Motif Investing is fast becoming one of the most interesting and powerful tools for savvy investors in the market today. Founded in 2010 by former Microsoft Executive Hardeep Walia and former Hedge Fund Analyst Tariq Hilaly and backed by serious venture capital they are rapidly becoming a player in Investing 2.0, a term I use to describe the services offered to consumers by firms like Motif, Betterment and Personal Capital.

Motif Investing is unique in that is allows you to build your own ETF, and actually hold the individual stock positions within it. You pick up to 30 stocks with weightings that are suggested by Motif Investing, but customized by you and that package of stocks becomes a ‘Motif’. What this means is that you have much more control over your asset allocations and are able to get much more hands on with your decision making.

Customizing an Existing Motif

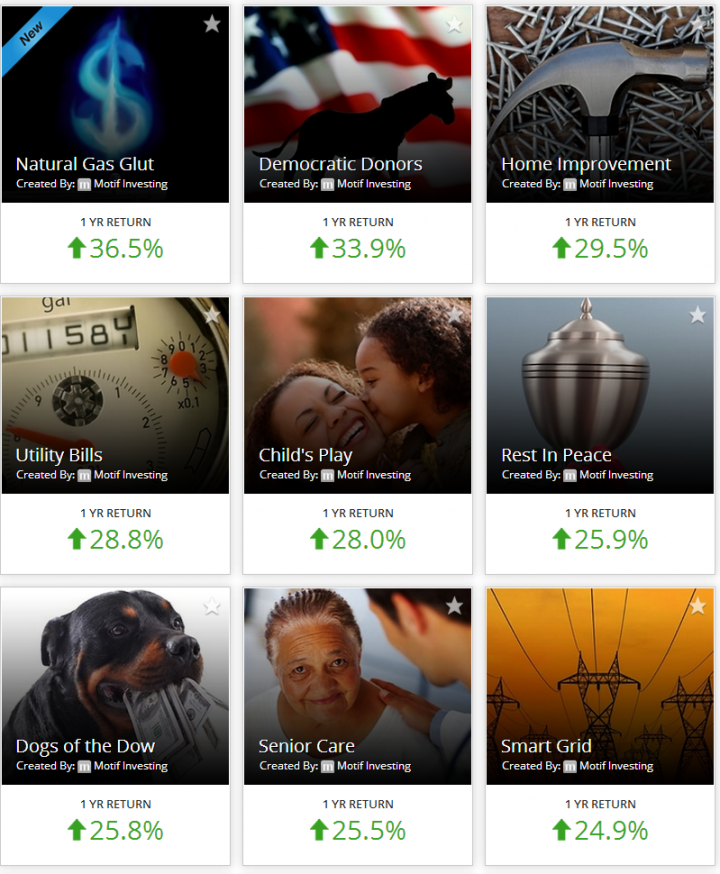

Motif Investing starts by offering a number of pre-constructed Motif ‘s based around Investment Goals. At the moment there are about 100 of these Motif ‘s listed on their Construction Page that you can then tailor accordingly.

Drilling down and Customizing your prebuilt Motif

If you select Dogs of the Dow you get to learn more about what this Motif offers, it is one of the smaller packages available, with the Motif holding 10 Stocks that fit the following Criteria:

“This motif screens the components of the Dow Jones Industrial Average annually, and selects the 10 companies with the highest dividend payouts relative to their stock prices.”Dogs of the Dow can now become your Motif of choice, or you can tweak it by shifting around the allocations, or adding and removing specific securities as you see fit. Below is a video walkthrough I made showing how to take the standard ‘Dogs of the Dow’ and customize it the way I want to. This is pretty straightforward, and you get to see what the changes you make will do to your performance (looking back 12 months).

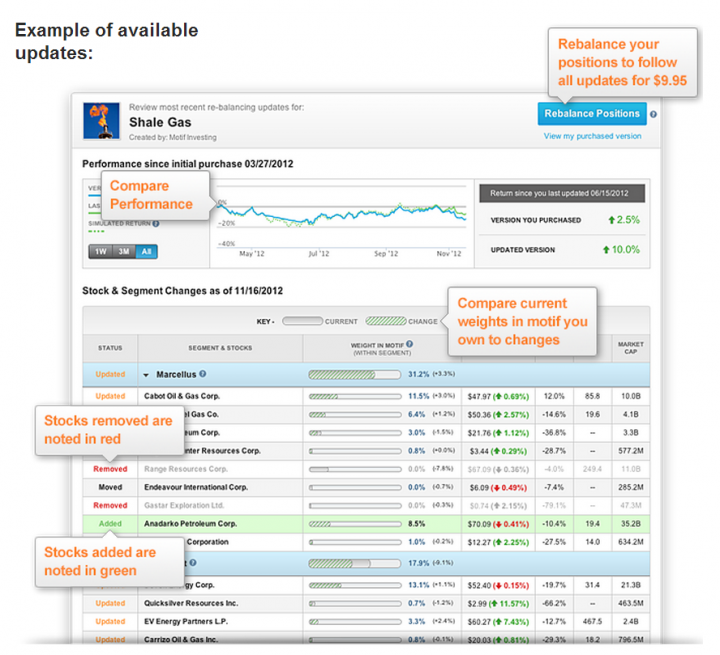

Rebalancing your Motif

Now comes a tricky decision, if you decide to work from this predesigned ‘Dogs of the Dow’ and do not make any adjustments to it, then periodically Motif Investing will release an updated opinion of the perfect Asset Allocation for this account. The rebalancing of your securities will not be done automatically, and will come with a charge – in other words they will make the suggestion, and with a click you can rebalance to what they think is proper allocation, the good news is that the total cost to buy and sell up to all 30 Securities that you can hold in an individual Motif is a flat 9.95.

- How Motif Investing suggests rebalancing ideas for your Motif

The Good, the Bad and the Ugly of Motif Rebalancing

When considering the Dogs of the Dow, the 10 stocks that are selected could change quite frequently. The criteria is Dividend Percentage Payout from the DJIA so if the stock price rises then they will be likely pushed out of the Dogs, and new stocks put in. The good part of this is that Motif will track these proportional fluctuations to keep you balanced as per the initial criteria, so you don’t have to watch everything and track them yourself. Additionally, the fact that they will tweak everything in one swoop for a flat $9.95 is excellent value.

However what this doesn’t take into account is Captial Gains and most importantly the ability to Harvest Capital Losses. Beyond what is suggested to keep to an original plan (which we can agree is an arbitrary decision) what we have after a period of time is actual results, actual gains and actual losses. As soon as these Securities are sold they become Realized Gains/Losses and have a direct impact on your tax bill. If this rebalancing is done on a frequent (perhaps Quarterly) basis then you are in the Short Term Capital Gains bracket. So just clicking ‘rebalance’ could be gathering a large tax bill, rather than using your ability to pick and chose which stocks to actually sell or hold which will lower your tax bill.

Portfolio Drift is a bad thing in some ways, but only from a Risk perspective, however sticking purely to a Risk decision when buying and selling stock and not thinking about Tax Implications of the trade is not risky at all, it is guaranteed to cost you money.

The Ugly part of rebalancing a Motif comes after you tweak it, if you decided to do what I did in the video and play with weightings then you have created a Frankenstein version of the Dogs of the Dow.

The flexibility that comes with your initial purchase, to add on new Securities and remove those you dislike creates an entirely new Motif. However, should you then try to rebalance to what Motif proposes is the latest allocation for Dogs of the Dow, they will not take into consideration any of your tweaks – so you have to rebalance by yourself. Not a horrible task, but one that can make you stumble if you are carried away with sliding and clicking things rather than considering your allocations fully.

Scratch Building your own Motif

Motif Investing also allows its customers to completely scratch build a Motif, not following any of the other models it has on offer. For example, you may wish to build a fund of funds by selecting a basket of ETFs from the Stock and Bond markets. You will be paying the originating ETF a management fee (to Vanguard or SPDR etc) but you will not be paying an overlying management fee to host all of these in a basket. You could also pick a theme that matters to you, such as Green Energy or Candy Consumption and build something around this. The flexibility here is great and you can custom build a Motif in minutes.

Account Minimums and Fractional Ownership

A Motif requires a minimum investment of $250, but within that you can hold Securities of much higher value as they allow trading of Fractional Shares, for example you could have a Segment called Technology that would be 20% of your overall Motif that you could hold Apple and Google in, despite them currently trading at $406 and $814 respectively, you would be able to have a piece of the action here within your Motif.

Conclusion

The real value add that a firm like Motif presents you with is the ability to hold a basket of securities in one place, and select which ones you want to hold, sell or adjust the weighting of. In essence you are given the ability to create a Hedgefund within the Motif and can benefit greatly by being savvy when it comes time to rebalance and reallocate funding. As always, if you do plan to aggressively Capital Loss Harvest please be wary of the Wash Sale rule

I am in for a small account to test the water, and bought in for $1000 for myself, out of which I will build just one motif (as trading costs require $9.95 per Motif) I will start with one valued around $900 initially, and track things from here. Also, they are having a campaign at the moment where new signups who do start off with $1,000 like I did get a $100 account credit. Here is the link should you wish to sign up, it would give us both $100 if you decide to fund with $1,000 as I did, which kick starts your earnings nicely.

To get the Credit your friend must fund a Motif with at least $1,000 and execute just one motif trade. In other words, your account will be up 9% immediately if you fund with $1,000, and pay $9,95 for the trade.

The links to Motif in this post are my introduction links, once you have signed up yourself, you can share the offer above so you and your friends both make the $100 each!

Leave a Reply