Today, I wanted to write about using your credit card as a competitive advantage because I have been perusing Reddit and seeing people use cash to handle their business. Reading on Reddit is one avenue that I have been using to research reselling. As a comparison, my observations with manufactured spending, the breadcrumbs are little bigger and the people a little more friendly. Maybe it’s because I am still new to reselling and think the crumbs are smaller? Who knows. But either way, both groups, MS’ers and resellers, they are some of the biggest and best secret keepers I have encountered. I can confidently tell some of my closest confidants something and it will never see the light of day. It’s a good level of trust, and some of the people I have never met in person.

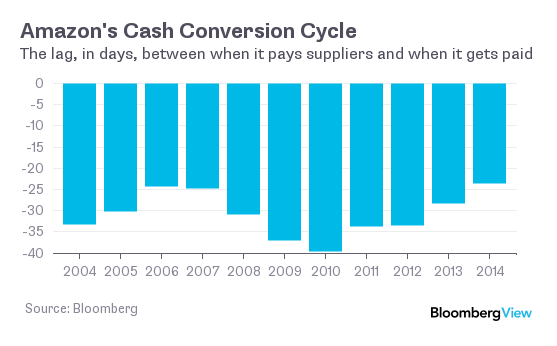

While perusing the Reddit Flipping channel, a large amount of people seem to be paying with cash. They are leaving money on the table because of a cash transaction. Sure, some are going to a garage/yard sale and it is a cash transaction, but there are those that practice retail arbitrage and they are hurting their business not using a credit card. For us, who are well versed in using the dark arts, have an advantage over them. Remember, using a credit allows us to pay whatever we buy at a later date. Remember this post I made? Amazon is unbelievably amazing with financial engineering. Their cash to conversion cycle is phenomenal.

It’s a negative CCC which means they’re able to receive and use cash before it’s due. If you are buying hot selling products, you can receive your cash before the credit card is due. That is one aspect of using a credit card as a competitive advantage amongst other resellers. On a smaller scale, you can leverage your fast selling products to receive the cash and then pay off a credit card. During the Q4 craziness, I was able to leverage this on more than one occasion.

My Credit Cards

After the latest Citi culling where I saw my friend Kenny see the axe, there will be a lot of people looking for their next cards and will research. We do not know exactly what kind of risky behavior caused Citi to close the cards, but it’s safe to say that no one is safe. I am extremely thankful that I escaped unscathed. If there was one credit card that I would recommend they would be the Bank of America Business Cash Rewards or Travel Rewards and try to get uplifted for the 50% rewards.

I have written in the past about my credit cards like the denials and what I think you can do to increase your chances for approval. To date, I have only closed a couple of credit cards, they were the first Barclay’s US Airways and Chase’s United MileagePlus Explorer card. All other cards I’ve either kept or product changed. The reason why I close so little cards are because I think on a manufactured spending level for year 2 and beyond. I do not churn cards.

I now have a gigantic portfolio of credit cards and bonus categories every which way to earn points quickly and effectively whether it is for manufactured spend or reselling. That being said, go forward, I do not plan to openly discuss the credit cards that I currently hold or plan to apply. The reason for that is to protect my advantage in both the reselling sphere and manufactured spending over the folks who are trying to leverage a better deal. If you want to keep up with what cards I use, be sure to check in on the Saverocity Forum.

You are like an insurance company, get paid now, pay out later, use the float to your advantage! W. Buffet’s GEICO is able to use that model to a tremendous advantage.

Cheers,

PedroNY

That sounds fascinating! I’ll be sure to ask you about that when we meet up