We’re back from our cruise now, and I wanted to give a quick update on how the MS aspect went. Here’s the original post, for cave dwellers, and some Q/A from the comments there, along with some things I learned:

Commenter: startspreadingthelove

I think its more than “2minutes” there are alot of things involved. I’d love to hear how you get the fees waived though. Thats the only crucial step involved here. Without the fee waiver its not really doable.

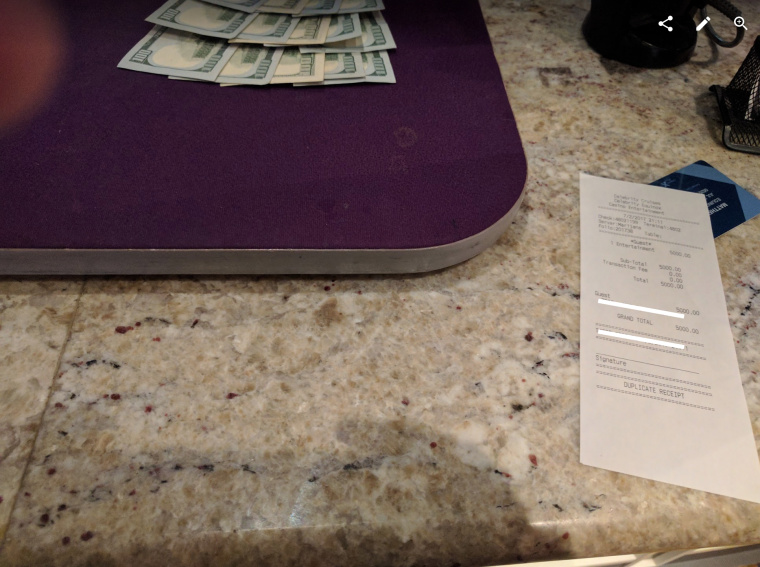

The process of getting cash took less than 30 seconds. At the cashier they swiped my seapass card, and I was presented with $100 bills. The limit was $5K as standard, and could be doubled to $10K on request.

In terms of waiving the fee, I was added to a list by the host. The host wasn’t aware of me coming on the cruise (weird, since it was a comped casino cruise by MGM) and I didn’t have my MGM Platinum card (gained from Borgata being acquired, where I received a Borgata Black card by asking nicely) with me. Without any verification of my identity, I was added to the list. Naturally, YMMV.

What I liked about this is that you get to see the $0 transaction fee on the receipt that you sign, so they can’t double back on the offer to waive the fee. NCL adds the fee, then credits it back, which feels more risky.

30 seconds for this was great, using my Altitude Reserve I:

- Earned 15,000 pts worth $225 of flights

- Met Min Spend for 50,000 more points for another $750

- Met Travel rebate requirements (which is important, because I would otherwise have to have looked up things like gift card buying, or funding travel banks and other silliness, rather than getting straight cash) PS for you landlubbers, I was rebated for Uber rides too.

However, the time expended was extended by the following:

Swapping cards to meet other spend (Capital One Spark for $600 cash back, and TYP for more of those points that I have no real clue how to use) took a few minutes, as the front desk didn’t know how to do it the first time around.

Also, I needed to fill out Fincen form 105, which I did before I departed, and had to go into secondary screening on the return, which took another 5-10 minutes. I typed and printed a couple of duplicate forms, leaving just the cash value blank to be added later.

Also noteworthy – the form 105 is for international arrival/departures, so I used one for arrival into Miami Port, but didn’t need to use one for the flight from FLL to JFK. That actually worried me a little, because carrying cash without declaring it raises the risk of civil asset forfeiture, and there isn’t really a way to declare it. I did consider submitting the form again, but in the end I opted against it.

Back to the story…

Commenter: Me (sic)

Royal Caribbean won’t waive that 5% on pure status. You need casino status, which requires spending in their casino. In addition, Royal Caribbean requires going to a casino cage. The regular ATMs onboard are for debit cards.

If you have casino status and use this perk, after the second withdrawal with no gambling you will get a call from the casino manager asking why you aren’t spending and pulling the perk.

Possibly for their top tier Pinnacle members….but not lowly Diamonds.

**i haven’t been on a new 2016/2017 ship, but this is the case on refurbed ships as recently as two months ago**

As addressed above, I was able to waive that 5% based on asking, without any status verification. There was something in the Seapass/Casino Card called Personal Bank, that appeared to be like the cashless gaming on NCL, but I had no need to set up a pin since cash was so fast.

I also disagree about them pulling the perk. They may flag the account, but I think with some simple social engineering it is fine. Some examples:

- Yep, I have the cash, but my toddler is sleeping now, and I want to play.

- I had the cash, but my wife/husband/cat was mad at me, so I had to buy them a Rolex in port today and used it. Will gamble from here.

Frankly though, I saw no connection between the cash transactions and management, so don’t think it is a problem. Also remember, while it is possible for the casino to track your play, it is impossible (or at least hard) for them to track your ‘not playing’. You could have put it into a slot machine without your players card, and they wouldn’t know unless the pulled the stacker to check and count it all.

Anyways.. long story short, it worked just fine. The only thing that I made an error on was thinking that I shouldn’t use my Business Amex for more min spend meeting. I avoided it because of the FX fee and I was going on vacation overseas.. but it would have billed to the US, so would have been perfect for this. Luckily I have another cruise in September where I can make up for that silly mistake, and I may get another Altitude for that too.

Great post – thanks Matt!

I noticed you referenced Capital One Spark for $600. I have seen an offer for $500 (Spark for Business), but not $600. Btw, do you know if the SPark card really requires business spend? I have seen it in the term and conditions, but wanted to know re: real worl usage. Thanks if you can help…

$5000 swipe = $100 at 2% and $500 signup bonus.

What do you mean by “funding a travel bank?”

United

any tricks to use this on NCL?

Same

Good writing and helpful

As usual, good writing and helpful

Asking questions are in fact pleasant thing if you are not understanding anything totally,

but this paragraph presents nice understanding yet.