I’m currently working on a project for my CFP exam where I take a High Net Worth couple with some risk factors, and craft a strategy that keeps their money in their pockets and out of the IRS. The goal of such financial planning is to evaluate asset allocation and titling and to shift things out of their estate for both Creditor and Tax protection. Needless to say, high on a cocktail of opiates and Absinthe I drew corollaries between sophisticated risk analysis of an estate, and that of our mileage accounts.

First, a digression into Estate Planning

Long term readers of Saverocity will need to worry about Estate Planning, because if you are a millennial now, and stick with me, we are going to grow rich, fat and ugly together. So if you think it isn’t relevant to your life now, keep an eye on this stuff and file it in the ‘someday/maybe’ part of your brain. The key to Estate Planning is channeling your wealth. If you don’t plan correctly you allow the government to make a plan for you,which will often include them stepping in, taking a large slice of your money in the form of taxes.

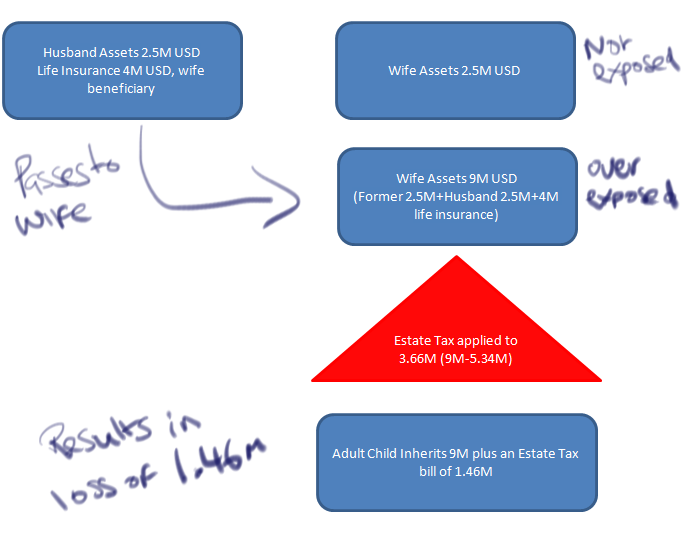

An important component of this is what is known as the lifetime exclusion amount, it is currently set at $5.34M USD, and is unlimited between spouses. What that means is that if one were to die and had less than $5.34M in assets then you would pay no Federal estate tax (State level Tax does often kick in at a lower level though) but if you owned more than $5.34M and wanted to pass it down to the next generation directly, you would incur estate tax at 40% of anything above the exclusion amount.

Here is a simple example of how this can often happen:

The Critical Eye

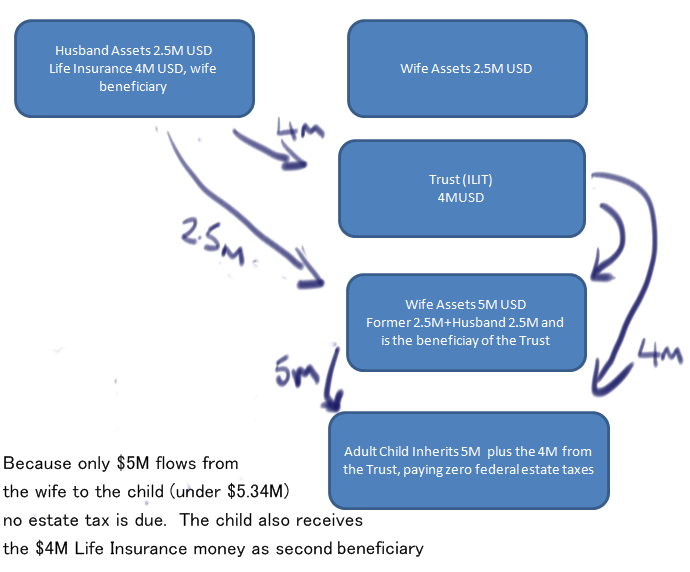

When evaluating accounts we look for titling (who owns what) and values. Anyone I see who owns more than $5.34M triggers alarm bells in terms of titling, as we need to shift those amounts out of the estate to avoid risk of loss, to taxes. In the example above, from a Federal Tax perspective there would be a bill of $1,464,000 due in Estate Taxes. This is despite Life Insurance not being taxable, the Wife simple owned too many assets in her name and when she passed them down to her child Estate Tax kicked in. However, if we were to shift out some of the wealth away from the estate we could avoid that altogether:

Application to Points and Miles

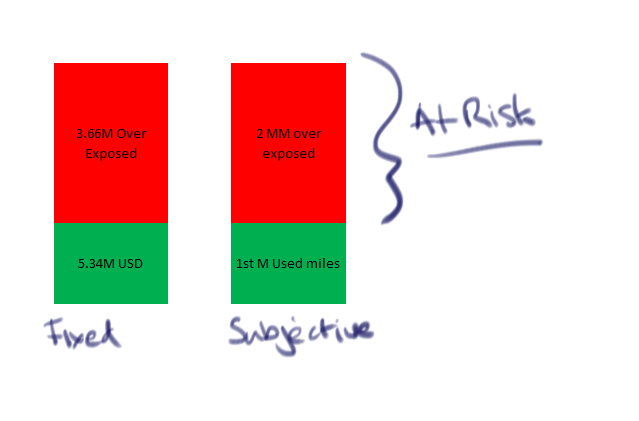

The government doesn’t penalize you for holding too many points and miles, and in fact, should you die the balances should end with you. There is actually some very real estate planning to think of there, but that is another story. So instead you have to find your own risk level. Let’s take for example someone who burns a lot of American Airlines AAdvantage miles, say, 1 Million per year are consumed, and they have a balance of 3 Million Miles.

Can you see that what you are risking here is not so much the government coming in to tax those above your threshold, but that anything above what you typically burn through in a year is an ‘at risk’ amount. The risk we see here is more inline with another important feature of the Trust approach, creditor protection. The primary risk being of course, devaluation. Points and miles devaluations occur on a regular basis, pretty much annually, and when they hit, they tend to hit some people harder than others.

In recent times, some of the hardest hit devaluations have been for First and Business class awards, with major changes occuring, and to a lesser extent those at Economy class level. It isn’t uncommon for devaluations to range from a moderate 5-10% of value, up to a 40% cut in value, as we just saw on some of the American Airlines charts.

Impact to valuation calculations – the BankDirect example

When you consider that people are earning miles and points at a pre-defined value (a subjective one) if you were to say that you opted to earn 5,000 miles for $12 per month for a $50,000 deposit with BankDirect you might have once calculated it as being:

5000/$12 = Purchase price of $0.0024 PLUS (and it is a big plus) the opportunity cost of the $50,000 being locked up.

Let’s say you could have earned 1% APR for that $50K, over the course of a year, with a simple 12 month compounding $50,000 would have earned $502.30 in interest. Let’s add on $12×12 maintenance fee and we get an opportunity cost of $646.30 to purchase 60,000 AA miles.

So the real cost is actually 1.077 cents per mile.

Now, at the time that you ran the numbers that might have been a good deal, heck it still might be, but the problem is that for the miles that are ‘at risk’ in that they are beyond your current annual needs level, you have to realize that these were ‘bought’ for 1.077 cents each, but are very likely to devalue and at some point in time, may be worth less than that. If all you can find is 1% APR you are probably good for now with AA, but a couple more devaluations and you might well not be, and can you get through them all before that happens?

Applying the Estate Planning Solution

In Estate Planning we shift the ‘at risk’ amounts into other titled ownership, they are called Trusts. In points and miles however, we cannot shift into Trusts, but we can start focusing our collection habits in a more savvy manner. Once we start hitting threshold ‘at risk’ levels we can focus more on topping up ‘Points and Miles Trusts’

The 4 Points and Miles Trusts

Cash

Swapping to cash back means we can accumulate wealth, and it can be parlayed into greater value by using it to reduce long term debt, fund retirement accounts (for tax benefits) and acquire income producing assets. Cash grows! Points do not, cash is king.

Transferable Points Programs

The points programs of Starwood SPG (best) American Express Membership Rewards and Chase Ultimate rewards act as trust vehicles in that the protect us against creditor actions. For example, if your goal was to accumulate 100,000 American Airlines points using your regular (or accelerated) spending habits, for a person spending $1000 per week it would take 100 weeks to reach goal.

It would take the guy putting $1,000 per week onto the Starwood SPG card 80 weeks.

However, that is pretty much 2 years of scrimping, and you can bet your bottom dollar that you will encounter one, if not more devaluations to American Airlines in that time. Should it happen when you are almost at that point where you can lock in your award flight two different things occur:

- Mr American Airlines collector is up shit creek without a paddle

- Mrs SPG Collector can decide if swapping to a different transfer partner can get them where they want to go. They have options.

That SPG has the 5K bonus on 20K transferred is just the icing on the cake.

Of course, transferable points programs aren’t foolproof either, if SPG was to stop allowing transfers to Airlines that would be quite the bummer…so again, the answer is not all our eggs in one basket.

Note – you might not want to consider Chase Ultimate Rewards a ‘trust’ if you are on the more extreme side of the hobby, you would be wise to funnel those points into United and Hyatt and suck up the risk if you are a heavy hitter, because the risk of Chase shutting you down and pulling the rug from under your strategy outweighs the risk of getting caught with too many United miles.

Zero is the new Hero

I remember bragging about the points balances I had, but now I realize not only does that make me appear to have a very small willy, it’s actually really stupid. Because if you are holding any more than you really can use (I am back to talking about points now) then you are asking for trouble. The goal has to always be to keep to a really bare minimum.

My personal approach to this is to have all International travel booked up for 330 days in advance, and for mini trips (weekend getaways etc) I hoard enough Avios (Southwest points could work too) to pull the trigger immediately. My major airline programs have been American and United, and our current family balances are:

- United Me 8000

- United Her 1500

- American Me 20000

- American Her 35000

- I have 69,000 Membership Rewards, 40,000 Ultimate Rewards and 70,000 in SPG points.

That is good enough for me, I am already moving onto protecting my spend decisions by pushing almost everything onto Cash back cards now. Should I start planning a new International Trip I will change my focus, and if needed apply for new cards.

For your own X amount you need to know how much you spend ‘on average’ for a trip, then:

If it is within 330 days of today book it!

If it is beyond 330 days, keep a balance slightly under what you need until you get closer to the 330 day window, and then ramp up at the pace you can manage. For me, I know I can get 100,000 AA miles in a month by applying for the AA Executive card and slapping 10K on it overnight, to do that you need to have 10K to pay off the amount if your liquidation techniques require more than a month to circulate. If that is too much to handle, then you should spread it out, and take 2 or more months to cycle through the spending.

Understanding the X amount that you need to keep in balances is a subjective thing, and is akin to putting a pot on a low heat. If you are able to turn up the gas at a moments notice then you can get to boiling point quickly, meaning you can keep a super low balance. But if your gas supply is a little less robust then you need more time to get to the same place, so you should keep the pot hotter (and carry a higher balance of points). Wherever that place might be, remember to keep balances below what you actually need to book, and time the increases to coincide as closely as you can with the time you need them to book.

The Counter Argument

Some might say that the tricks of being able to generate a large number of miles quickly will evaporate, and as such it is better to ‘make hay when the sun shines’. The future is always hard to predict, and they might be right. I am going by the old adage, there are only two things in life that are certain, death and taxes, and I see devaluation as a tax on the balances we hold,. Earning methods do vanish daily, especially when overly discussed by scummy bloggers like myself… but worse than losing a trick like Vanilla Reloads from Office Supply stores, is losing 50% of the value of your miles, especially if they cost some money to acquire..

The real solution – live fast, and be ready to die young. Travel as much as possible as soon as possible, and don’t hoard.

Love it.

Glad you do, cheers!

You continue to put out some of the most unique content in this “travel hacking space”.

Question: With what you said above are you still actively applying for multiple credit cards every 3-4 months or only applying when you need to increase points in a specific program?

If one is trying to move most of their spend (both real and manufactured) to cash back cards then constantly trying to hit minimum spends on sign-up bonuses would get in the way of that.

Thanks Andrew. I do not apply every 3-4 months, I apply only when I need the points, I look forward to a pipeline and see when and where I need them and apply in this manner.

Your question on do minimum spends impact cash back is a opportunity cost question. If your monthly spend is capped at say $10K max, then certainly needing to use $6K of that to meet spend will reduce cashback. But also you can have a flexible risk tolerance or cash flow and decide to put more money into play on certain ‘earn’ months. For example, I don’t use Kiva as a monthly thing any more, but I might if I want to hit spend, and therefore maintain regular/irregular cash back spend plus add on more, taking money from savings to cover the spend.

That long-term approach, looking forward in the year to when I will need points, is what I am currently moving to. When I first began this hobby I simply grabbed every lucrative bonus available on a quarterly basis. However, I am getting to a point in my life where I simply won’t have the flexibility to travel as I once did and now know when most of yearly traveling will occur.

With the above scenario, I am now moving towards cash back cards with my spending (real and manufactured).

Yep, a lot depends on that – with my kid due in a month I think travel will be a lot more structured and planned so this is why it works for me too.

Thanks, I loved the whole article.

Get with the times. Post fiscal cliff deal we have portable estate tax exclusions.

http://www.kitces.com/blog/permanent-portability-of-the-estate-tax-exemption-is-it-time-to-bypass-the-bypass-trust-for-good/

Actually portability is not to be relied upon as it doesn’t have permanent powers yet- but yeah, nice catch 🙂

Matt,

Portability was made permanent as part of the American Taxpayer Relief Act. See http://www.kitces.com/blog/financial-planning-implications-of-hr8-the-taxpayer-relief-act-of-2012/

In fact, because it’s now permanent after having been temporary, the IRS has granted taxpayers the option to go back retroactively to the beginning of 2011 since portability was created and claim if now. See http://www.kitces.com/blog/irs-opens-temporary-window-for-retroactive-portability-of-estate-tax-exemption-in-rev-proc-2014-18/

Nonetheless, interesting application of the concepts to airline miles. 🙂

– Michael

Hey Michael,

I enjoyed your article on this in the FPA magazine recently, I think it is similar to the second link you list here. I’ll certainly dig a bit deeper because I agree on paper it seems permanent, but the input I received from several people in the field who I respect implied a weakness. That made it not something to be relied upon as a planner. I’ll be chatting about this over the weekend and will put something up on it, I think portability is an interesting concept in general, and i’m big enough to say I am wrong about the idea that it isn’t permanent. Should that be the case 🙂

Matt,

The sad reality is that the expansion of the estate tax exemption, along with the introduction and then permanence of portability, has become a SEVERE threat to estate planning attorneys. There are now far more attorneys that do estate tax planning than there are prospective clients who have an estate tax problem. That has led to a lot of attorneys making ‘leading’ statements that portability might somehow magically vanish to spur clients to action (the same attorneys who claimed the sky was falling and that the estate tax exemption would fall back to $1M in 2011, and again in 2013, neither of which happened either). The reality is that the disappearance of portability is little more than wishful thinking. There is no momentum, discussion, or even interest in Congress to eliminate portability right now. Short of making the “Estate tax planning attorney employment act of 2015” there’s no reason to, either.

Certainly, it’s true that Congress CAN change the rules. But that doesn’t mean there’s any reason to do so. We could (conceivably, though highly unlikely) reduce the estate tax exemption if we want to expand the scope of the estate tax again; it makes little sense to do it with the elimination of portability, as all that would do is punish middle class married couples, which no Congressperson wants to do right now!

– Michael

Interesting. Of course it makes sense for people to want to protect their own interests, but I would be surprised to see that from the people I have been dealing with as their ethical view seems very strong. I’m heading into meet with some of them today and see if we can get to the root of it.

One thing I have found in the Financial Planning sector thus far is a tendency to sell to fears, so this would fit that bill. It is something that pisses me off no end as I find it exploitative, even if packaged in a ‘CYA/I did no wrong’ presentation.

Generally speaking though, one thing I am trying to tackle right now is that if everything could theoretically ‘go away’ in the future, such as the $1M fiscal cliff, why don’t we advise our clients to use up some or all of their 5.34M today, rather than wait? There has been a lot less talk of retroactive taxation than the possibility of changing/losing end of life limits, and a bird in the hand is worth two in the bush.

Your estate planning description is not completely accurate. We now have complete portability of our exemption amount to our spouse and a 100% marital deduction. So Husband could give all of his assets to his wife to enjoy for life and could also give her his $5.34 million exemption. So when wife dies, only assets above $10.68 million would be subject to tax. You may have just used it to analogize to points, but just thought I would point that out.

Another one with portability! Yep I was going to include it as a side not but felt it detracting.

You should be aware that it isn’t permanent and a good plan would not rely upon it.

Oh I just realized someone else pointed this out. Nevermind. I don’t know what you are talking about though–not relying on portability? Tons of estate planners are using it.

They shouldn’t, it’s future isn’t fully guaranteed so if it is revoked you could be in trouble.

I’m really confused where you are getting this information. It was enacted for people dying after 12/31/2010 and before 12/31/2013, but then it was put in place permanently by ATRA 2012. So it is never expiring. I could see Congress maybe getting rid of it, but not for people who have already transferred their Deceased Spouse Unused Exclusion Amount to their surviving spouse.

I’m definitely not saying portability is for everyone, because there are a bunch of factors to consider, but it should definitely be considered and could be advantageous depending on a family’s personal situation.

If you know something differently, could you cite your source?

I was discussing its application for a HNW client with a board member of the CFP and separately with a T&E attorney. I believe that although it appears permanent there is a loophole that implies it could still vacillate.

I’m doing a lot of work this week with it and estate planning at this level- on Sat I’m meeting with the CFP guy again and I’ll dig into the exact risk aspect as for now it escapes me.

I remember the answer it’s status being that it is ‘temporarily permanent’ may have something to do with revenue rulings… Will write it up next week as a post.

Oh and yeah- if you got it already then cool- but don’t plan for it to be there is what I meant. I doubt there is any precedent for retroactively removing the benefits.

“…high on a cocktail of opiates and Absinthe…” Hmm, well, the mixture did produce a helpful post. Hope you are on the mend.

I certainly can’t comment on the portability or other technical issues, but the post did make me wonder if the trusts we wrote in October 2000 should be reviewed. We wrote them because we experienced a huge difference between the ease and cost of settling the estates of my in-laws, who did not have trusts, and my parents, who did. I know the important thing is to make sure all newly acquired assets get put into the correct trust. We have been careful about this, but the new bank accounts I opened since starting this hobby are not presently in either my trust or my husband’s. There balances are low – a few thousand bucks – except for one that is a low five figures.

I have let this be because I remember opening an account that was joint with my mom when my dad was dying, that was outside their trust, so I could write checks as necessary to help her manage things. And we never ran into any issues when the assets passed from dad to mom. I then used that same account when my mother was sick, to pay bills for her, and ultimately to pay her bills after she died. And again the existence of that account did not cause trouble when the assets passed to the heirs.

If there are any points ‘n miles junkies out there who also maintain a few bank accounts outside of a trust, I’d be curious whether you’ve verified that this won’t cause your estate to go through probate, despite the existence of the trusts you’d hoped might help avoid that.

So the two topics do indeed converge!

Everything converges with enough Absinthe 🙂 I’ll look into your question. Though I guess what matters is why you want to avoid probate – if it is a cashflow issue that can be alleviated with ease, if it is a privacy issue that is something else, though I highly doubt an external account will bust a trust.

Thanks, Matt. Put it on the far back burner because between the DO and the other things you have going on, no need to add one more thing.

We did the trusts because it was a nightmare to settle my in-laws’ estate in NY. My FIL died suddenly and my MIL had a hard time managing what had to happen re: their assets. When she died, her kids had to hire a lawyer and they paid him thousands of dollars. My parents died in Oregon. Things passed quickly and smoothly first to my mom. When she died, after a brief visit to the attorney who wrote their trusts, I was able to handle everything myself for the six heirs.

So we decided to have my parents’ attorney set up trusts for us, to make it easier for ourselves and our heirs. Also, the maximums that could pass tax-free were lower then, and with property values zooming, we thought the trusts would be a way to protect our assets in case they increased in value enough to have tax consequences. I think this is now moot, because the federal limits are higher. Not sure whether Oregon follows the state in this or not now, but I expect I can find that out with a quick google search.

Oops, I meant not sure if Oregon follows the feds in this….

Isn’t point devaluation just inflation? Whether you have points in your account or not, they are still worth less after a devaluation. If we apply your theory to money, you would say we should not save very much of the money we earn because it will devalue as time goes on due to inflation. I doubt very many people would agree with that savings theory.

Personally, I try to earn as many points as possible for the amount of money I am willing to have at risk at any given time (for me, around $12,000 / month to earn around 36,000 points + a little cash) because I believe it is always going to be easier to generate points now than it will be in the future. This gives my family enough points to do a couple of vacations a year.

One thing I don’t think I have seen ever discussed is the insurance implication. If I have $12,000 a month in GC lying around and something catastrophic (fire, tornado) were to happen, I would be out that amount. My budget could handle a $12,000 hit (not that I would enjoy it!), but I wonder about the folks that claim to be doing $100,000 / month. That could be a big hit in a worst case scenario.

Hey Michael,

“Whether you have points in your account or not, they are still worth less after a devaluation.”

If we consider AA again, if they devalue but I have all my points in SPG it is like a reversed leverage position. One of my outlets has reduced, so my base currency is also reduced – but another can step in to become valuable. So yes, it does devalue, but it is a fractional share.

“we apply your theory to money, you would say we should not save very much of the money we earn ”

Not at all – If we apply that theory to money I would say do not keep your money in Checking paying 0.1% when inflation is 1.5%. Points stagnate and do not appreciate in value unlike money.

I explore risk and loss here, perhaps it covers some points. The risk isn’t just on the fire/loss side but also what happens if Bluebird goes bankrupt?

http://saverocity.com/finance/enough-regulation-within-electronic-finance-frontier/

Cheers,

Matt

Re: points – I should have been clearer that the points I earn are typically Chase Ultimate Rewards and Barclay Travel Rewards. I would not transfer them until I knew where I needed them. Flexibility is important when trying to get 4 award tickets on the same flight.

Re: insurance – I should also clarify that my $12,000 monthly spend is spread out over the month, not all at once, so I don’t actually leave $12,000 worth of GC laying on my desk all at once. However, I also have not typically written down the card numbers and kept them in a place separate from my house (something to think about) in case the worst case should happen. Once a gift card is lost, it could be difficult to get the money back without the card number.

I hadn’t consider the bankruptcy aspect, interesting (and a little scary).

Curious: Are the still teaching Modern Portfolio Theory and the Capital Asset pricing Model or have they finally given up on these?

Still teaching- it is testable material in the cfp exam, they make you work out portfolio returns using the equation for capm, and MPT is in too. It’s good to have in case clients ask about it at the least.