I love the guys at Travel is Free, and think they product great content. However, I feel the urge to challenge their latest post: MSing for Hotels. It’s just wrong. See, the numbers may be right for points requirements ( I didn’t check them) but what good are good numbers with bad concepts? However, in fairness, MSing for hotels is damn hard, so it was a great effort.

The great part of the post is that you get to see the prices of the hotels in relation to one another. Where it falls down is that you are relying on the co-branded cards and a brand driven strategy – or in other words you are looking at the tail that wags the dog.

I’ll start out first with a valuation concern: Drew lists Citi Thank You points as being transferable at 1:1.5 to Hilton. That is something that I didn’t know. The reason that I didn’t know it is that I would NEVER transfer a TYP to Hilton.

Understanding the intrinsic value

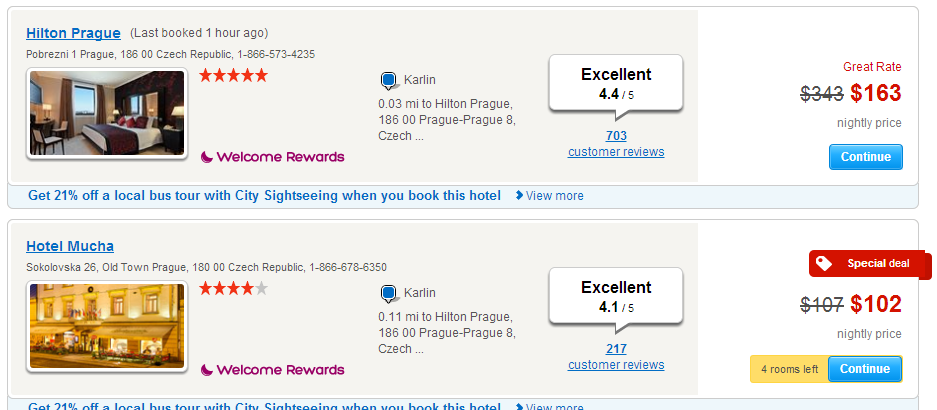

Citi TYP have a base value of a penny when used on travel. In his example he lists a 30,000 point hilton for which he would transfer (I guess 20,000 not 26,666) to get one free night. So you would spend $200 for a night in a hotel? What’s more, if you hold the Prestige Card you get a 33% bonus for flights, which becomes a 60% bonus for AA/US flights. Note, they have other transfer bonuses for travel but it seems they are depreciating this year. Value wise, that means we are talking about a $320 AA/US flight vs one night in a Hilton. Incidentally, I pulled up a random night on Hotels.com and came up with $167 for the Hilton, or right below it a 4 star for $102.

Don’t get me wrong, Drew and Carrie do travel a lot more than me, and I am certain they do so at a very low cost indeed, I am just pointing out that when you start comparing ‘scientifically’ like this, you have to keep your eye on the bigger picture. What they did here was take a 5x card and multiply it downwards by transferring to Hiton, even at a 1.5x multiplier.

The reason for this is the base value of a Hilton point is less than [1.5X 1 cent] especially when you can stay next door for less.

This is the tip of the iceberg

Before you go off and say ‘that’s just one little thing’ actually, the TYP example is the key to the real answer on how to MS for hotels. You find a real card that offers 5x and you buy the rooms with that. How does that work…? Let’s rip up the table and start again:

- 4 star hotel in Prague $102

- 5% cashback to earn $102 >> 5x $505 for $2525

- $2525 * 5% = 126.25

- minus $25 fees = $101.25 profit (close enough)

So we go from needing a hotel in Prague and being willing to pay $53 for it, to getting one for zero. Neat? OK mine doens’t come with the free breakfast for Hilton Golds, but I can go buy a bagel and a shot of rum somewhere nearby to kick off the day.

The Domestic/International Flight Effect

People rave about the Arrival card offering 2.22222% (or more if you can’t do math) cash back for travel. As we know, this can be useful for domestic flights, but not for long haul business class. The reason is simple, domestic travel is often bearable in economy and is relatively CHEAP. Long haul Business or First Class is EXPENSIVE.

Just the same with hotels. There are people who like to… dare I say it… Vendome their hotels. If you like fancy hotels then cash (or the Arrival at 2.668585%) isn’t viable.

At a certain point you need points

When you start seeing the ratio of a redemption increase above 1:1 then you have entered points territory.

- Example 1 Hilton Prague $163 per night with 20,000 points to spend is a ratio of 1:0.815 – cash is better

- Example 2 Park Hyatt Vendome $690 per night with 30,000 points to spend is a ratio of 1:2.3 – points are better

In example two we would be perhaps considering Chase Ultimate Rewards, that could be transferred to Hyatt, so rather than blowing 69000 by paying with them, you would use half that to transfer in for your room. Admittedly, in my case if I had 30,000 points to spend on 1 night I’d be looking to see what 4 star hotels I could pick up for <$300 per night.

We do get into that weird zone now of the Vendome – would you stay here and claim you got 2.3 cents per point value and tell your friends at the holidays (they hate you anyway because you travel and they have ugly kids) or would you shop around?

The SPG Effect

How about this… $350 cost to stay in the top tier SPG property via MS. Simple math is that you earn 1x SPG per dollar, so if you spend $35,000 you get a free night. Simple doesn’t work in Travel Hacking though.

35,000 SPG can get you one night in a nice SPG property, or it could get you Iberia Business Class from NYC-MAD with change. At this point, you need to start thinking about having a basket of points and miles, and knowing where to use them for maximum value. Just like using TYP was a bad transfer into Hilton, SPG is a bad award at a hotel (subjectively I admit). However, we have a further complication with SPG… the 5x factor. SPG points typically cost 3.5 cents each to buy with cash.

Let me ask you a question… if I gave you $10,000 (plus fees) of my float and said. Come back with as many SPG points as you could, what would you do?

- buy 285,715 points with the 10K?

- buy 20x $500 cards with your SPG Amex and earn 10,000 points?

- buy 20 x $500 cards with your 5x, earning $500 cash and use that to buy at 3.5cents each?

- run off with my $10,000 and say screw you pal?

If you picked option 1, you don’t get MS, that is OK, but if you have a significant other I would recommend that you give your credit cards to them for safekeeping. If you picked option 4 then yeah, you got me, that is much smarter than MSing it!

Option 2 (use the SPG) vs Option 3 (use a 5% and buy points) is the difference between earning 10,000 (SPG card) and 14,785 (14,285, plus the act of buying the would earn 500 more)

In short you not use SPG to earn SPG nights because they are vastly over valued. And furthermore but you should not use the SPG card to earn SPG points (if we are using this world of multipliers on cards) because you are losing 30% every time you do that.

Conclusion

You need a travel budget. The problem is that when people earn cashback they think of it as cash back, instead, think of using cash earned to top up your travel fund. Personally, this entire notion of comparing MS for hotels has some value in terms of perspective, but when I travel I tend to think of things differently.

My approach is:

- Where should we go? Anywhere (wife)

- I then get us there using points from signup bonuses

- I then book hotels using points or cash depending on the want- sometimes I/we want fancy (Park Hyatt Milan) sometimes I want value Radisson San Juan. If I can’t make fancy work for free then we go cheap. In my world, cash is king, and I won’t waste it, but I will splurge using my points if I can.

I’m pretty sure that Drew has a similar approach to travel, so I am just ragging on his post because I have a few hours to kill.

If you did anything BUT option 1, you would have failed the task of bringing back the most SPG points.

Ok I’m not giving you my money.

Binny makes a valid point.

Good analysis. Couple of questions:

1. For earning SPG points, can you please elaborate on “losing 30% every time you do that”? How much do you value SPG points? Sometimes SPG gives bonus xfer options to Airlines that we need to think about.

2. How much do you value UR and MR points? Do you recommend xfering UR to Hyatt or other Airlines?

My own feeling is that, I will stay at a Hotel with points that I will never pay with cash “if” I am earning the points “very easily”. So, I have never used SPG points for hotel stays bec there are too many other hotels that I earn points very easily.

You are losing the extra cash. Using a 5% card gives you 1 spg and 1.5 cents (when buying at 3.5 cents)

I don’t know what I value UR/MR at, it changes depending on my mood. Something around 1.5 cents give or take.

UR to airlines is the best value, I have stayed in Hyatt hotels at the old 22K rate (once)

My approach is:

1. Fully fund Roth IRA.

2. Diversify w/ all kind of points.

3. Limit my travel opportunities to where my points will take us.

4. Let my family pick the destination.

=> points/cent calculations are a waste of my time. I spread my love across several CCs to secure their future use.

How about buying 20x$500 AGC from a portal earning 2-3% CB, then convert AGC to VGC at CVS later? You will get 10k SPG+2-3% CB.

Hmm, let’s not get into specifics because there is enough talk of MS technique out there already, but you’d need to pull 1% from your CB to pay at the drugstore.

You need 1% cost in your option #3 as well in either drugstore or grocery store.

Fair point.

Do we have to give you $10,000 back? As option #1 and #4 do not give it back to you. If I can just keep on cycling that $10,000 for a while, and liquidating those cards, I think we can get into 7-digits of SPG points before we exhaust that $10,000 in transaction costs — if we ever even do that.

You sir understand this game far greater than 99% of the credit card pushers, ahem “bloggers” out there.

You should never use points on a hotel stay unless it’s Club Carlson or SPG nights and flights. The only way to go is 5% cash back used for stays at a Ritz Carlton with AAA or corporate rate code, and we can let the “bloggers” keep their Park Hyatts.

Unless you’re doing a “Lost in Translation” Tokyo vacation and just have to stay at the Park Hyatt Tokyo 😉

No? That’s news to me. What do you suggest I do with all my HHonors and Marriotts?

I was speaking in MS terms and mainly referring to what a dismal return it is to transfer to the much blogger beloved Hyatt when compared to MSed cash.

Corporate codes or Hotwire Hot Deals can get you much further IMO.

I know, just kidding.

I love the blog Andy. Keep up the good work sansei.

Thanks a bunch for your kind words! (I have no idea why, but there is no reply button under your last comment).

WordPress limits the number of replies, I set the number to 4 or 5 as it helps mobile readers

Thanks Matt. Too much to learn… 🙂

so what if im getting a 2c/point value out of my UR pnts transferred to hyatt? this is a bad proposition?

i should be paying cash only for hotels?

im missing something here

I like the idea of approaching it from a $10k of float idea. It forces you to do things smarter rather than brute forcing your way to the numbers you need. For me this really has more to do with my limited MS throughput per month but it forces you to look at the math the same.

I thought about doing a post in the forums about maxing points per $1 of float/throughput and what value your float/throughput has (not necessarily quantifiable) but as I was writing it I felt like I was rambling.

Well- the float idea was instrumental in milemadness- they had $5k bankrolls to play with and had to liquidate it prior to spending again.

And the winner of milemadness was the miles professor, doing 5x everywhere.

My wife and I stayed 8 nights in China in Cat 1 Starwood hotels for 21K starpoints. We signed her up for the SPG Amex and got the 25K bonus for $5K in spend in the waning days of VR. The 30K starpoints we earned cost us $39.50. What we could have afforded otherwise was JinJiang Inns, which runs $40 or so a night for basic accommodations on a par with Motel 6 or Best Western, except cleaner and with better service. Even had we MSed 21K starpoints without a bonus, we would have come out ahead.

There’s always one… 🙂 yeah I actually had a discussion with Kumar about India cat 1s and I agree there is value there- a very similar example to yours. I just always tend to think of them as Cat 3-5 (where I shop) above is too expensive by far, and below are very hard to find where I have been recently.

I went through a phase of spending 10-15k per night and realized that was madness.

For me what I run into is having limited ability to MS at 5% per month. After maxing out my limits at 5 I have to move to other options to do more and so maybe it’s not the best option but it’s what I have available if I want to do more volume….

@Kate – right on target. I do the same. Rarely do I find paying cash is better value for hotels that I want to stay at. And since I don’t stay in enough hotels to get status via BIB (butt in bed), I really like cards like the Surpass where I can get Diamond just from spend.

Well, once you are over the 1:1 ratio for prices, which you are in nicer hotels points can make a lot of sense. Travel style/habits do matter a lot too.

@ Paul – What hotels are you staying at that you can do better in points over 5% cash back? I have a tier 5 Ritz in Grand Cayman for example at $345 a night with $100 daily hotel credit booked. That’s $8,750 in spend @ 4% net at our favorite store per night stay. Sure you could generate 40k+ Hyatt elsewhere with $8k spend but you’d still be out $200 cash for doing so. I’m out zero cash and earn tons of Marriott points for doing so.

I think the point Matt was trying to make was that a $1,000 per night Park Hyatt Midtown doesn’t necessarily mean you really earned 3.3c on your hyatt points if the St Regis Central Park is only $500 per night that you could have stayed at if you used cash that you generated for free.

Kate, true, if available resources exceed card limits I can see the value in switching to points.

“People rave about the Arrival card offering 2.22222% (or more if you can’t do math) cash back for travel. As we know, this can be useful for domestic flights, but not for long haul business class.”

Not sure I’m following. Are you saying that because rewards rates are constant with the Arrival a business class fare takes much more MS compared to a miles card?

Makes sense then.

Yep

@Too Nashty –

The Westin Riverfront Resort & Spa at Beaver Creek Mountain, 12/22-23/2014

SPG Cash & Points: 6,000 Starpoints + USD 110 per night

Lowest Standard Rate: USD 509 /night

You will get (509-110)/6000 = 7 cents/point

@spgbus – In briefly searching I see a Hotwire Hot Deal with the same star rating for $229 in Beaver Creek which I’d earn 4x Chase rewards for portal and CC (It is also marked down from $509 so it may very well be that Westin). Not sure I’d blow 6k starpoints to save $129 when manufacturing cash is easier than starpoints.

Cash = flexibility. But you are correct at certain times you can do better with points. Although for the majority of us travelers that travel for the location over lodging, cash will do better in most circumstances.

Also I wouldn’t travel all the way to Breck in December from Miami to hang out at my hotel 8)

Am I missing something? Wouldn’t the points you earn in option 3 be UR points and not SPG points?

@Too Nashty – Majority of travelers don’t ms. The true ms believers do points and cash together. I don’t have any complaint to stay at a top rated ski resort with 7 cpp value. Enjoy the opportunities, don’t simply close the door for the points. 🙂

I think credit card churning should/would come into this valuation as well. Getting a large deposit of miles is nice from a sign-up bonus…but it’s not always the amount you need. This is another case where I think it would/could be worthwhile to MS on a hotel branded cc…merely to get you to your redemption goal. If you’re starting from scratch and purely MSing hotel nights, then the strategy you’ve outlined here is preferred.

SPG option 3… feel like you can find a better use for the $500 you netted MSing via 5x than purchasing SPGs

Matt, you are spending FAR more than you should with your strategy. MS as much as you can on 5% cards. Then MS on hotel cards and use the 5% cashback to subsidize your MS fees.

Example: I can MS SPG at 0.4cpp. Top tier is 35K = $140/night effective cost. Cash price to get similar room is multiples higher (sometimes approaching $1K a night).

Example 2: I can MS HH at 0.2cpp using Surpass. Top Tier is 90K (95K high season) = $180/night. If I paid revenue rates I’d have to pay multiples for similar quality room.

So why not use 5% cashback to subsidize MS fees? That’s the optimal way of saving money.