I’m bothered by Amex. I feel like they got inside my head. The American Express Platinum Card is one card that I tend to keep paying the (exorbitant) annual fee on, and while I can justify it as ‘profitable’, providing you think that sending over real money in exchange for discounted coupons each year is a smart play.

The one-two punch of American Express Membership rewards is that if I cancel the Amex I lose the Membership Rewards- until recently this meant downgrading to a different version of the card, such as the Gold, but that still comes with a $175 fee. Now, you can do some fancy footwork and get a Gold with waived annual fee in year 1, then cancel the Platinum and be all set, but that only keeps you going for the first year.

The Amex Everyday Card came into play recently, and may be the solution, they have a no fee version that has Membership Rewards, so swapping into that might be the best way to keep the points alive. When the card was launched the ‘points’ bloggers gushed, and I kinda switched off, so I don’t know enough about these new cards to make an informed decision. However, at the root of it all is ‘why do I WANT to keep the points alive?’.

The trap of bundling everything together.

I find myself stating time and again that it is important to have a robust set of transferable points, indeed, that you should keep you other points balances low to avoid devaluation risk. I always chime on about keeping Membership Rewards, Ultimate Rewards, and SPG points handy. In fairness I should add in Citi ThankYou points now since they also transfer.

But I have to be frank here – I go through Ultimate Rewards fast- with probably a 90/10 split between United and Hyatt. SPG I use every now and then, have found them useful to top up American Airlines, but these damn Membership Rewards are killing me. I can’t find any good uses for them! So if I am not really using them, why the effort to keep them alive? Why not simplify?

Is there really value with Membership Rewards?

Yes. There are people that do really well with them. I know several readers who love to earn at a multiplier with the PRG (Gold) card and then redeem for British Airways Avios. This offers 2x on groceries and gas. Clearly the best way to earn Avios on regular spend as the Chase Visa only earns 1.25/$ everywhere. However, my travel plans are such, that even with tickets for two (now three) I seem to have too many Avios. They came from the 100,000 point offers, which I got a brace of, and then spent 30k on each card, 275K Avios have taken me quite some time to burn through. I do love me some Avios, but I haven’t needed to transfer in to make more in the 3 years that I have held the Amex. It is worth noting that Ultimate Rewards do transfer in also, so you wouldn’t be totally screwed without Amex. Oh, and I also happen to love my 5% cash back that I get for Groceries and Gas.

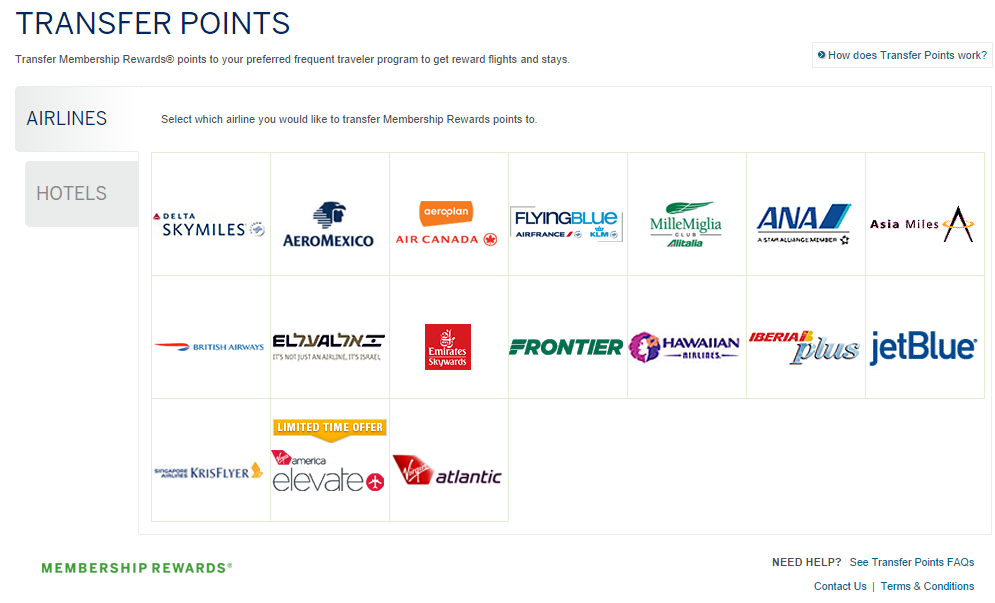

Also, I’d argue that the airlines available for transfer do offer some of the best aspirational seats – airlines like Singapore, Emirates, Cathay Pacific offer fantastic products. But these guys, while they are international players, clearly focus on certain routes. Perhaps from living in Asia for some time, and from visiting the Middle East fairly recently, neither are particularly high on my to-do list. I think that will change, but we seem to be going through a ‘Europe Phase’ right now, and I don’t love Membership Rewards for that.

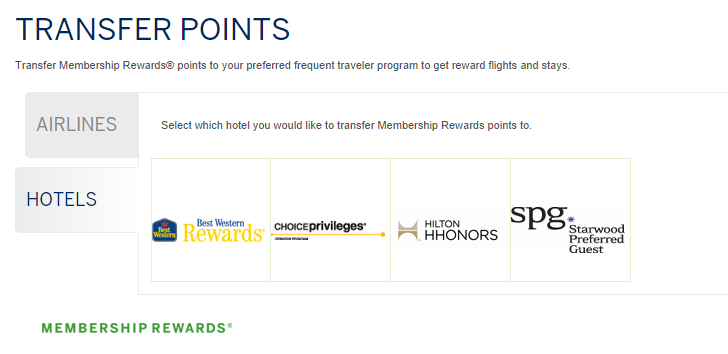

The Membership Rewards program also transfer into hotels, but from what I know of these brands, the transfer ratios make it quite wasteful.

Teaching an old dog new tricks

This old dog is tired right now, babies and protracted house moves do that to a guy. Maybe it is because of that that I don’t want to invest the energy in figuring out sweetspots on Partner awards. I am sure there is a way to get some good value out of these guys to Europe, but I haven’t got around to needing to yet.

Do you gravitate to certain programs?

I’m not sure what it is, but I have always liked United and American Airlines. I hear constant whining from people about both, but having used these award programs to travel without buying a revenue ticket for the past 5 years, I have to say I’m pretty happy with them. But when I think of getting value from Membership Rewards I think I’ll have to figure out KLM, Al Italia, and others, and its like learning all over again. I like US based airlines as my core program for customer service reasons – my last booking on Iberia took 1hr on a call to Spain, and they still haven’t fixed my last name….

My procrastination on cashing my chips in is simply that I KNOW there is value there, but I’m not getting around to booking it. The trick with being adept at award bookings is not just knowing the theory (how many miles to X) but also the practical – how much in fees they tag on, and how viable finding a seat really will be. I’m OCD when it comes to value, so I’d also have to know all about their free stopovers and whatnot.

So… all this procrastination with my points, and in the interim I am paying annual fees, and programs are slowly devaluing. The best value I got from these Membership Rewards was to transfer to Hilton back in the days before they nuked their program. Now I still transfer to Hilton, but sending over 1000 points every year or two in order to keep them alive is hardly effective.

Where’s the good, old fashioned, Apple Pie transfer partner?

With Ulitmate Rewards it’s United, post devaluation or not, it’s a no brainer. And once you get comfortable with learning more, branching out with them is easy. I also like that Hyatt, also post devaluation, is still a nice hotel option. Where is it with Amex? Is it Delta? Eeek.. How about JetBlue? Hmm.. we know SPG is great, but its a 3:1 ratio! Jumeirah hotels? I don’t think so… I think the no-brainer partner must be Avios, but when they are accessible from other routes, it almost feels wasteful to cash these points in for this program.

What do you think, are American Express Membership Rewards great – or are they just overhyped by the travel bloggers who cite them as the best way to fly ‘Suites’? Save me from my madness, and give me some nice and easy redemption options for these points!

Not directly to the question asked, but I believe there at at least two no-annual-fee AMEX cards that allow you to maintain your MRs, the blue biz card and the no-fee Everyday Spend. I’ve only made onenMR redemption for Virgin during a bonus for inter-island flight in HI on Hawaiian. So I have the same underlying problem, but United may be my next redemption.

How would United be your next redemption, via a Partner?

sorry, poor train of thought there. UR redemption, not MR.

OK, it is not just me. My husband and I both have MR points and we have never redeemed them, ever. I book flights and hotels on miles and points all the time and have multiple currencies and the knowledge base to go along with them and yet, never have we found a use for them. Why is that? They are burning a hole in my wallet and portfolio. My husband loves the Centurion Lounge and so he won’t give up his Plat. I have the ED Preferred and it is a decent card. Just still waiting for that lightbulb goes off redemption and it hasn’t happened yet for me either.

Yep – I know they exist too, but sometimes I wonder about them just sitting there and not really getting value from them. Am yet to check out a Centurion Lounge, not sure if my travel plans will involve one either…

Worst case, I’ll keep the card to the new year, as I have some airline fees due in January…

I just got the platinum on a 50,000 upgrade bonus from PRG. Got it just in time for a looong layover in Dallas. The Centurion was absolutely great. The food is pretty good, I’d certainly think it’s on par with anything you’d buy in an airport. So, that was real money saved. I had a 15 min massage, not something I would’ve paid for, but certainly a nice bonus. And there’s decent drink and a pleasant atmosphere. I’m counting two visits to the CL in DFW (both layovers on a RT to SCL) as worth a total of $50. Very happy with it.

Yeah, I agree that if you are a frequently flyer (domestically) it’s great to have a Centurion lounge.

Interesting article, and I agree mostly what you state. However I am holding off to utilize Amex points for some unique redemptions:

ANA for booking United and Avianca in the Americas OR Island hopper from Hawaii to Yap with 2 stopovers.

Top off Frontier to visit Yellowstone.

Aeroplan to go to Western Europe and (no YQ(

I might even transfer some miles to Delta once 1 ways are allowed and there is availability on some of their partner airlines.

Yep – I am basically aware of these (barring Frontier which I need to learn more about). I just wrote up ANA over on the Forum and agree there is a ton of value there – but I’m not convinced I want to transfer in to them, it’s a weird thing…

Matt – without question, Avios are the bread and butter of this program. I’ve never had a problem spending all my Avios, so I’m perfectly happy with MR. The only other use I’ve had is transfers to AF for intra-Europe redemptions (i.e. Continental Europe – secondary UK cities) which I think are very reasonable compared to paying cash. Norwich for only 12.5k! Who needs SQ suites when you have a Focker!

Also, there are reasonable options on Delta within the US too, like Hawaii for 15k. Still if you have access to enough United and AA options, the third alliance option may be an extravagance.

Those sound interesting too – Delta I need to get on top of, I have always avoided them, but now am earning through the ST card, so having a txf partner for them may come in handy. I like the intra-EU options, good to know about.

MR is only good for one thing now, top up on Krisflyer and BA miles. All other airlines impose surcharges though you can find some sweet spots and exceptions somewhere such as Aeroplan.

I’ve not needed to top up Avios, per the post- in fact I am even burning them internationally in Business class… but I guess that time will come soon. Krisflyer is another one of those ‘oh, I gotta figure out to get value’ from that some day.

Again, there is that discrepancy between analyzing an award chart, and actually knowing the fees and likelihood of booking a certain class of service.

Funnily, I think if you were just selling the Amex card in a post, such things don’t matter- a picture of a chump in Suites and a glass of Krug. But if you are actually thinking about getting value out of these things then its a bit more nuanced.

Doesn’t the Green card keep them alive too? $95 AF if I’m not mistaken. Anyway, I’ve always had great success with Delta – it takes work but I enjoy it. The worst thing about transferring to Delta is the fees they charge – they add up – so I only use it for topping off. Other than that, like others have said, Avios is the bread and butter though I’ve transferred to SQ as well

I got confused by that, will have to look further sometime, I know I got a green as AU for the wife on my Plat, no fee. But then heard there was a fee for the green. I think the Biz/Consumer products complicate things.

If you can find United award availability, in many cases you are better off using Amex MR with a United partner’s mileage program instead of using United miles. For example, east coast to Europe can often be < 60K in economy and as low as 68K in business with ANA. Or anywhere in the U.S. to western Europe for 60K economy / 90K business with Aeroplan. There may be a few other partners with low/no fuel surcharges when using ANA/Aeroplan, but for U.S.-based travelers, United is the big one. That provides a lot of opportunity.

I do see your point that there is no bread-and-butter transfer partner with Amex MR. It's a blessing and a curse. The counterpoint is that United redemptions post-devaluation are always good, but rarely great. Some of the examples I provided above are great, especially comparing with United.

Yeah those awards are great, I have written several times about those tier sweetspots on the distance based awards – certainly great value, but then I’d have to start earning some more to get more than one ticket there…

I think the post is a mix of ‘hey MR isn’t obviously good’ and “I’m not ready to learn a new program today”.

As I recall, the AMEX everyday card membership rewards program does not permit transfer of award points to other partners. It only lets you redeem points for travel using the amex portal. So while the everyday card is a way to keep AMEX points from evaporating, they are not very useful. Then once you have a desire to transfer the points to a partner you would first have to apply for another AMEX card that offers this option.

Interesting! I’ll have to look into that, as I mentioned I kinda glazed over when people were effusing their amazing value, i’d rather do my own research on it. Plus I am never going to hit those ‘everyday’ quotas as I don’t shop that often anymore.

I can confirm that the Everyday Preferred does allow transfers. I don’t have the Everyday, but the language on the offer page is pretty clear that it does allow transfers to “17 frequent flyer programs and 5 frequent guest programs.:

I was referring to the no fee Everyday card since I thought the objective was to eliminate fees. I believe the Membership rewards programs for the two cards are different.

This is definitely NOT true! Cut & Paste from Amex Everyday site and even the T&C states that this is possible.

Membership Rewards® Program

Use your Card every day and earn points – they have no expiration date. Transfer points to 17 frequent flyer programs and 5 frequent guest programs or use them for gift cards and merchandise.

Yeah I just googled it up and saw both cards seem to state they transfer to partners.

Matt said:

“I think the post is a mix of ‘hey MR isn’t obviously good’ and “I’m not ready to learn a new program today.”

This is exactly where I am and have been since I started collecting points seriously. And I do not expect it to change anytime soon. No MRs in my near future!

Yep – though sometimes you just have to… I jumped in on a 100K offer, which clearly is worth it, but the hard thing is cashing those points in.

MR mean a lot less to me now that Delta is capping transfers at 250k per account per year. That doesn’t get me 3 seats in business class to Europe without fuel surcharges, which was the biggest reason I loved MR. DL sucked on its own metal, still does, but Air France, Virgin Atlantic and Alitalia were great values at 100k RT (now 125k) without the big fuel surcharges that apply to business class awards.

With as easy as it is to accumulate UR, it’s now worth it to just concentrate more there and transfer to KE for those same seats. 80k + fuel surcharges. Even if you call it a penny per mile, that’s a $450 difference in the mileage costs anyway between KE and DL.

Also, I might add MR transfers to hotel partners are brutal. I’m not saying they should fully cannibalize the SPG card, but at least a better transfer ratio for those paying $450 on the Platinum card would not be unreasonable. UR going 1:1 to Hyatt makes it that much more compelling to go UR over MR.

Yeah I agree- Dia brought up some interesting ideas for Choice in EU, but for the most part there aren’t many options here..

ANA is a great transfer partner if used strategically. Fuel surcharges are quite reasonable when on United metal. Chicago to Europe is 68k roundtrip in business, with enough miles left over for an intra-europe flight (since the program is distance based). Redeeming through ANA rather than United brings with it higher fees but a lower mileage cost. Roundtrip to Europe from Chicago is 68k instead of 115k. Four seats for my family saved me 188k miles redeeming through ANA, I found the increased fees were a fair trade-off for saving me the hassle of 188k of MS.

I agree, there is some super value, I just explored the different tiers for ANA and think you can save a ton of points – my issue, as you raised, is the fees. I find their program a bit harder to delve into in terms of transparency on fees, so it will be a learning curve. It is one I may well take, but right now I wouldn’t focus on earning for ANA to EU because I don’t have real clarity on fees.

Personally, I like my money more than my points, so I might be averse after a certain fee level.

You do need to call in to inquire about fees. Fees will show on the website but only if you have enough points within the program—not advised—points expire after a few years with no possibility to renew.

As a data point for anyone interested, my tickets were $170 in taxes/fees/surcharges each for business class ORD-AMS, BUD-BRU, BRU-ORD.

Crazy timely post. I’m sitting on over 100k of MR points and need to transfer or pay $450. I got way more than the original $450 year 1 but obv can’t replicate so likely to downgrade unless I get an amazing retention offer.

Paul over in the Comments on Dias reply to this mentioned something between 15-25K retention bonus, which is pretty good, I think either makes the fee a wash.

Drew wrote today that MPs from one card can’t be combined with the MPs from other cards that can transfer to partners. I am really bummed…

Why does that matter? Can’t you just funnel multiple cards into one third party account- EG 1 Plat and 1 everyday both feed into the ANA account?

YMMV. If you have more than one MR earning card, they likely have the same MR account number, and are for all practical purposes ‘pooled’. If they set up multiple MR accounts for you (it happens) they may allow you to combine. Occasionally they even allow combining from a spouse’s account. A friendly conversation with a CSR can go a long way.

I just used those to transfer to Air Canada to book a flight for my sister on United, but without paying United’s $75 close-in booking fee!

Yep, Avois are the apple pie (which was British first, anyway) of MR. Unfortunately, you have no use for transferring them right now.

What you say is so true, about not just needing to know the textbook stuff about a program, but also have a feel for fees and availability etc. It’s much easier to stick with one or two programs, even if you end up spending a bit more in miles. As milenomics is always going on about, our time is very valuable.

Yep- I need another 9 hrs a day right now 🙂