I recently added Prosper.com to my list of Passive Investment vehicles for this year, and I am very excited by them at the moment. I’m looking forward to seeing how things progress with these loans, this post will take you through the process which is very straight forward to setting up and funding your account, you can use this link to get signed up

After you enter the basic details of your account you will be ready for funding, to do this I sent test payments to my Checking Account and once they arrived entered them on the Prosper website. Just like setting up any ACH for a bank etc. Once the account was linked I transferred my deposit and waited patiently for it to be available… it did take a day or two more than I liked but it was there today around lunchtime.

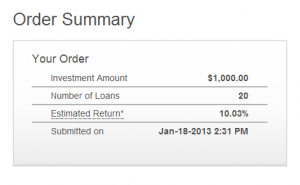

My initial plan was to invest $5,000 in Prosper.com however since there is a good chance we will be buying a house in the next few months I thought it wiser to keep more liquid funds, so I dipped in with $1,000 initially. If this goes well I’ll add to the position later.

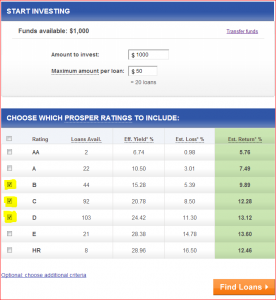

I also had several thoughts about what to do regarding asset allocation with Prosper, they have a range of APRs tied to the risk of the credit. My first plan was to take a broad mix, some very safe, then some very risky. I later decided to go heavy into the risky loans. I also had flipflopped on how to invest in each one. Whether it was to be 40x $25 loans or 10x$100. The Prosper website suggested 20x $50 and that seemed good to me. I used the quick invest option.

This allowed me to pick from a range and I liked the ROI for loans rated B,C,D offering from 9-13.12% on average. I hit the ‘Find Loans button and was presented with a nice mix:

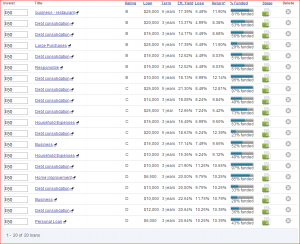

After the visual they broke down the loans further by type:

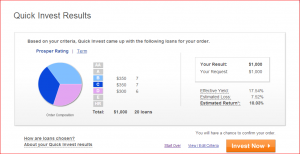

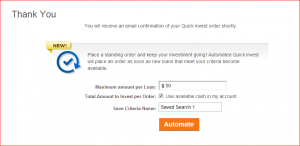

So far so good, I moved forward and selected these, and also got the chance to Automate new loans whenever my balance reaches $50, using the same search criteria of B,C,D mixed loans. I did this as it appeals to me in the sense of making the investment more passive, and I don’t have to worry about $100 or more sitting around not working for me in the account:

So the entire process took me about 5 minutes to fund 20 loans and set up automatic reinvestment. I look forward to checking in on this in 3 months and 6 months to see how they are performing. Seems like a very good investment vehicle for diversity and getting a solid payout – at up to 13% for these relatively safe investments I am very pleased about the potential of this. Prosper wrapped up by explaining my expected average return on the $1,000 would be 10.03% over the 20 loans and including estimated default losses. Here’s the screenshot so we can look back in 3 months, 6 months and 1 year to compare with these estimates:

Here is my signup link if you want to join and start investing yourself, and you can start from as little as $25 so it is a very accessible way to start building a diverse Passive Income portfolio. The links here are my affiliate links, if you decide to join Prosper through these I may receive compensation from them.

Leave a Reply