I received a piece of ‘junk’ mail from US Bank notifying me about their American Express Flexperks edition. I currently have their Visa card and it’s treated me pretty nicely considering all of their targeted offers for bonus Flexperks here and here. For this holiday season, they have another Flexperks deal where you need to spend $3,000 and earn a bonus 3,500 bonus points.

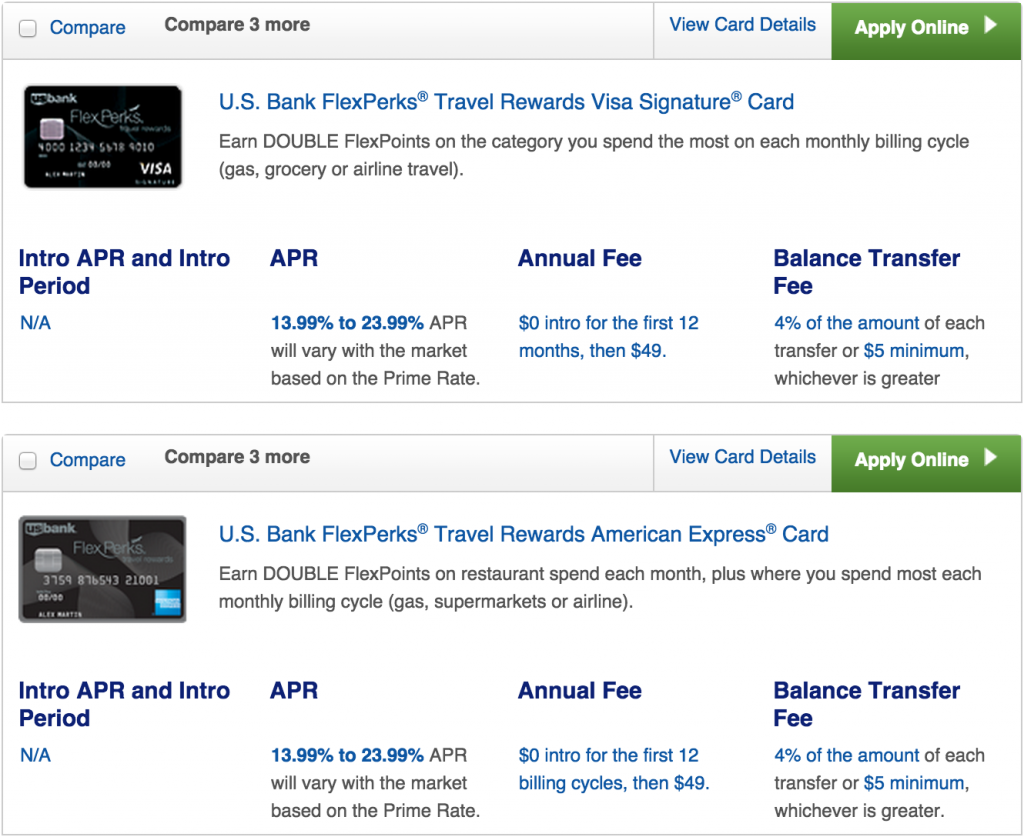

What caught my eye in the mailer was the AMEX edition had 2x points on restaurant spend. That was a little surprising because I thought I missed the memo on it being on the Visa. Turns out I didn’t miss the memo because US Bank is purposely excluding the Visa from the 2x bonus on restaurant spend.

I find it very unique that US Bank is offering virtually the same product, but different card type akin to Chase with their Visa and Mastercard offerings when it happened.

Even if US Bank had put 2x in Restaurants on the Visa Flexperks, I would have to think hard about switching from my Citi Forward at 5x on restaurants not because it’s a 5x multiplier, but because I now have flexibility in where to transfer the points.

If I did not have the Citi Forward and had only the Chase Sapphire Preferred, I would switch to the 2x Flexperks in restaurants because each Flexperks point is worth up to 2 cents if redeeming for airfare, making restaurant purchases up to 4% back.

Check out this article from Freequent Flyer Book on another way to redeem your Flexperks points, where they could be worth up to 1.5 cents per point. That means that if you did restaurant only and redeem for hotels, it could be a 3% back card.