Before we began 2015, I thought about my next credit cards and what to close and open. I actually wound up changing the plans and product changed my Sapphire Preferred earlier than I had expected to fully utilize the first quarter bonus.

My Latest Cards:

In my latest round of cards I applied for or at least what I thought applied:

- Barclay’s UPromise

- Synchrony PayPal Extras

- TD Bank Aeroplan

- Bank of America Better Balance Rewards

- Chase Ink Plus

Only the Chase and UPromise cards I was motivated by the sign up bonus. At some point, I knew I was going to sign up for them, but the timing lined up. For those following at home, I have the Chase Ink Bold and added the Ink Plus so I have a “real” credit card for my business (Chasing The Points).

UPromise for the $100 sign up bonus which is one of the highest they’ve offered that I’ve found. I previously covered the UPromise and finally got my way around to reapplying to it. Originally, when I applied the UPromise card was not automatically approved. That led me to call the reconsideration line, the agent asked me where my employment location and number of years, with yearly salary and monthly credit card expenses. When I told her my employer, she was was surprised and said “[name of the company], like [product we specialize in]!?” and asked a few personal questions while staying professional since the line was recorded. I’ve redacted the name and product because it would give away my employer, and I do not want to do that. I thought that was going to help win me the new account, but alas, she said I had too much new credit and couldn’t approve me. She gave me this crap about how I have been a great customer and on time payments. My only reaction to that was, could I move credit around to open the UPromise. She still said no.

I didn’t want to give up so easily and planned to call them a week later. I think this piece saved me and recommend everyone doing this if they plan to apply for Barclay cards every three months. I will expand on this theory in a later post. Use your Barclay’s card for a few charges. When I called a week later, the agent noted that I was previously declined from the first agent, but she opened my file again, asked about my employment history, and was able to approve but only after I move some credit. At the end of the day, I was approved for UPromise, and this card is quite promising (pun intended).

I won’t write too much about Paypal Extras, but just know it’s a really good card. Free-Quent Flyer and Chuck Sithe covered it and they convinced me that this is an excellent credit card for manufactured spend.

Some people might think this was a wasted pull for the Bank of America Better Balance Rewards, but I feel this is worth it. Free-Quent Flyer is an excellent blogger, and as a show of support, I signed up for his newsletter. I will be utilizing the Better Balance Rewards bonus to earn myself a [near] free subscription as he mentioned.

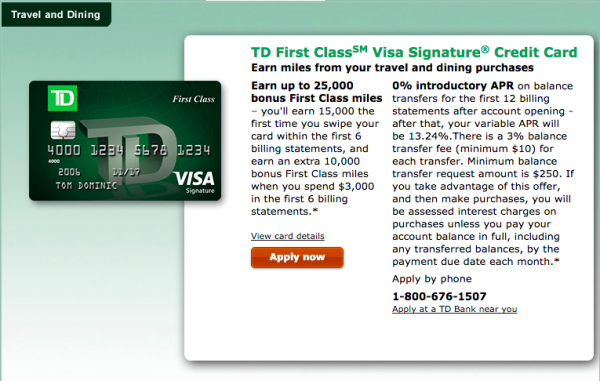

Finally, I also wanted to sign up for TD Bank’s Aeroplan card after researching about it some more. Sadly, I’m stupid and applied for the wrong card.

I applied for the First Class product instead of the Aeroplan. I didn’t pay enough attention to the application (obviously) and wondered why during the application where it didn’t ask for an Aeroplan frequent flyer number. I didn’t think too much about it, and then after the card came in and I’m reading the letter about the activation, I realized it.

What’s Next:

I now plan to just earn the sign up bonus, and then figure out a way to use up the “First Class miles.” In my next round of applications, I’ll be sure to sign up for the right card, but it won’t be for at least 3 months. Sadly, it will put me behind schedule to earn Distinction status so I probably won’t press it as hard in 2015.

In the next couple of weeks, I also plan to apply for the Citi AAdvantage Business card for the 50,000 mile offer bonus. Originally, I said I was going to pass on it. Now that I know there are options, I now plan to sign up for it.

The TD First Class looks better than the Aeroplan in my opinion. It looks like you will receive $250 in travel credits through Expedia?

I didn’t see that – do you have a link? I only saw the sign up bonus is worth up to $250

Ahhh. Might be different I was looking at the TD First Class Infinite Card

https://www.tdcanadatrust.com/products-services/banking/credit-cards/view-all-cards/td-first-class-visa-infinite-card_d.jsp?mboxSession=1426081860802-122903&

That Canadian version is better than the American version (which I have):

http://www.tdbank.com/personalcreditcard/firstclassvisa.html

I know some people have had problems with downgrading to the BBR card, but I’ve honestly never had any trouble. I’m just applied for three BofA cards recently and was approved for all (just a single pull), fingers crossed I can downgrade those to BBR cards after I get the sign up bonus.

I guess at some point BofA will stop me, but it’s a nice little earner already.

I didn’t even think about that, more than 1 card at a time from BofA. Would have been nice for other cards. I will have to do that next time!

n2people.nl

I know some people have had problems with downgrading to the BBR card, but I’ve honestly never had any trouble. I’m just applied for three BofA cards recently and was approved for all (just a single pull), fingers crossed I can downgrade those to BBR cards after I get the sign up bonus.