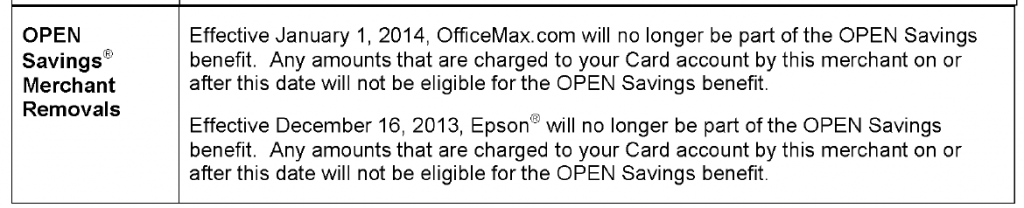

I just want to throw this out there that I really, really miss the OPEN savings from OfficeMax.com. That deal silently died and I don’t think many people realize how awesome it was. The premise was, if you spend over $250 in one purchase you receive 10% off from American Express.

While buying gift cards on OfficeMax.com didn’t receive credit on a portal, Plastic Jungle was still around and selling on them with TopCashBack and buying/reselling Nordstrom gift cards could have led to a profitable gift card churn, at worse, you were buying points from American Express for a penny. Those were the days I weren’t smart enough to ask for a higher rate as a bulk seller. Those were the days…

Back To The Regularly Schedule Program:

So my American Express statement closed mid month (the screen capture is different as I requested to move the dates to the first, trying to simplify my life)

But you will see that it said the original close date was December 16 and the new charges since December 17. So we will see what happens after the first statement closes in 2015 in how my spending will count towards SPG gold. This year, the Hyatt gift card purchase was extended on to January 1 and we don’t know what 2015 holds, so I nearly maxed out my card. And the terms and conditions say Open Savings are calendar year. And they really mean calendar year, as I crossed over $10,000 in purchases for this statement, but was spread across 2014 and 2015 and received the 5% back. I’m just hoping all of the purchases that I made for this statement will count towards the $30,000 for Starwood Preferred Guest Gold

usually the transaction post date dictates what calendar year it belongs to, no matter what date the statement closes

Last year all spending through 12/31 counted toward the gold threshold regardless of statement date. I assume it’s unchanged.

@jerry & @nun well, that settles that – I don’t need to wonder about that any more

Unless I’m missing something, SPG Gold is not that valuable and not worth spending $30k. Besides, you can get it via the Amex Plat card.

What Chris said. I’ve found SPG gold underwhelming, but if you really want it, get the platinum card via Ameriprise (not only is the card fee-free the first year, authorized user cards are free as well). Even if there is no MR signup bonus, you’ll still get the $200 annual calendar year credit (so I’d wait until late February or March to get the card to ensure you can cycle through it twice).

@Chris & @Neil – you’re right SPG Gold is bleh, and I likely won’t make many stays if any in 2015.

As a side note, I’m not sure if it’s also applicable from AMEX Platinum, but “buying” gold like I earned it with stays. SPG gave me all these cards to hand out for “exceptional” SPG employees and I’m to be credited for an extra 500 points. When I first got it in early 2014, they also gave me this “welcome” gift for making gold to earn extra points.