Personal Capital is a website that collates your Investment Accounts, from Taxable Brokerages, SEP IRA’s, Keogh’s and 401(k) and provides you with a very clear picture of your current holdings, and suggests improvements to any weaknesses you might have. In some ways the product is a little like Mint.com in that it gives you a pictorial snapshot of accounts, showing growth, exposure, risk and costs.

My personal investment strategy is shifting from Actively Managed to Passively Managed. Like many people I started out investing in individual stocks hoping to find stars, and in fairness didn’t have the best success, partly to most of my investing career being since 2000, and that being quite a tough period for the markets. The upshot of this transition is several stock positions that I am waiting for certain events to occur in order to raise their prices, perhaps it is an emotional attachment, but the fact remains that I feel several of my positions will experience a very positive turn around shortly, and they are also positioned well for acquisition.

Until the time that these stocks do pop, I am migrating my investments over to a Passive Portfolio, focused on low fees and diverse funds; in short any new money that comes into my Investment Accounts is assigned to these new funds, and other money locked in stock is staying put until I see the move I want, then I will shift it in also.

Also, on the journey of my Financial Independence I have gone through several stages of Financial Intelligence. Initially, after several harsh lessons with individual equities I sought to purchase Funds (sector, dividend etc) in order to hold a diverse mix – however what I forgot to consider at that time was the most important part of Fund Investing – The Devils Cut.

The Angels Cut and the Devils Cut

The Angels Cut is what Whiskey Makers call the Whiskey that evaporates from the barrel during maturation, it soaks into the wood and evaporates, unfortunately there is not much that can be done about this, and the longer the Whiskey remains in the barrel the less of it will be there when you open it up for bottling. When it comes to Investing I would rather call it the Devils Cut, because the ‘evaporation’ of your investment is tied directly to how much you pay out to the fund management company – some traditional funds can charge up to 5% a year.

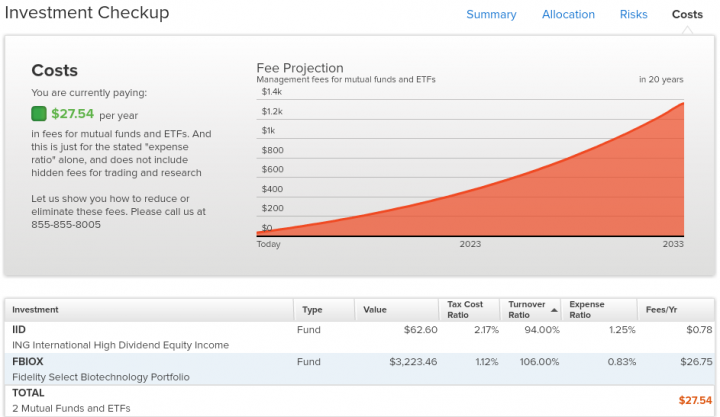

Of course, one of the hardest things to do, especially if you are like me and have cobbled together investments over time, perhaps over several brokerages, is to know at any one time what your expense fees are for your funds. What I like about Personal Capital is that they identify this immediately so you can see where the errors are in your plan. Here is one that was highlighted that requires attention:

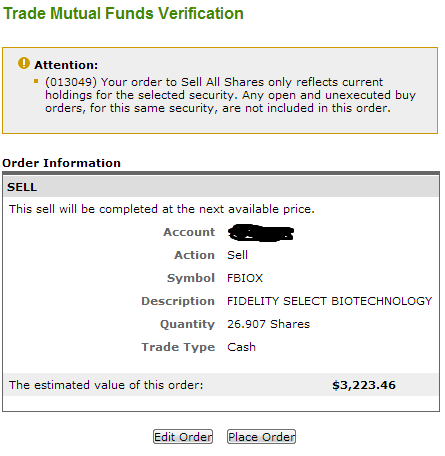

There are two funds here that have high expense ratios , however IID is an orphaned position (valued at $60) that would cost more to sell than leave as it is. I’ll just let that sit. The FBIOX though, that is costing me a lot more than is necessary, and whilst it may not sound like much, the Devils Cut is 3x-4x what I should be paying out to hold those positions. Thanks to Personal Capital pointing this out to me I logged into my Fidelity IRA Account this morning and I exited my position in FBIOX.

I exchanged the Fund with Vanguard ETF (ticker symbol VHT) it has an expense ratio of 0.14% which is incredibly low, even for the ETF market. The positions are diverse and are mixed between established Healthcare companies like Pfizer and smaller Biotech. The amounts seem small, but lets plot out the difference over 20 years to see.

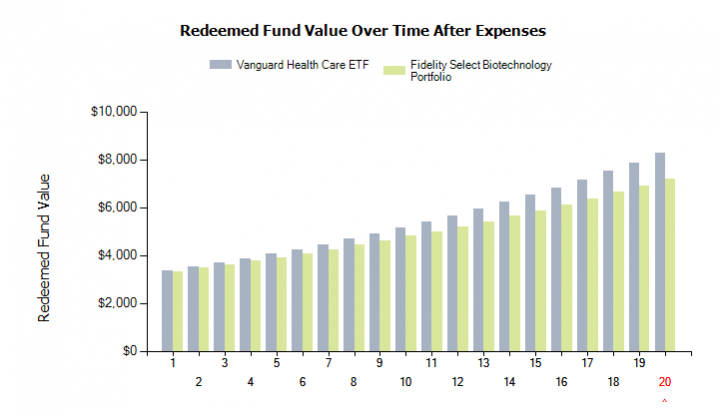

The projected profit, assuming that both move in a similar manner, and simply considering Fees would be:

- Vanguard Total Fees $149 Total Profit $5,056

- Fidelity FBIOX Total Fees $818.30 Total Profit $3,991

Personal Capital just saved me over $1,000 by that one small adjustment in my portfolio, and that was on a small, today’s value $3,200 position; imagine that over a $30,000 or $300,000 position, you could be saving $10,000’s to $100,000’s of your retirement money just for checking where you are allocating it today.

Sign uphere for a free account with Personal Capital, and check your own account for positions that are like this today. Getting started is simple and it only takes a couple of minutes to be up and running, you can analyze your portfolio today, so that you can save more of your money for tomorrow.

– Please note that this is an affiliate link for Personal Capital and if you do decide to sign up I may be compensated by them. I do appreciate your support, and I am a customer of Personal Capital and I endorse them because I think they add real value to my finances, and could to yours too.

Leave a Reply