A couple of weeks ago, I wrote about a price matching deal using TigerDirect price matching to Newegg. Reader Hua left the comment:

I like the price protection provided by Chase on the CSP and some of their other cards… They just send a check for the difference.

I actually wound up calling Bank of America and they don’t have the price protection/match available. This got me thinking, this scenario that I wouldn’t feel comfortable crossing.

Now The Ethical Question:

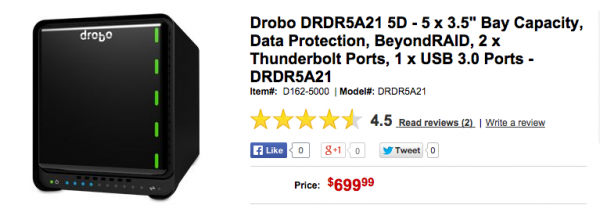

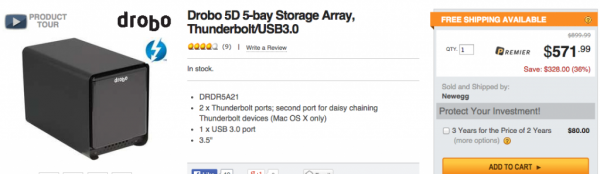

We’ll continue using the same example with the Drobo 5d.

And the best price at $571.99

Say you used a credit card like Hua with a Chase card that provides purchase protection or a Discover card who also provides it and are now eligible and you know full well that there’s a price match policy with TigerDirect.

You are now able to receive two price matches, one from your credit card company and one from the retailer. See, TigerDirect charges the higher price and the credit card will unequivocally match the price. Here’s a snippet from Chase Freedom (benefits hosted on my Google Drive) and bolded emphasis is their’s and italicized is mine:

Benefit Information

What is Price Protection?

- Price Protection provides reimbursement for the difference in price on products you buy with your Account or by using rewards points earned on that Account.

- If you purchase an eligible item with your Account in the United States and see a Printed Advertisement at any retail store or Non-auction Internet Advertisement for less within ninety (90) days of the original purchase date, simply file a valid claim and the Benefit Administrator will reimburse you the difference up to five hundred ($500.00) dollars for each item. Price Protection is limited to twenty-five hundred ($2,500.00) dollars a year for each Account.

- Price Protection is limited to fifty ($50.00) dollars for each item and one hundred and fifty ($150.00) dollars a year for each Account for advertisements of cash only, close-out, liquidation and going-out of-business sales.

- Price Protection is secondary to and in excess of store policies offering a lowest-price guarantee or any other form of refund for price differences, and any other valid and collectible avenue of recovery for which you are eligible.

- To be eligible for coverage, you must charge some portion of the item’s purchase price to your Account or use rewards points earned on your Account toward the purchase. You will only be reimbursed up to the amount charged to your Account or the program limit.

For the ease of simple numbers from the pictures, say you were charged $699.99 from Tiger Direct. They say they will price match you to $625.67 and you also contact your credit card company. Because you were charged $699.99 and they price match it to $571.99, they will cut you a check for $128 and Tiger Direct just gave you a $74.32 gift card. Therefore, you will get back a total of $202.32.

This reads like my MBA class in management from my last semester – it’s not against the law, but just because it’s not against the law doesn’t mean it’s not ethical.

What do you think? Ethical? Is it maximizing your savings?

Or how about? It’s totally unethical because it is abusing and taking advantage of the programs.

Wow, that person is super savvy, and is can find a great deal!

Wow, that person is so sleazy for pulling off a move like that!

Ethics are incredibly tricky, and it is up to the person to decide. For me, after putting additional thought into it, I wouldn’t doing anything like this. I like the mental exercise because it’s posts like these that get the brain going and you make a similar realization on a manufactured spending avenue.

Please take this post down… posting things like this causes people to abuse systems, which get them changed. I am all for finding ways to ‘game the system’, but you are making it too easy…

Interesting little loop hole but the price per item limit is $50 to limit how much anyone can score. Also companies keep track of who uses this benefit(along with other benefits like warranty protection purchase protection). People might be able to abuse it a couple times before getting caught, but they’ll quickly rise to the top of a manual review list being outliers after only a couple claims let alone if they “hit it hard” and thats never good.

The limit is $500 per item except for cash only, closeout, discontinued items, etc. which are limited to $50 per item.

I find the litmus test to be for exploiting any given legal loophole to be, if your methods were exposed in evening news, what would the general perception be of you character? If it’s going to be net negative, don’t do it. In this case, it’s borderline from my perspective. Defensible that you’re simply double dipping benefits from two different companies, but fraudulent in the sense that you’re profiting from a benefit that works like an insurance claim. All the people complaining “this is why we can’t have nice things” and “don’t make it too easy” need to recognize all loopholes should eventually be discovered. Actively encouraging hiding them is actually shady in itself and sounds parasitic. Not something I’d want to be colored as on the evening news anyway. Either way, this particular loophole isn’t scalable(probably because card companies recognize the risk of exploitation) and hardly worth the risk in trying.

Yeah… I don’t think I will be doing any double price matches. I haven’t considered this but when I read the terms (for the CSP) I believe it had some verbiage about not being eligible for price protection if you used a store’s policy. I may have misread the CSP terms but the Freedom policy seems to be begging to be used in addition to the store policy:

“Price Protection is secondary to and in excess of store policies offering a lowest-price guarantee or any other form of refund for price differences, and any other valid and collectible avenue of recovery for which you are eligible.”

I think most stores would refund the difference to the CC which would then mean you would only be protected to the total amount anyhow (otherwise have some really odd purchas/refund patterns) but Tiger Direct’s policy seems to create a loophole… or other retailers would probably be happy to issue a store credit rather than refunding to the card.

Have you ever tried to use one of these? Enough paperwork to fill a coal mine. It will take you at least 4 hours of your precious day. How much do you make per hour?

I have not, I am under the impression that it would be pretty seamless and quick

Register now and you can start playing instantly. Also poker and slots turn out to be popular games in online casinos. It really matters small how a lot your bankroll is at the begin.