, if your statement close on the 15th:

You spend: $5000 on VR on the 8th:

Pay:

March 8th, 9th, 10th, 11th 12th: each $999. Assuming that payments post in 2 days your statment balance would only be $5 which would be the only amount showing up on the credit agency for that month?

Am I missing something? Of course you are leaving money, but the idea is to make sure that your balance is paid off before the statement closes and you can still do some MS and not get a ding on your credit score.

I’ve experienced high rates when I have left it and not paid prior the post date. But I’m going to try to get better facts to see if I’m accurate- I tried to pull my full report but it would not give online access- will try again and see what we can glean.

However, I think that on the vendor side they see different data also… Will see what I can gather.

I think based on the credit report 3rd party banks have no idea whether you pay off your credit card every month or not, just because you prefer keeping your statement balance high for cash flow reasons.

So in this case, you give up a little more of your cash flow, in order to keep your credit score high for a loan application.

I just pulled my report from Experian, it shows me balances in full at end of month and doesn’t show how much or little I paid off.

If the %utilized was high on those (in my case it was little ones) that would look negatively on your report.

I just tried to check my credit online and got this message. Do you know what could have triggered it?

Online Delivery Unavailable – Mail in Request

We’re sorry, for your protection we are unable to deliver your Equifax Free Annual Credit Report online.

Request by Mail

Yep that’s what I got too- I’m signing up right now for a paid account so I can see what is showing

Or you can just snail-mail it to them. Let me know what you found out.

Because we always use autopay and never carry balances, I always assumed I was home free. So this is enlightening. I never paid much attention to the high credit limits we get with new cards. Nice to have for an emergency but hard to imagine going anywhere near them with any spending, MS or otherwise. The only time I would charge a lot in a short time was when trying to make a minimum spend.

I looked using CreditKarma and see that overall, I have just a 2% credit utilization. But the new AA card that demanded a $10,000 spend has a utilization in the 40% range. I have been mailing Citi BB checks mid month and just sent another, but can a mid range credit utilization for one card really make that much difference?

Great topic and helpful info, thanks!

This is pretty well covered in several FT and FW threads. All MSers should be paying off all but one or two of their cards BEFORE the date that the lender reports the balance. For Discover and USBank, this is the first of the month regardless of statement date. For most of the rest, it is the statement balance. The 1 or 2 that do report a balance should ideally report 1%-2% utilization, but definitely not more than 20%. Autopay is a great tool to make sure your card gets paid if you forget, but it should never actually wind up doing anything IMO.

Of course if you are applying for a large loan it also makes sense to have low or zero balances at the time of application.

Interesting….I did not know that Discover and US Bank reports 1st of the month instead of the statement balance. Please provide link if possible…

I have neither US nor Discover so I am not speaking from experience, but one thread is here http://www.flyertalk.com/forum/credit-card-programs/1505646-fico-score-getting-killed-i-am-obviously-doing-wrong-fico-utilization.html which has several links to other resources and threads. Particularly interesting is post #55.

Utilization is a snapshot of one point in time when your report is pulled. As a result, all you have to do is write down your statement dates and make sure your payment goes through before the statement cuts. You will have 0% utilization if you pay all your cards before the statements cut no matter how much you spend on your cards during the month. I’ve been doing this for years. There are a lot of threads about this topic on Creditboards.com, Myfico.com and Fatwallet.com. Easy Peasy.

Jack-as I understand it, when you pay off by autopay you are sending utilization to the reporting agency, and also, when you hard pull you snapshot.

Is that how you see it too?

If you use autopay it pays after the statement cuts. If you don’t want a balance to report you need to pay online before the statement cuts, far enough in advance which for most banks is two or three days. You can figure out your situation by keeping track of your actions and results. If you rely on autopay to pay your bills your credit report will show whatever the statement balance is and that is where you can get the problem of your report showing high utilization.

@Jack, correct.

Except that not all cc companies rreport on the statement closing date.

Some companies report on the 1st of every month (E. G. Discover IINM)

Matt,

I just signed a contract on a new house and then realized that I will need to furnish the LO with bank statements and unfortunately they show 1k being sent through AP and then transferred back to my bank for the last couple of months. Any way I can explain that? I now realize I should have waited a few months before applying.

Do you need to explain it? Firstly you may be seeing problems where he does not. If he does then we need a simple, and honest answer… If he is looking at CC and Bank statements and makes an issue of it id probably just tell him the truth- meeting min spend as you have low expenses and wanted airmiles. If he only sees inbound 1k plus a generic number outbound then you could say someone paid you back for a loan- still kinda true…

Personally I wouldn’t sweat it and use your people skills.

My goodness, another Elaine!

I wouldn’t worry about it. We did a refi recently which we didn’t really plan on, and the LO asked me about the multiple CC apps which she saw on our credit report. I explained that I apply for CCs to get promos, miles and good cash back offers. She commented that I was jeopardizing my credit rating and asked me to write a letter for the underwriters explaining the multiple CC apps. I wrote a two sentence letter saying the above.

We got the refi with no trouble or trauma.

Basically they ask for two months of bank acct statements to make sure the money you report as assets is truly yours. I doubt they will look at it transaction by transaction.

Good luck!

I thought it was you for a moment since I knew you did this too!

Thanks guys! I hope I’m overthinking too and it won’t be a big deal. I love all the good info on your blog – keep up the good work!

Hi Matt, I know this thread is over a year old but I hope you see my question………I am looking at going for a mortgage May 2016 but in the meantime I am engaging in M$…….not much at the moment but plan on doing quite a bit for the next couple of months. The purpose for me to do the M$ is to gain credit line increases more than the rewards because at the moment I have low limits on my accounts (highest is $2000). So with this in mind I have a couple of questions:

1) Are my credit card companies likely to shut down my accounts if they see that I am spending like 5 times my limit (such as $10,000 on a $2000 credit line)……after all they are making money on the transaction fees etc (though no interest from me) so I find it hard to believe they would but of course I don’t know for sure….I mean the last thing I need is for my utilization to be negatively instead of positively affected by M$ because I didn’t get the credit line increases but instead got the account shut down.

2) I am aware that all payment history including amounts paid each month are listed on the credit reports……..is that likely to raise a red flag even though I pay in full every month except for the one card that I have a BT on?

When it comes to the small amount of M$ I have done already, I always use the same procedure……..get the gift cards, load up my Serve card or buy money orders with the gift cards and then on the same day make the payment back to the credit card with bill pay. So far the payment has always posted before the charge…….I have noticed that the grocery stores where I get my gift cards from take at least 3 days to post the charge.

Any advice would be great.

Thanks

Patric k

Frankly I’m not sure.. My gut says I don’t like it as it seems you are hitting too hard. We’ve got some people on the forum who might have better data points.

Card companies will shut you down for MS and it seems that going too much over your CL is a bad thing.. I’ve heard of 2x or 3x but 5x seems too aggressive.

That BT is going to hurt your score also..

Overall.. I don’t love it.

Well the BT isn’t actually hurting at the moment because it now isn’t showing on my credit reports……..I had paid off my credit cards completely and decided that my wife needed a helping hand with her credit card debt as I need her scores to go up for the mortgage so I transferred some of her debt to me. While I pay it down and off, I am transferring it back and forth between two credit cards each month as I am not getting charged any fees to do so and because I setup the statement closing dates of the two accounts to be more than two weeks apart I am able to do the transfer so that each report the balance as zero.

However, the main reason why I doing this is because I am not qualifying for totally free BT on my other accounts……I am either getting the 0% with the 3% transaction fee to do the BT or 10.99% interest rate with no other fee…….I know this isn’t ideal thing to do but I need to save every penny I can while I pay off this remaining debt and so every little helps.

As for the original question, there really isn’t any consensus on what the credit card companies will do with too much M$ according to the websites I have visited and I guess one of two things will happen, I’ll achieve my goal of getting higher credit lines to help my utilization or they’ll shut down the account. Now I am making heavy use of my accounts for regular spending (I pay all my bills through them instead of through my checking) so I am hoping that counts for something in the end.

Cheers

Patrick