As some of you may know, we have just returned from our ‘babymoon’ to Carmel, California and we are expecting our first child in June. Of course, the first thing I can think of is how can we get to Disney for free, and taking a look at the Chase Disney Card proved quite interesting to me.

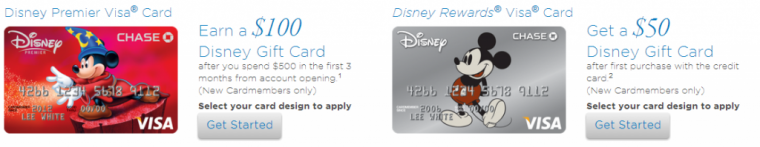

There are two flavors of the card, the Disney Rewards (annual fee free) and the Disney Premier Rewards (annual fee $49) the latter gets you something rather attractive, a 2x multiplier at Gas Stations and Grocery stores, plus the ability to exchange the points for airline travel. So, with my increased spend at Grocery stores on diapers and beer (for the wee one and myself respectively of course) we could generate enough points to not only cover our vacation to Disney, but also the flights to get there.

5. Reward dollars may be redeemed for a statement credit towards airline ticket purchases made with your Disney Premier Visa Credit Card within 60 days before the redemption request date, where permitted by law. Reward dollars cannot be redeemed for an airline statement credit using a Disney Rewards Redemption Card. Redemptions start at 50 reward dollars for a $50 airline statement credit toward tickets on any airline to any destination. Each additional reward dollar is redeemable for a $1 statement credit. Subsequent purchases after redemption must meet the $50 minimum to qualify for a subsequent airline statement credit redemption. Airline statement credits will post to the card account within 5-7 business days of a request to redeem and will appear on the monthly Chase credit card billing statement within 1-2 billing cycles. Until the credit posts, we recommend you pay the full amount of the airline ticket charge on your credit card bill to avoid finance charges. Disney and Chase reserve the right to determine which Disney Premier Visa Card purchases qualify for an airline statement credit.

Additionally, both cards come with a signup bonus of $50 and $100 respectively, which is a nice little boost to your savings.

I’m currently going through a mortgage application, but once completed this card will be the next one to add to my wallet. I like the simplicity of it, and the chance to earn free family vacations. I also noticed that it shows up on the evolve app as a billpay option, which makes paying off the card simple, something that I am looking for as life gets a little more hectic, if anyone has the card and could try a payment that would be helpful, as it would be a deciding factor for me. I for one can think of nothing more wonderful than the magic of a Disney vacation coupled with Chase, it just warms the cockles of my heart.

If we were to go to Disney, we would probably get a car rental too, I like the BP card that PF Digest recently reviewed for 3.75% rebates for that, what about you?

I was like “WTF” and then I saw the Evolve bit at the end. Now I am very interested.

Ahh.. the subtly of my post wins 🙂

So now you cash out/ pay off via Evolve your disney card and pocket the 2%? You will need to spend some major $$ to cover your Disney trips and tickets. Is there something I am missing? I am thinking, there must be more to it. Yeah or Nay?

You are missing something. I’ll send out what via the newsletter.

Just signed up for the newsletter. When does it go out? I’m interested in what you refer to above.

Hey Andy,

I just sent it out, please let me know if you got it, and ask your questions (discretely) here.

So if it costs 3k to take my family of 9 to Disneyland, I would have to push 300k? Seems I’d be shut down, am I missing something?

Yeah, that’s what I’m thinking too. The only way I see to do this costs about 1% in fees, so if you are earning at 2%, then your net gain is 1%. Not sure it’s worth the trouble and risk of getting shut down. Still wondering if anyone has a general feel for what a safe level of MS is on a chase card.

That’s what I think, I made a mistake though, 150k for 3k worth at a cost of 1.5k

That’s my angle too, but apparently Matt says we’re missing something. I did or could not find anything other additional info that would show me. It is a straight up 1% return on your money.

[Matt] Am I still missing something? You can load something on this thing for free?

Straight up 100% return on your money.

Hi Matt,

Are you saying you get 100% return on, ie, you spent $1500 in fees and now you have $3000 to spend on Disney?

Thanks

I’m betting the under on Evolve’s longevity as a useful MS tool. (My account is still frozen.) If I read this correctly, this is a 2%/1% cash back card, redeemed for travel after purchase? Somewhere, back in the day, a prominent blogger argued that the CSP beats Disney in that the CSP also earns 2 pts at the theme parks. (Too lazy to look it up.)

Sure, before evolve it wins with ease, now not close. Surprised to hear your account is frozen- any reasons why?

Funded 529 with two separate GCs. Others were doing so with intent to cash out quickly (and announcing their actions on FT). Mine is a legit 529; I get my Evolve account re-opened when I send them two 529 statements.

Honesty never pays…

I would assume redemption works for any Disney place around the world, including theme park, hotel and cruises.

It seems that way, plus flights.

Dis points can be used for theme park tickets (which are very difficult to discount in other ways), and (useful for some) maintenance fees on Dis time share contracts.

I appreciated the link to this post in the newsletter because having adult kids who do not yet have their own kids, I am not planning any Disney trips right now. But it sounds like redemptions can be made for any airline tix of $50 and over. Having downgraded from CSP to the plain CS to save the fee, this may be worth considering since the fee is less. The $100 bonus would cover the first two years of the fee too. Good catch!

Elaine, I would only recommend this card if you are going to use the evolve app, otherwise go for 2.2% with the Arrival, a much better option for more traditional spending habits…

2 questions- 1) Why do you think it could be redeemed for Disney Cruises? We are planning one and this seems like a good option if it can be, but I don’t see anywhere that it can be redeemed for disney cruises.

2) You say that you can generate points with your increase in drugstore purchase, but this card doesn’t seem to get 2x on drugstores. None of the grocery or gas allows credit cards where I am, although a ton of cvs do. So how do I get the 2x at cvs (besides the barclay arrival card, which I have). do you have any other card that offers more than 2x at drugstore?

Thanks

Hey Mark,

Sorry, brain typo on Drugstores, only Grocery’s and Gas. As for the cruise stuff, I just called in to reconfirm and they said it was possible. If you think about getting the card please call yourself to confirm first so you can’t shout at me! 🙂

Basically you got to Disney Travel and use certificates that you create from the Disney rewards you earn, good for anything there.

Any better ideas besides the arrival for drugstore purchases? (and don’t tell me any cards that I can longer get!)

Thanks as always!

Not really- WF 5x for 6 months perhaps?

Yeah, I was hoping for a more permanent solution. Although, can you churn WF every six months???

5x doesn’t last forever- the old Amex blue is great- not sure if it has links.

Us bank 2% unlimited?

If you are talking 2% then the Fid Amex or the Arrival work well enough, not sure about the US bank option

I guess I am looking for a good revenue generator to offset my office etc purchases. Seems like Flex is unlimited to 2%. Arrival is only 2% if redeemed for travel, cash is 1%.

Flex you have to re-register each quarter, but seems unlimited.

Cool. Personally I use the Amex blue, and the Fid amex everywhere else

So how much do people think could safely be pushed through this card without angering Chase? I do most of my banking with them and would like to stay under their radar. Opinions, experiences?

My husband has the Disney Visa. I tried making a payment through evolve, but it kept saying that my account number was wrong. So, no luck for me yet.

Over the weekend, I found a link for a $200 credit on the premier card. Here it is:

https://disneyworld.disney.go.com/disney-visa-card/wdw/vac-financing/?trackcode=18D&appRedirect=http%3A%2F%2Fdisneyworld.disney.go.com

Great info Shannon, I’ve not got the card yet, so would be very helpful to see someone make it work. And thanks for that $200 link too!

Evolve is a no go on the Chase Disney Visa.

For Jayson, et al… My comments system only nests 10 replies, so here it is, yes, that is what I mean for the ROI, with the only correction being Disney or Flights.

Thanks for clearing that up for me Matt. Seems like it might work for for few thousand a month, but I would think with major spend, evolve would shut it down, they seem to shut down accounts when they think something is being abused from what I’ve seen on flyertalk. Searsvacation.com looks interesting to me, should be able to get 20% + off that way..

I *just* cancelled this card. BTW, the way I got the offer for $200 signup bonus was to order one of those free disney vacation DVDs. They mail it to you and then soon after, they mail you an offer for the card w/ $200 signup bonus.

I still do not get the 100% ROI part.

Even with evolve, how is the ROI more than 1% (2% at Grocery bonus-1% fees for the card)?

Is there a separate post with that information that is emailed out? If yes then I have not received it.

What is the ROI on VR with a fidelity amex? Same concept, different tool.

Hey Matt, I bought 75 disney gift cards at various office stores for 5x points to take my family to disneyworld. The disney phone rep was very patient as it took about 90 minutes for him to input all the cards for payments lots of work but bookoo points and no hard credit pulls. Winner! We had a great time!

That’s pretty neat, I’m thinking in the future to write up a deep analysis of how to make this trip really cheap, and that is certainly a solid factor.

Add those gift cards to the Disney savings account and get up to 2% bonus from Disney ($20 gift card for every $1000). Fund with any card that travel expenses are a bonus. See further details in forums.

Thanks Haley- all the good stuff is in the forums!

Hi Matt – Evolve doesn’t play out. My sister entered her Chase Disney cc # and it would not take it. I think it’s meant for Disney store cc only. Just FYI