I wrote recently about the dangers of Manufactured Spending to your credit score, in that post one guy in the comments called me out for ‘not knowing what I am talking about’. After I got over my initial reaction to punch him in the face, I thought perhaps he may be onto something. Time to dig deeper. Oh, and this doesn’t apply just to Manufactured Spending, it applies to carrying any sort of large balance on your cards, or when you do a 0% balance transfer, so keep reading if you have any type of large purchase or balance going on.

As a quick recap, here is what I posited in that post:

I stated that even if you set your credit card accounts to auto-pay in full each month, if they ‘pull’ your score mid month when you have a balance, that shows on your report. That makes it appear that you are in debt, when really you are just carrying a revolving line of credit with no debt. I also stated that I believe when you put a large charge on your credit card it sends a flag to your credit report on that day.

Now, I actually agree that there is something wrong with my initial statement, it can be refined in this way:

Your Credit Card Utilization will be sent to the credit report agency every month, but the day it is sent is not always the day of statement due. Some cards will send on a seemingly random day each month, but that card will keep that date consistent, eg:

- Amex Blue may send your current balance to the reporting agency on the 14th of each month

- Citi AAdvantage may send your current balance to the reporting agency on the statement due date, which might be the 26th of each month

- Chase Sapphire may send your current balance on the 28th of the month

You will need to check with each card as to when they do send that balance report, as it may, or may not, be the same day that you receive an email notification that your ‘payment due date and balance due’ has arrived for the month.

With that in mind, if you are able to map out exactly when each card reports, and ensure that nothing major is sitting on that card on that day (pay it off a few days prior to ensure the payment is processed, watch out for weekends etc) you can keep appearances that you are using zero/low credit utilization, which is key when applying for new credit cards, mortgages, or other loans or lines of credit.

The initial statement remains the same – do not think that you can just put large purchases on your credit card, not apply for new cards, and have no impact on your credit rating, but I do agree, for the most part, that you can help control things if you are aware that each card can report on different days, and manage that paydown.

Does the large purchase trigger a flag?

Now, one other thing that I brought up as a concern was that whenever I personally put large utilization purchases on a card, I seem to receive a flag alert from my FAKO provider Credit Sesame. This company draws its data from Experian, and I thought that when I put a $5,039.50 purchase on my trusty Amex Blue, that has a credit line of $7,200 (making a 70% utilization) I get an email saying ‘warning’.

Now, in truth, I have always thought about it somewhat lazily, that I get the message ‘right after’ I put that much on the card, but today I am going to see if it is coming from the purchase, or from the ‘report date’.

In this image I have 2 alerts, in others I sometimes get just one or the other, the key here – do I get them the day after purchase – IE does that trigger a flag and can I therefore never buy anything big, or does it sit there with a heavy utilization not being reported until that standard monthly day of report?

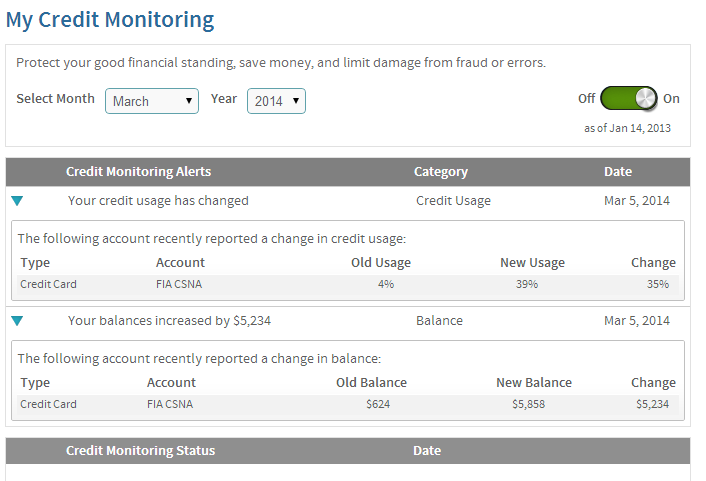

To test this out I am going to use my most recent ‘usage alert day’ which was March 5th, which is pretty scary if I am applying for a mortgage this month! And compare that with the actual purchase date for that account:

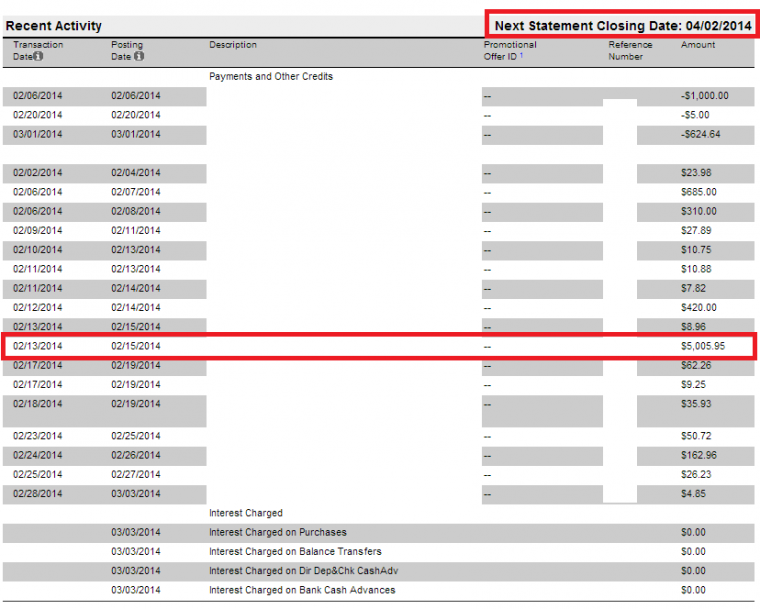

From the code used by Credit Sesame (and the amount) I can deduce that they are talking about my FIA Card Services account, which is my Fidelity American Express. They are worried about how my utilization went up by about $5000. It was my lazy opinion that they sent out that alert at the time of my $5,000 transaction, but if you look at the dates, the large jump in use occurred on Feb 15th and the Alert from Credit Sesame came in on March 5th. If you look below at the statement, the last lines show that all of the summation occurred on March 3rd so if we give them a couple of business days, here is what we can deduce from this:

- If you make a large purchase, and do not pay it down by reporting date it will show as a red flag and usage alert, which will harm your credit applications.

- If you make a large purchase it does not trigger a flag on the day of the purchase (what I ‘thought’ might also be happening, is not happening).

All that data on 03/03/2014 at the bottom, indicates that this is when information was collated and then forwarded onto my Credit Report, however, it wasn’t all zeros, as it also forwarded current account balance.

From the above you can see that there was no flag from Feb, so if I had been more prudent and paid off in full prior, I could have avoided that alert. I can attest to that, since I have put a goodly amount of money onto my Amex Blue, that I do pay down with a couple of days, and I have no actual flags relating to that card within Credit Sesame. The problem is that I put many large $5000 transactions onto various cards in a month, and I don’t always know what is what, and since I don’t know the ‘report date’ for my Amex Blue it is possible I could lazily buy $5000 on that trigger date and report that I have a high balance.

What was really happening to me is that I bought $5000 on Feb 15th on Card 1, and another $5000 on March 3rd on Card 2, and received a flag on March 5th for Card 1 – since the amount was similar I thought it was a flag for the purchase, but it was actually reflecting the purchase made 2 weeks prior that I had left Auto-pay to clear off.

However, I could still trigger that ‘instant flag’ if I bought on Card 2 say 3 days before it reports in that month. In other words, buying without knowing when you will report is playing with fire. But you can control this by learning your reporting dates and sticking to them.

I am glad that reader Mark brought it up and I looked into it further, I was right that it is not harmless to leave a large balance, even month-month paid off in full as it will look like you have debt when you do not, but I was wrong about not focusing on how the risk could be mitigated by a little forethought. I will now punch myself in the face.

This post, and me taking the time to really figure out what was happening came down to a comment that challenged my post, please, if you do not agree with what I write, question it – it helps everyone get better information and I love the challenge.

Matt,

Do you have a recommended way to determine when each cards reports?

Kim

I don’t have a great way to, but I would suggest a great way not to.. I wouldn’t rely on other peoples information.

I think that most cards will report close to the statement close date, but that can be different based on when you signed up or what you asked to set for this when you signed up. So someone saying ‘I have the Arrival and it always posts on the 28th’ can be misleading.

I would recommend calling up the companies that use the cards in question, it should be a select few cards I imagine and not too hard to clear up, ask them specifically about your account and its reporting/posting schedule. Ask when statement close date is. Confirm if they report to the credit agencies on that date or on another date.

This is easy to sort out. Just get a service that allows you to pull all three of your reports daily. I use Experian’s CreditCheck Premium (there are a few other vendors) It can be very educational. You will be able to map out exactly when each of your cards reports (The vast majority of them tend to be consistent on day of the month they report). That way there is no guess work. You can also chart how long it usually takes your electronic payment to be recorded by the bank, this can have more variability depending on day of the week, holidays etc. I have been successfully doing this for years with hardly a misstep. Once Discover caught me by surprise because they will sometimes report off their normal schedule. You can run 10’s of thousands of dollars through your cards and the only way it shows is in ways like Experian’s most recent payment info where it might list your large payment but I’m not sure who looks at that information or factors int in to anything. So there may still be hints about your volume even if all your cards always show zero balance on the day they report. But this is stuff that has been discussed a lot on the big credit forums. Lots of info out there. If you want to do experiments to see how changes affect your FICO score you can subscribe to services like ScoreWatch that will send you your actual FICO score (one service supplies Equifax FICO and I think Transunion has a version of this product too) when your score changes based on updates to your report. Between daily pulls of all three reports and a FICO monitoring service you can learn a lot about how your particular FICO score will react as information changes on your report.

Thanks Jack- that’s a fantastic comment

Great post and for me, a very timely post. I am trying to figure this stuff out so I have a sense of how much MSing is comfortable for me. Most helpful.

I have a not-so-related question that I actually posted over on TBB for the mavens there. (I was hoping you’d see it and reply but it seems more direct to do it here.) With apologies to folks who read both blogs, I am curious about the following: can I do a churn for my husband on the same day as a credit pull is done for the refi we are about to apply for?

The two folks we have been speaking with about the refi both said that any mortgage pulls over two weeks merge into one, and that cc pulls are separate, but I think it best to not go for the credit card either the day before the refi pull, or the day after…hence a churn that very day. Is this a great idea or a terrible one?

My husband’s last churn was in October and I have my eye on that 100,000 AA card for him and I heard rumors it may disappear soon. Although I haven’t read your post about it yet 😉 ! Still, the question remains: can I do a churn on the day of a refi credit pull? What do you think?

I think why would you? Can’t it wait at least until you have the refi in hand? I don’t know the real answer here, but I wouldn’t play that closely with fire.

Hi, sorry for being so harsh in the comments on the other post.

I was a little taken aback by the misinformation.

Nice to see that you did a follow up post.

Generally the reporting date is the statement closing date – not the due date.

If it isn’t the closing date, it’s a different random date. But I don’t think any banks report specifically on the due date.

Hey Mark you were totally right to do that, thank you!

Gosh Matt, you are a mindreader! This has been a concern of mine as I watched my score go down about 20 points since I started doing some MS. My problem, if you could call it that, is that my travel interferes with my miles-earning activities, in fact, I missed your first post on this because I was in transit back to the country. Jack’s suggestion about daily pulls is the right thing to do if you are really diligent, but what about the rest of us who slack off some of the time? What about if you never go above 50% utilization on any card. Would that protect you from credit score slides?

Thanks for all you do. Loving the blog immensely!

Thanks Guera, your method would work, but the number can’t be 50%, It think it should be more in the 15/30% range (ideally 15%-20%) max, and if you can maybe set a random ‘other date’ to just pay off a fixed amount that may help on top of auto-pay in full.

The ‘easy’ way to manage this is to set different statement closing dates on two week cycles, and then alternate between cards to MS on while keeping your utilization levels low for when that card reports. I can think of four different cards from four different banks that are all worthy of MS, it’s not that hard of a system with a little planning.

Do the reported values report the percentage as weighted or unweighted? That is, does my Arrival card reported at 1.5k/7.5k have the same weight at 20% my British Airways card at 1k/5k? It would make sense to keep a few useless cards open at a low CL if so…

There are 2 factors- utilization ratio which is a percentage and the debt to income which would be influenced by the amount of the debt even if it had a high credit line

So utilization reports are treated equally? That seems… Disingenuous.

Specific cards flag your credit- have a 90% full card they report they are full, you get a dent.

Not exactly.

If you are at 50% on a 2k line, so 1k balance due reported- that will ding you once no matter how much avaliable credit you have on other lines. However if your total combined line is 25k and on all other lines you are at 10% that 1k will not ding you a second time on the overall utilization because it isn’t going to push you over 20% on overall utilization.

If instead you are at 50% on a 10k line, so you have a 5k balance due reported and your total credit line is 25k and the same 10% utilization on the other cards the 5k will push you into the 30% overall utilization and ding you twice.

So the overall utilization half of the formula effectively weights things.

The effect on debt to income is also weighted, or worse, if the credit line that is over 50% is a big one rather than a smaller one.

There are many reasons to have “useless cards” open.

Overall utilization. I think why/how is obvious.

Average age of account. If you open a fee free card and keep it forever it will help keep your AAoA from being low, which brings down your score. I think this is too often ignored by people in this game.

Number of positive reports. That useless card is going to report good standing.

Number of accounts. I’m not sure what the magic number is, but number of accounts (including all types) that is too low will lower your score. This number includes closed accounts as long as they are reporting (10 years normally) so it is easy to build if you play the points game.

Haley –

Excellent explanation. If I would have known this before Q1 w/Dividend Select, I’d have adjusted my lines.

Do you know how often total credit is reported? Is it a rolling snapshot? It sounds like even keeping 15% utilization on multiple cards might get you trouble with debt to income ratios (for those over-privileged souls with CLs > 50% their annual income…)