I signed up for Zidisha this week and loaded up a small amount to test the water with this new site. I love the concept of Micro-lending and what really excited me about Zidisha is that they have a Peer-to-Peer Model rather than using middlemen.

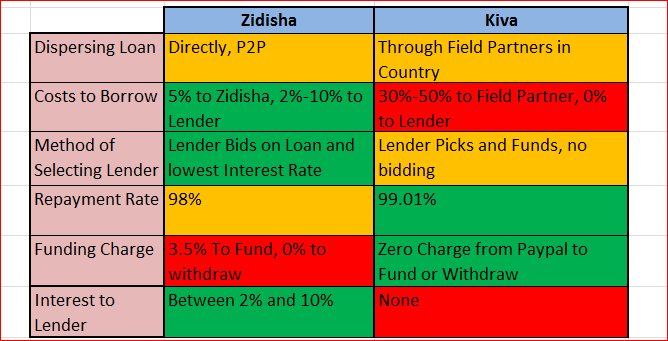

I would compare this company with Kiva, who do a lot of great work, I have loaned over 400 times with Kiva and currently have about $4,000 in outstanding loans being repaid at a rate around $600 per month. Here is a snapshot of the differences between the two companies:

My biggest Peeve with Kiva is that they are at the mercy of their Field Partners, these guys are the agencies that disperse the loan, and they also do some good things for lenders like check credit scores and chase up delinquent payments – however they charge such an exorbitant fee to the Borrow that it feels like your lending is promoting some sort of slave trade. These Partners have been known to charge up to 50% interest to the borrower, putting them heavily in debt on the loan that you are carrying the risk on.

What I love about Zidisha is that they charge a flat 5% fee to the borrower for the admin of the loan, plus $12 for a background/ credit check. However since they aren’t using the middlemen they also have less leverage in the field to make sure people pay back the loan.

The other nice thing about Zidisha is that they pay the lender an interest rate, which is actually bid upon. So the borrower has a page and states they will pay up to say 10%, you get the chance as a lender to offer any amount up to the full value of the loan and charge anything up to the 10% rate.

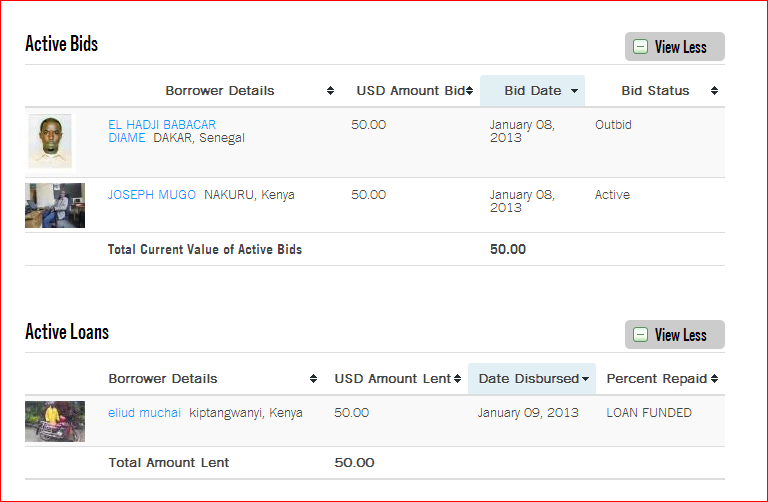

I decided on 3 loans of $50 each to try this out and was outbid on one where I asked for 10% (I am a slumlord at heart).

Whilst I am saddened by losing my bid, it is pretty cool that they allow this free market approach and therefore the borrow gets the best possible interest on his loan based upon what the market bids -I’m really excited about this concept.

The other thing that is bad about Zidisha is that they charge a fee to load via Paypal (read Credit Card or Gift Card) the charge is 3.5% to load the account, so to just breakeven you need to get that amount back in Interest, and have zero default. So I would estimate something around 5% average interest being a good breakeven point, and a little higher would be better still.

I’m going to leave my investment at $150 for now as I play with the system and see how it goes, if it gives me confidence I’ll buy in for some more later on.

Hi Matt,

Thanks for the post. I just joined Zidisha and invested in the first projects. I love that it is true p2p, as you’ve also pointed out, as well as possibility of communicating directly with the borrowers.

Also, I haven’t found any good alternatives that can be joined here from Denmark, so it was great to stumble upon your post.

Now it has been almost a year for you, so how is your experience?

Cheers!

Hey Stefan,

My experience has been ok. It’s a good program, but I find that the loan repayment being quite slow in general (at least for the ones I picked) meant that it was a little anti-climatic. You get that initial buzz of helping someone, then see tiny repayments coming in and the occasional note. I think a lot of that has to do with the small number of loans I lent out initially.

I’m actually up to $81 repaid now in a year, because one of the guys accelerated the repayment of his loan, so I’ll go ahead and lend another $50 or $75 and see if I can recapture that excitement I felt a year ago.

Hi Matt,

My first experience with zidisha was unfortunately not a positive one.

My borrower made no repayments and $50 was eventually written-off. My loan was made at 0% interest to the borrower.

It has definitely turned me off using the site. I hope others have better luck with it as it is a great concept.

I loaned through Zidisha for approx 2 years and lost over half of the $750 I uploaded. Great concept, however, all accountibility falls to the lender. I am now checking out United Prosperity but I will start with very small amounts.

Yes, I just received my first default notice having only loaned 3 times… I’ll write a follow up and look into United Prosperity

The history of Zidisha is littered with the fallout of cherry-picked data, and falsehoods hidden by a thin varnish of apparent fact. THAT’S what makes many Zidisha lenders angry (check the forum posts) — it’s not losing money on charitable “loans”. It’s the misinformation that led them to expect so much more.

She only changes the facts when (1) She gets caught and has to back track (eg., the 98% repayment rate that was published for at least two years in order to appear Kiva-esque), or (2) fresh manipulation of old data lets her put a new spin on things in order to illustrate a story.

In the case of the new 5% rate cap the Zidisha director tried to justify her decision with a phony graph based on a “private” survey of 0.0027% of Zidisha lenders. She used the false data to justify a knee-jerk decision on the rate cap, made in response to an outside article critical of Zidisha’s rates.

I’m dumbfounded that the Zidisha director has not yet learned about the importance of telling the truth.

Only use Zidisha if you feel like being a second-class citizen as a lender.

Basically Zidisha does not respect lenders. Even if your loan defaulted and you make honest accusation on the borrower (usually the borrower stole your money and walked away), Zidisha would censor your comment, and even close your account.

I just had my account closed today because of this. So yeah, Zidisha is a great concept, but until they understand lender-borrower is a equal, win-win relationship and they should be a neutral platform instead of siding to one side or another, I am out.

i just had the exact same thing happen to me

there was a thread on the forum on someone asking if anything was done about late payments

i made a strictly objective note that nothing seems to be done about late payments, not even an enquiry towards the lender and that this makes me not want to lend more

next day, complete thread was removed

i’ll never work with them again and will work to prevent others from loosing their money with them

Sorry to hear that – and weird that the thread was removed…

I agree that the loss of money is too large for the lender. I have lost almost 60% since 2012 and expect to lose more before the loans are complete. In addition, their new defaulted auto-lending program was instituted without my knowledge or notification and money was lent from my account without my awareness or authorization. This has happened to other lenders too! The organization will not reimburse our accounts for lost money and removes posts on the forum that discuss this problem and try to warn others.

Even worse than the very, very poor repayment track record is how disrespectfully Zidisha and in particular Julia Kurnia treats lenders. Banning lenders who complain and censoring (deleting) their posts or complete threads is the norm now on Zidisha. Just google “censorship” and “zidisha” and you will find enough information. Among others in the milepoint forum, one of the biggest lending groups on Zidisha.

But it’s not enough: mid-December Zidisha changed the rules of the game and now lenders are obliged to either re-lend or withdraw their credit within 60 days of each repayment. If you don’t relend or withdraw Zidisha will automatically re-lend your money for you (even if you have auto-lending OFF!). So now lenders are not even allowed to wait and see if (a) things will improve as promised and/or (b) wait to find a loan that they actually want to support – and not simply a random borrower who posted his/her application online (and there are some very very bad applications on the platform, without picture, without real business plan, etc). Try to complain – as couple lenders did in the last weeks – and your posts will be deleted within hours and you will be possibly be banned!! Even a thread that simply asked that such changes in the terms of use should be announced to the members was deleted and the author received a violation notice. Only (misleading) positive posts are allowed in the forum. I guess it’s a good way to deceive (future) lenders…

And on a final note: Zidisha bans and censor members (lenders) but keeps their money!!

I am sorry to learn, as a new Zidisha lender, that Zidisha itself is trying to get hold of my money without my consent. I will be sure to remove any repayments promptly, lest they be “re-lent” without my consent.

I cannot understand what Zidisha hopes to gain from this policy, which is new and seems to be universally disliked. (And with good reason!) Are they afraid they will not survive if lenders have a choice?

Hi Susan,

I just read the comment you posted here an on the Zidisha forum (we will see how long your post there will be allowed to be online…). I do have an idea of why of what Zidisha hopes to gain. In your post on the Zidisha forum you mentioned another thread, now closed for comments, that complained about the forced auto-lend policy. There you can read in Zidisha Staff (Bayle) reply: “In response to the growing volume of inactive lending balances…”

Because that is the truth: an increasing number of lenders is leaving zidisha very disappointed of the high loss rates and of policies that are very often to the detriment of lenders and only advantage for borrowers reducing their accountabiliy. I’ll mention only two: while Zidisha states to use volunteer mentors to help (new) members and follow up on repayments, practically many do not have any VM and there is no one to follow up in case of troubles. Second, Zidisha allows borrowers to reschedule without limits, it’s no exception to see loans that were posted with 1-2 months terms being rescheduled to 4-5 years.

Instead of adressing lenders’ concerns Zidisha does nothing and now censors any type of constructive feedback and criticism. Since lenders are fleeing, Zidisha resorted to hijacking their money…

You did notice that the other thread is closed to comments since it “is over a month old”. But did you notice that that thread was started on Jan 9, 2015 and so it’s not a month old at all?! The reason why they closed it is that lenders were complaining there on a daily basis about this forced auto-lending policy (and “poor” Zidisha staff was working overtime to delete all these posts…I’m actually surprised they didn’t delete the whole thread).

On a final note, are you and other lenders aware that according to Zidisha terms of use Zidisha does not have to repay lenders at all? In the terms of use we can read:

“Zidisha makes no guarantee or representation that funds lent through its website will be repaid to lenders, regardless of whether the loans financed with lender funds are repaid to Zidisha. Any cash payouts are promotional gifts offered solely at Zidisha’s discretion.”

Good luck and to be on the save side “grab all [our] money the instant it arrives”, you never know when Zidisha will change its policies…

Hi

This is interesting. I have been considering microfinance. I note that most public facing material including articles in Forbes and the Huffington Post about Zidisha replicate material on the website. I’ve read it pretty thoroughly keeping in mind the criticisms I’ve read. I’ve also seen blogs where Julia Kurnia/Aidisha respond to some of these comments but in general the thread of commentary has not been as long as this one – or over a concerted timeframe.

The last post here appears to be January 2015. Has anyone noticed a change since then – or should I keep my money?

It’s just as bad. I started out with about $100 way back.. And now I get 2 cent repayments that I need to withdraw in order to prevent them auto relending.

I’ve got about $5k in loans to Kiva, coming back at $1k per month, no stress… But I need to remember to log in to Zidisha to withdraw $2-3 bucks a month to get my money back.

I’d advise you to steer clear.

Thanks Matt. Appreciate the advice. Is Kiva the way to go would you say?

I am a borrower with zidisha and so far I’ve good standing at my 2 loan.

I wish all of you lenders would lend me and i can’t disappoint you.

If you can lend me i can about $5000 I’ll be ready to repay with 9% interest.

Regards

I am a borrower with zidisha and so far I’ve good standing at my 2 loan.I wish all of you lenders would lend me and i can’t disappoint you.If you can lend me i can about $5000I’ll be ready to repay with 9% interest.Regards

I joined Zidisha about a year ago and can’t say enough about how rewarding it is. I don’t look at this as an investment and don’t expect to ever withdraw the money I have invested. Zidisha is about helping people put food on the table, have a place to live and help their family and community. Over and over you can read how one entrepreneur takes care of others, it is heartwarming to say the least. You must consider that the countries where Zidisha work have no social safety nets like welfare or social security so sometimes a micro loan can mean the difference between having one meal a day to going hungry. Five Stars to Zidisha and the work the all volunteer, non profit staff continues to do.

Just like Kiva, but with complications and annoyances that they don’t have

Glad to see your post, Ma. I previously loaned through Kiva until I found out that these were loans that were already made, and usually made by loan sharks… er, local money lenders. Zidisha seems to have gone through a lot of changes, and I am new to them since they’ve made those changes. It’s not money-making. No interest charged or repaid. I do expect to be repaid the principal (and so far, so good, though one borrower is behind). I don’t loan money I can’t afford to lose, but I’m careful who I lend to. It’s amazing what a little boost can do, whether it’s fixing a motorcycle, buying a dozen chickens, or helping with an unexpected expense. I notice that many loans go unfunded — I’m betting scammers fall into this category. Also, frankly, when Craig Newmark (Craig’s List) puts his money there, I’m pretty comfortable adding my pennies.

Zidisha recently added a feature where you can view borrowers applications who have a 100% payback rate, it is great for those who look at this as an investment rather than charity and expect to get paid back.

I do have several loans that I never expect to be paid back for, like one for a daughter whose mother needs kidney dialysis, the daughter works, supports 2 children and has her mother’s medical bills as well, she cannot earn enough to survive. Her mother cannot get treatment unless she pays up front. The daughters repayment rate is less that 10% on time yet she did manage to pay off her last loan, in these cases I consider this as humanity, not investing.

I continue to loan through Zidisha and encourage others to do the same. Give up one cup of gourmet coffee or a dinner out this week to help someone in need, such a small amount can make a huge impact in someone’s life.

This was some of our comments that got censored multiple time and we surely do not agree they should have been. Hence we are posting our review here.

After a little while on the platform we wanted to share our feedback and impression and why we will be leaving temporarily. To provide a little context, we control a small charitable organization outside the US and we were testing Zidisha to lend our idle funds for purpose that are inline with our philanthropic mission. With changes to move more toward higlighting the platform as philanthropic vs investment, like the no interest change as well as your impact vs your loan pages, we think there’s also a great opportunity to confer the same message on borrower. In almost all definition of philanthropy, there is a notion of public good that we think most borrower would fail. I think we can all agree that borrowing money for a hair dryer can hardly be called philanthropic in nature. Even when considering the platform as a whole, job creation has never been a good measure of a population well being, so even then viewing Zidisha as a philanthropic platform is questionable.

As a charitable organization, we are consistantly giving out money. However most of Zidisha borrower and Zidisha itself would not qualify as a charitable activity in our country since for that it needs to pass the public test:

• its purposes and activities provide a measurable benefit to the public; and

• the people who are eligible for benefits are either the public as a whole, or a significant section of it. The beneficiaries cannot be a restricted group or one where members share a private connection—this includes social clubs and professional associations.

Hence why we cannot give funds but must lend them. However, as we can see our 1000$ reserve being depleted in the near future, being subject to currency fluctuation, and the effect of inflation it is a mathematical certainty that with time our money would be depleted. In addition, while we welcome the loan loss reserve fund instead of trying to manually manage the interest rate to cover our losses the problem is that it doesn’t scale at all. It would be impossible to have more then 1000$ in outsanding loan while benefiting entirely covering the loans against default. We agree that the interest has downsides, but at least it is an effective mechanism to protect against loan default whether you have 10$ or 10000$. We feel that even using the word lending in a philanthropic context is misleading, lending implies getting your money back. Even though one could stretch and not consider inflation, being subject to currency fluctuation and borrower default without interest it is not lending you are certain not to receive 100% of your money back, and as we stated with enough time your money would be entirely deepleted. While we can understand the need to move away from being viewed as an investment platform, we feel at this time it is not a philanthropic platform nor a good investment platform so we must temporarily withdraw. We feel there’s great potential in the platform and look forward to coming back in the future when Zidisha either move towards becoming a full fledge philanthropic platform or move back toward an investment platform. In the mean time, Zidisha made us realize that we can do more with our idle funds and we will try to look for something else or start an initiative internally.

Hi, Thanks for sharing this information.

Get tech assistance for the hp.com/123 printer. Our team of experts will help you in setting up the printer from unboxing to printing. We help you to get the updated printer driver compatible with your OS. Visit our website for more details