My biggest areas of manufactured spending is through gift card churning and since discovering bill paying in Manhattan, I have been leaving reported balances on my cards.

The other day Matt highlighted that manufactured spending does indeed hurt your credit in the credit utilization ratio.

And yesterday, Matt covered more details on credit utilization, a must read!

I am here to report to you that paying your credit cards regularly so the utilization is near 0 is the best method when you go through a process of an app-o-rama or any type of large loans.

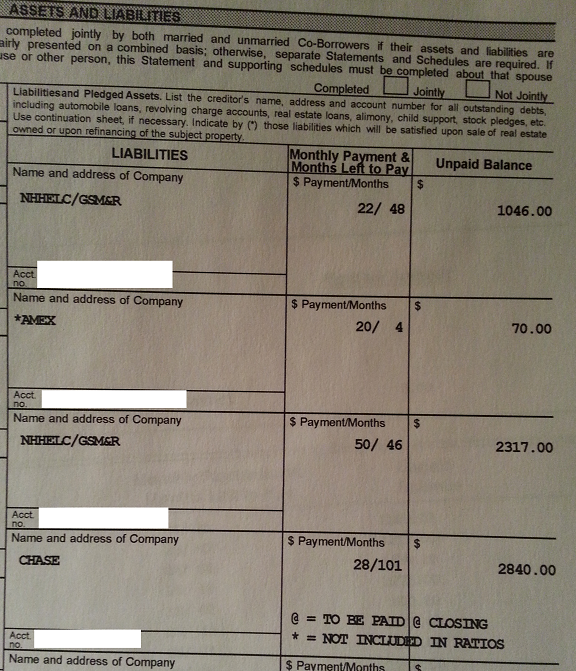

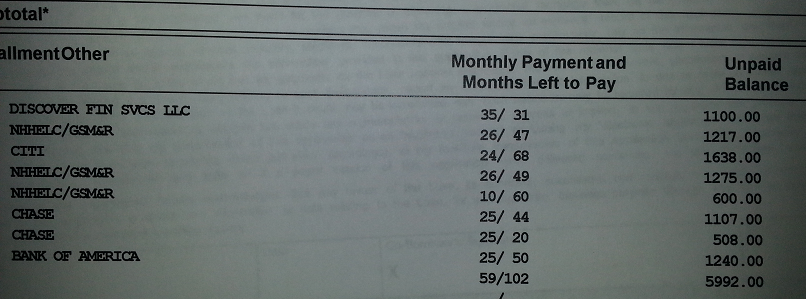

Otherwise, with that credit pull for your refinance or mortgage you will see this:

Except that if you split all of your spending up to get all the category bonuses and maximize your points earnings (as recommended in many blogs) and then used autopay you could have a very similar picture. It is your lack of balance management during that particular month, not your MS, that hurt your score. The good news is that it recovers very quickly.

Yup, it does recover quickly. I don’t remember when the snapshot was taken, I think it was sometime in January.