H/T to @konorth

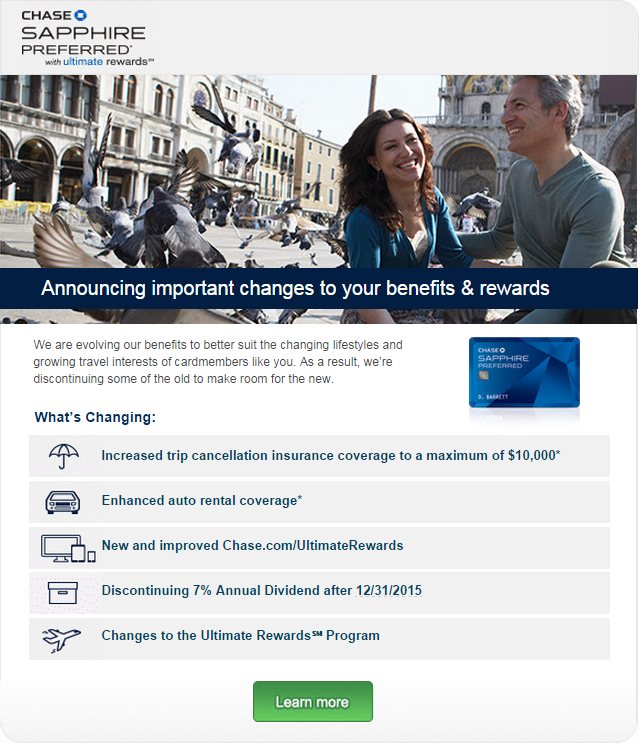

I noticed the e-mail yesterday from Chase, but it didn’t really strike me as something meaningful. I’ll blame the jetlag. Take a look at the graphic for yourself. Nothing to see here, right?

@konorth had a fairly simple tweet that made me think to take another look.

Chase changing UR but gives us over a year notification on travel booking bonus +Clarifies what makes one lose points (churning for points).

— Karyn aka Cu (@konorth) September 5, 2014

So I took a look at the new terms. You can find them here.

Yes, things are changing as far as the travel booking bonus. But, something that jumped out at me (perhaps its this fascination with taxes of late), is this statement:

Your participation in the program may result in the receipt of

taxable income from Chase and we may be required to send to

you, and file with the IRS, a Form 1099-MISC (miscellaneous

income). You are responsible for any tax liability, including

disclosure requirements, related to participating in the program.

Please consult your tax adviser if you have any questions about

your personal tax situation.

This could just be a way of Chase to cover their bases in the future. It looks somewhat boilerplate too, so I did some searching and found an Ink Bold Terms and Conditions write-up from last year.

I don’t have any contacts at Chase, and I’m almost scared to pose the question, but why else would Chase introduce such a clause?

What do you think?

Did you bother to do any Googling about this topic before posting?

If you Google “CC Rewards as taxable income” you’ll come across a 2012 Private Letter ruling (http://www.irs.gov/pub/irs-drop/a-02-18.pdf) from the IRS that states the following:

Consistent with prior practice, the IRS will not assert that any taxpayer has

understated his federal tax liability by reason of the receipt or personal use of

frequent flyer miles or other in-kind promotional benefits attributable to the

taxpayer’s business or official travel. Any future guidance on the taxability of

these benefits will be applied prospectively.

This relief does not apply to travel or other promotional benefits that are

converted to cash, to compensation that is paid in the form of travel or other

promotional benefits, or in other circumstances where these benefits are used for

tax avoidance purposes.

So as long as you aren’t converting your FF miles to cash, you’ll be fine. However, this could be interesting if you redeem MR / UR for cash / Arrival+ / cash back cards since are those could be considered income. However, given that you have to make a purchase for these rewards, it is technically considered a rebate, and it is difficult to believe that these will be treated differently from manufacturer/store rebates as these are not considered taxable income.

Furthermore, the IRS has long considered bonuses from bank accounts to be taxable income. See the following article: http://www.creditcards.com/credit-card-news/irs-taxable-income-credit-card-rewards-points-gift-1277.php

“Rewards and airline miles that are provided in connection with a purchase on a credit card are routinely not subject to individual income tax reporting,” Citi spokeswoman Emily Collins, said in an e-mailed statement.

On the other hand, “When a customer receives a gift for opening a bank account — whether cash, a toaster or airline miles — the value of that gift is generally treated as income and subject to tax reporting. This is separate and distinct from miles or points earned by our credit card customers for their purchases,” Collins says.”

I’d be glad to be proven wrong, but IMO, this is just Chase covering themselves in case rules change.

@Pillow – I did, and have googled regarding the tax law. As @Andy noted about the recent tax law piece, as well as what Wandering Aramean posted a couple of weeks ago (and I referenced a couple of weeks ago): http://blog.wandr.me/2014/08/some-award-points-taxable/ – Point being. Yes, Chase is probably covering themselves, but I tend to believe that if there’s activity, there could be an underlying push.

If anything, they might be gearing up to offer UR points in exchange for opening a bank account, which could then be 1099’ed into taxable income. Hard to believe that they would be doing 1099s for CCs though.

I was under the impression that private letter rulings are, as the name implies, private. As such they should not

be called upon to defend a position from someone who did not engage the letter- is this incorrect?

@Matt, from a quick google search: “IRS Written Determinations do not contain proprietary (“Official Use Only”) information. However, it is important to note that pursuant to 26 USC § 6110(k)(3) such items cannot be used or cited as precedent.” — That said, I’m skeptical on this not meaning something more…

Yes they do not contain “Official Use Only information”. The reason why you cannot use them as precedent is that the specific context that the IRS is issuing the Private Letter ruling is not fully revealed/outlined in the Private Letter.

But I still firmly believe that no CC issuer is going to issue 1099s for CC rewards, regardless if they are FF miles or CB.

They are probably doing that due to the recent Tax Court decision finding that Citi frequent flyer miles are taxable.

@Andy – right – My guess is that they’re covering themselves, but it also makes it easier to shift course if it starts looking favorable to their interests.