Nick, over at PFDigest recently wrote the seminal piece “are we all doomed?” In which, he quoted the overly positive post by Marathon Man and posited on the state of the game. Is the Golden Era behind us? My first reaction to this was that the game is always changing, and you need to evolve in order to keep up with it.

Personally, with every devaluation or ‘enhancement’ to a program I make small mental calculations, nothing too formal. I also note these when I think airlines are silently devaluing regarding throttling award inventory and whatnot. These little nuances add up to shape my approach to the game, and I thought to see how that reflected in my earning habits.

How I’m changing my habits

To an extent, I think that there is a natural growth pattern in the game, you start off chasing every gig, and zero in on those that fit your lifestyle and needs. Additionally, some deals are just killed so you are forced to adapt. Luckily, I remember back in the day having a series of posts called ‘The Haul”. I started writing them back when the blog started out and I was super excited about travel hacking/ points earning. This gives me a window on my evolution, here’s a couple of examples of a weekly haul:

- 15018 HHonors from MS

- 450 UR from regular spend

- Staples Free After Rebate Ream Paper $6.99

- Money Order $996 for 498 AA Miles

- 8000 British Airways Avios

- $10 Free Amazon Card from UFB

- 10x Ink Recycling at Office Max for $20

July 8th 2015 – Haul

First, I’d like to consider two high level differences between me then and now:

- I don’t count fees anymore. They don’t matter to me. Every transaction makes a profit, so I don’t sweat it. This choice is easy once I decided to not manufactured points directly, barring immediate top ups.

- I don’t count regular spend anymore. For the sake of the post I’ll break that somewhat…current monthly expenses (on cards) are several thousand dollars. I optimize (5x) perhaps 25% of that, the balance is at a mix of 1x and 2x. But basically it is irrelevant.

- I no longer do the Staples Ink stuff. This was due to lifestyle change, previously I could pop in on my way to the gym any day of the week, now it requires a drive.

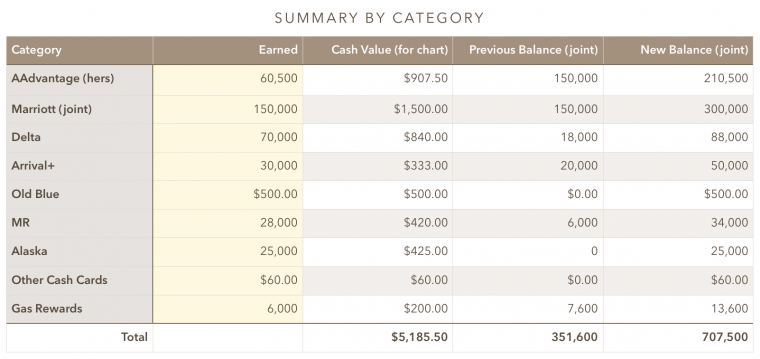

That said, here’s the Haul for last week

Not bad eh?

Now, some of it is from a recent App-o-Rama, and some from manufactured spend. Some of it came with a cost, some with no cost, and some could be considered a negative cost. For example, Delta:

50000 from Gold Biz card after $2000 in spend. I just added $2000 to Kiva. I then added another 18000 for a gross cost of about $5, but the DL card came with a statement credit of $50. So my DL earning in isolation was 70,000 pts and inflow of $45 in exchange for a 6 month loan to Kiva. Technically I could have cleared the spend faster and for about $10, but I’m at the point where I don’t really care. I’m breaking it down to the following:

- Inflows

- Outflows

- Time Spent to optimize

I’m at the point where I’d pay a bit more to make something faster and cleaner. The above spend/liquidate cycle was met in probably a couple of hours max. Note that the above week is somewhat exceptional, as I do not App-o-Rama every week, but it isn’t unusual to see something like this on a quarterly basis.

Two last things to note about this Haul. I picked up an Amex Platinum simply because I wanted the wife to check out the Centurion lounges in LGA and DFW (she wasn’t blown away), and I picked up 2 Marriott cards simply to rapidly gain a 7 night+flights certificate from them. I see these transactions as making a lot of sense, and at the same time they highlight how little I value credit pulls. If you are starting out, please keep in mind that back in 2013 when I was doing this I was doing it very differently, so start small, and keep within your limits.

The game is changing, I’m changing with it.

“I don’t count fees anymore. They don’t matter to me. Every transaction makes a profit, so I don’t sweat it.”

This is the one I should be writing 100 times on the blackboard! Having had very easy access to no-fee Paypowers I could buy with a CC – both of which have disappeared – made me loathe to buy prepaids that have fees.

But adding an Old Blue to my wallet means I can make money every time I go to the grocery store, whether or not the cashier who still allows me to buy $3.95 fee PPs with a card is there or not. Old habits die hard, but I am doing my best to forget the fees!

Fees can’t be ignored. Not when MSing. Signup bonuses are about the only time they don’t really matter. But signup bonuses are a fraction of my MS and getting smaller as banks clamp down on churning.

I think fees are important, but if you make basic decisions you can forget about them. If you focus on earning low value points (that you then inflate theoretically) for high fees then you will be in trouble, but if you keep fees below a certain level across the board, and focus first on the most valuable points, its fine.

EG I don’t like to pay $5.95 per GC, but if it comes in at 5x or more then it is fine. If I was earning Club Carlson points like this I’d be worried..

So if you dont track your fees how can you tell what your net is ?

I can show lots of gross rev but if its on a 2% then my net isnt very good. I cant help but track my costs as its my only way to tell my net profit at the end of the month.

It doesn’t matter because fees on gigs I accept are always between zero and 1% so net is whatever is left over.

It’s the decision at fee level coupled with only earning 2% or more that negates the need to track net.